Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

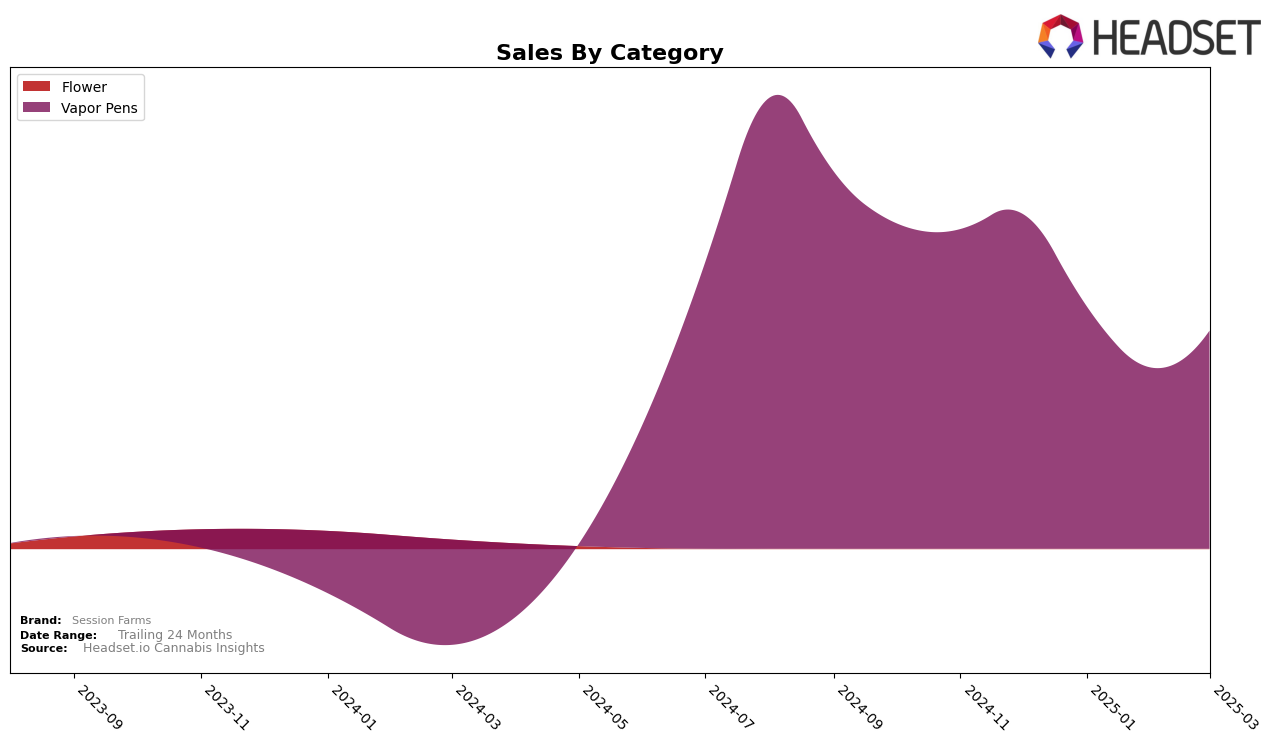

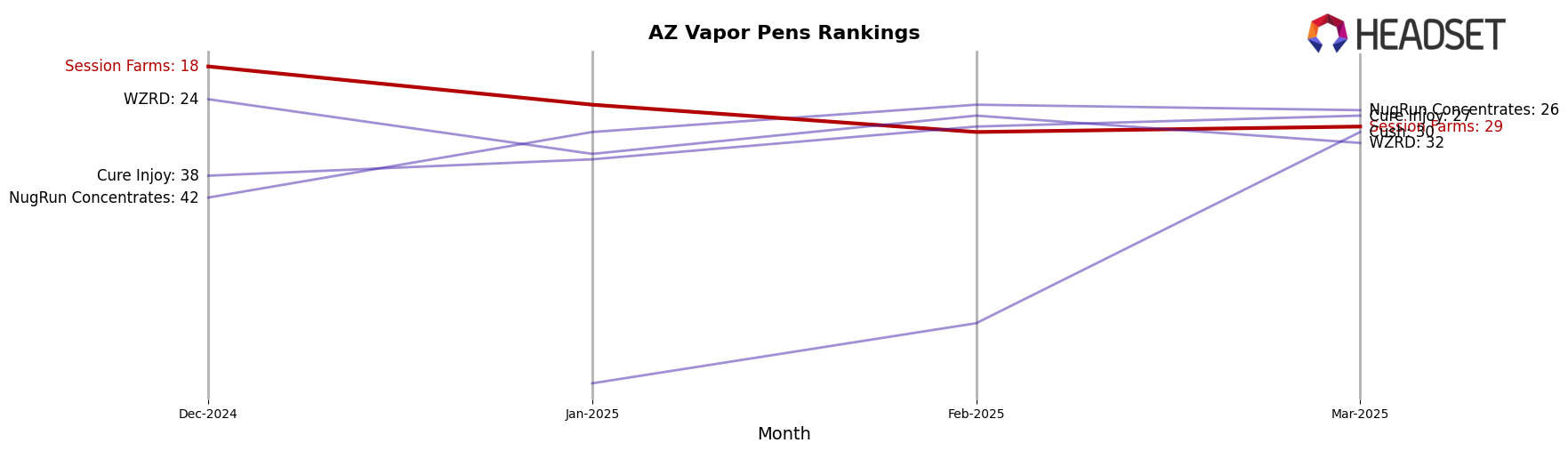

Session Farms has experienced notable fluctuations in its performance within the Vapor Pens category in Arizona. Starting from a rank of 18 in December 2024, the brand saw a gradual decline, reaching the 30th position by February 2025, before slightly improving to 29th in March 2025. This downward trend in rankings is mirrored by a decrease in sales, with a notable drop from December 2024 to February 2025, before a modest recovery in March 2025. This suggests that while Session Farms faced challenges in maintaining its market position, there are signs of potential stabilization or recovery in recent months.

It is important to note that Session Farms remained within the top 30 brands for Vapor Pens in Arizona throughout the observed period. This consistency, despite the fluctuations, indicates a resilient presence in the market, although the brand's declining rank in early 2025 highlights the competitive pressures it faces. The absence of a ranking outside the top 30 can be seen as a positive indicator, suggesting that Session Farms maintains a foothold in the category, albeit with room for improvement to regain a stronger position. Further analysis would be required to understand the specific factors influencing these movements, such as market dynamics or consumer preferences.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Session Farms has experienced notable fluctuations in rank and sales over the past few months. Starting from December 2024, Session Farms held a strong position at 18th but saw a decline to 29th by March 2025. This downward trend in rank corresponds with a decrease in sales from December to February, although there was a slight recovery in March. In contrast, NugRun Concentrates has shown a consistent upward trajectory, moving from 42nd to 26th, with sales steadily increasing. Similarly, Cure Injoy improved its rank from 38th to 27th, also reflecting a positive sales trend. WZRD and Cush have shown mixed results, with WZRD experiencing a decrease in rank and sales, while Cush made a significant leap from being unranked to 30th, indicating a substantial increase in sales. These dynamics suggest that while Session Farms faces challenges in maintaining its market position, competitors like NugRun Concentrates and Cure Injoy are capitalizing on growth opportunities, potentially impacting Session Farms' market share and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In March 2025, Session Farms' top-performing products were the AK 1995 Live Resin Disposable and the Las Vegas Triangle Kush Live Resin Disposable, both ranking at the number one spot in the Vapor Pens category with sales of 919 units each. The Blue Dream Live Resin Disposable followed closely, moving up to the second position from fourth in February, with 771 units sold. G6 OG Live Resin Disposable made its debut in the rankings at the third position, showcasing a strong entry. Royal Wedding Live Resin Disposable also entered the rankings, securing the fourth position. Notably, the AK 1995 and Las Vegas Triangle Kush products showed significant improvement from their previous ranks, highlighting their growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.