Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Sessions Cannabis Extract (OR) has shown a notable performance in the Arizona market, particularly in the Vapor Pens category. Starting from a rank of 25 in December 2024, the brand climbed to 17th position by January 2025 and further improved to 13th in February, before slightly dropping to 14th in March 2025. This upward trend indicates a strong market acceptance and growing consumer preference, highlighted by a significant increase in sales from December through March. Such a consistent climb in rankings within a competitive market is indicative of effective brand strategies and product offerings.

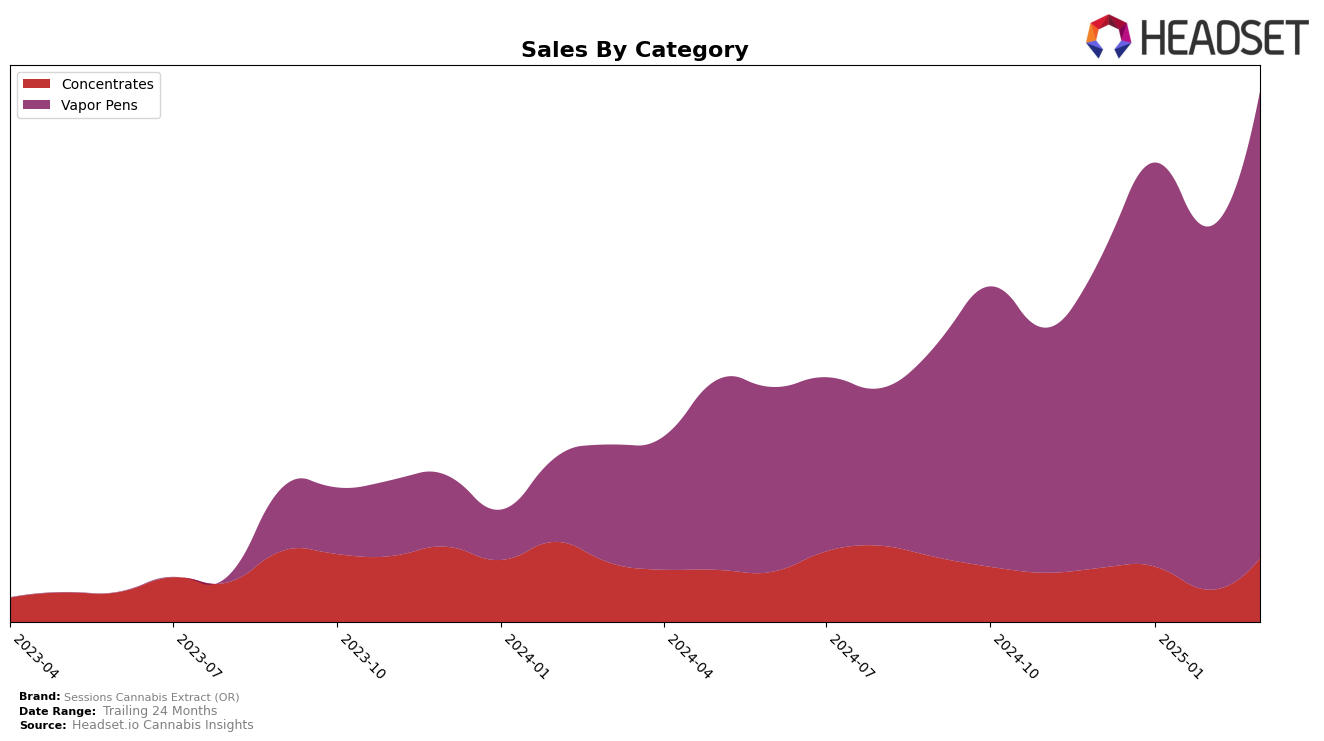

In Oregon, Sessions Cannabis Extract (OR) has seen varied success across categories. In the Concentrates category, the brand saw a dip in its ranking from December 2024 to February 2025, moving from 19th to 23rd, but recovered to 14th by March. This fluctuation suggests a competitive market environment and possibly a shift in consumer preferences. Meanwhile, in the Vapor Pens category, the brand maintained a more stable presence, with minor fluctuations, holding ranks between 15th and 18th over the same period. This stability in the Vapor Pens category, despite market dynamics, reflects a strong foothold and consistent consumer loyalty in Oregon.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Sessions Cannabis Extract (OR) has shown a dynamic performance from December 2024 to March 2025. Despite fluctuating rankings, Sessions Cannabis Extract (OR) managed to improve its position from 18th in December 2024 to 16th by March 2025. This improvement is notable considering the competitive pressure from brands like Select, which maintained a relatively stable presence, and Boujee Blendz, which consistently ranked higher than Sessions Cannabis Extract (OR) during this period. Meanwhile, Verdant Leaf Farms saw a positive trend, climbing from 16th to 14th place, potentially impacting Sessions Cannabis Extract (OR)'s market share. Despite these challenges, Sessions Cannabis Extract (OR) experienced a significant sales boost in March 2025, indicating a potential upward trajectory in consumer preference. This competitive analysis highlights the importance of strategic positioning and adaptability in the ever-evolving Oregon vapor pen market.

Notable Products

In March 2025, Goldigger Cured Resin (1g) from Sessions Cannabis Extract (OR) emerged as the top-performing product, securing the number one rank with notable sales of 3328 units. Strawberry Gary Cured Resin (1g) followed closely in second place, while Gorilla Snacks Cured Resin Cartridge (1g) held the third position. Blueberry Gumbo Cured Resin Disposable (1g) ranked fourth, showcasing the popularity of vapor pen products. Mother's Milk Live Resin Disposable (1g), previously ranked third in December 2024, slipped to fifth place in March 2025, indicating a shift in consumer preference. These rankings highlight a strong performance in the concentrates and vapor pens categories for the brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.