Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

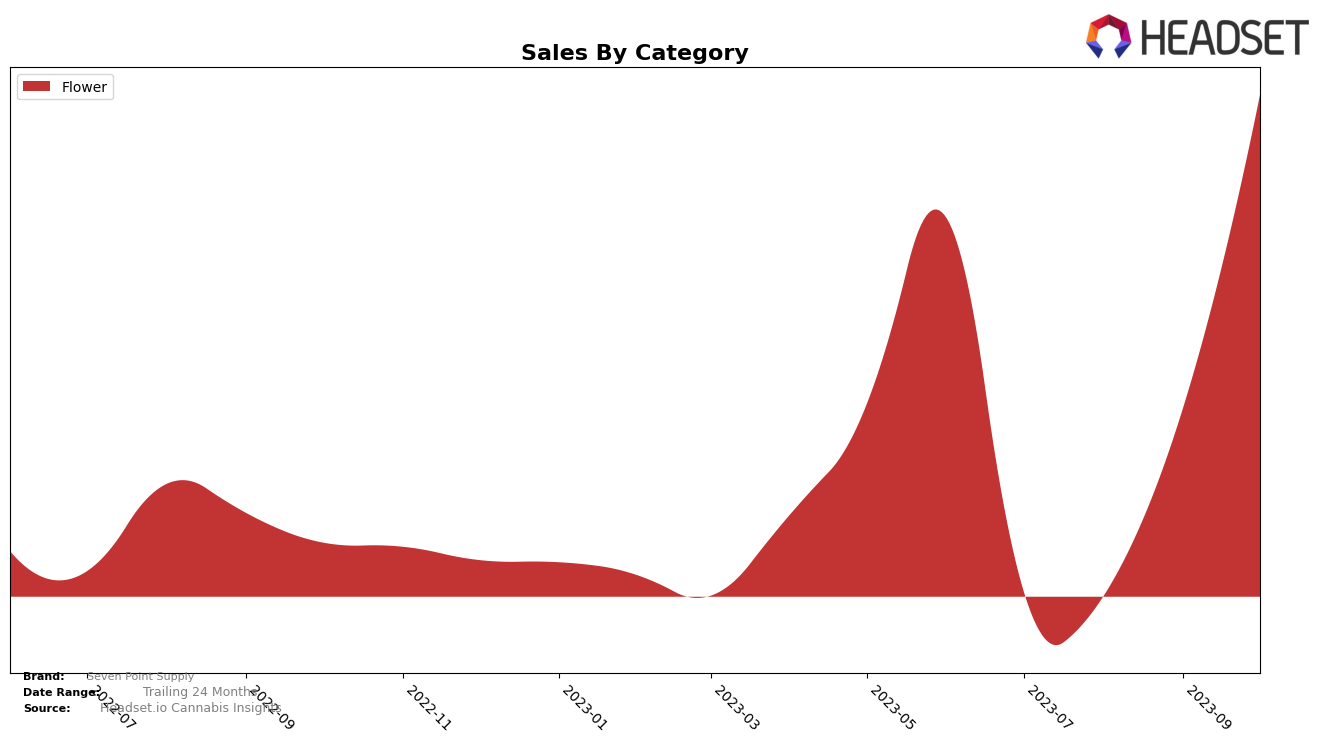

In the Flower category, Seven Point Supply has shown significant progress within the Michigan market. The brand was not ranked in the top 20 for July and August 2023, however, it made a notable leap in September, securing the 56th position. The real breakthrough came in October, when Seven Point Supply surged to the 18th spot. This upward trajectory indicates a positive trend for the brand in the Flower category within the Michigan market.

Delving into sales data, we can see a correlating rise. While specific sales figures for July and August are not disclosed, we can observe a substantial increase in sales from September to October 2023. The sales in October nearly tripled from the previous month, reaching a commendable total of 1,105,618. This dramatic increase in sales complements the brand's improved ranking, suggesting a growing popularity and consumer preference for Seven Point Supply's Flower products in Michigan.

Competitive Landscape

In the competitive landscape of the Flower category in Michigan, Seven Point Supply has shown a significant upward trajectory. Despite not being in the top 20 brands in July and August of 2023, the brand made a dramatic leap to rank 56 in September and further improved to rank 18 in October. This suggests a strong growth trend. In contrast, Redbud Roots has maintained a relatively stable position in the top 20, while Glorious Cannabis Co. has seen a slight decline in rank over the same period. Pressure Pack has also shown a positive trend, moving from rank 43 in July to 17 in October. Play Cannabis has fluctuated within the top 20, but ended up at a lower rank in October compared to July. These shifts in rank indicate a dynamic and competitive market, with Seven Point Supply showing promising growth.

Notable Products

In October 2023, the top-performing product from Seven Point Supply was 'Cakelato (Bulk)' in the Flower category, with a notable sales figure of 5575 units. The second best-selling product was 'Zushi (28g)', also in the Flower category, which climbed from the 5th position in September to the 2nd in October. 'Pure Michigan (Bulk)', another Flower category product, maintained a consistent performance, securing the 3rd position in both September and October. 'Super Gremlin (Bulk)' dropped from the top spot in September to the 4th position in October. Lastly, 'Zushi (Bulk)' dropped one spot from September to October, ending up in the 5th position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.