Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

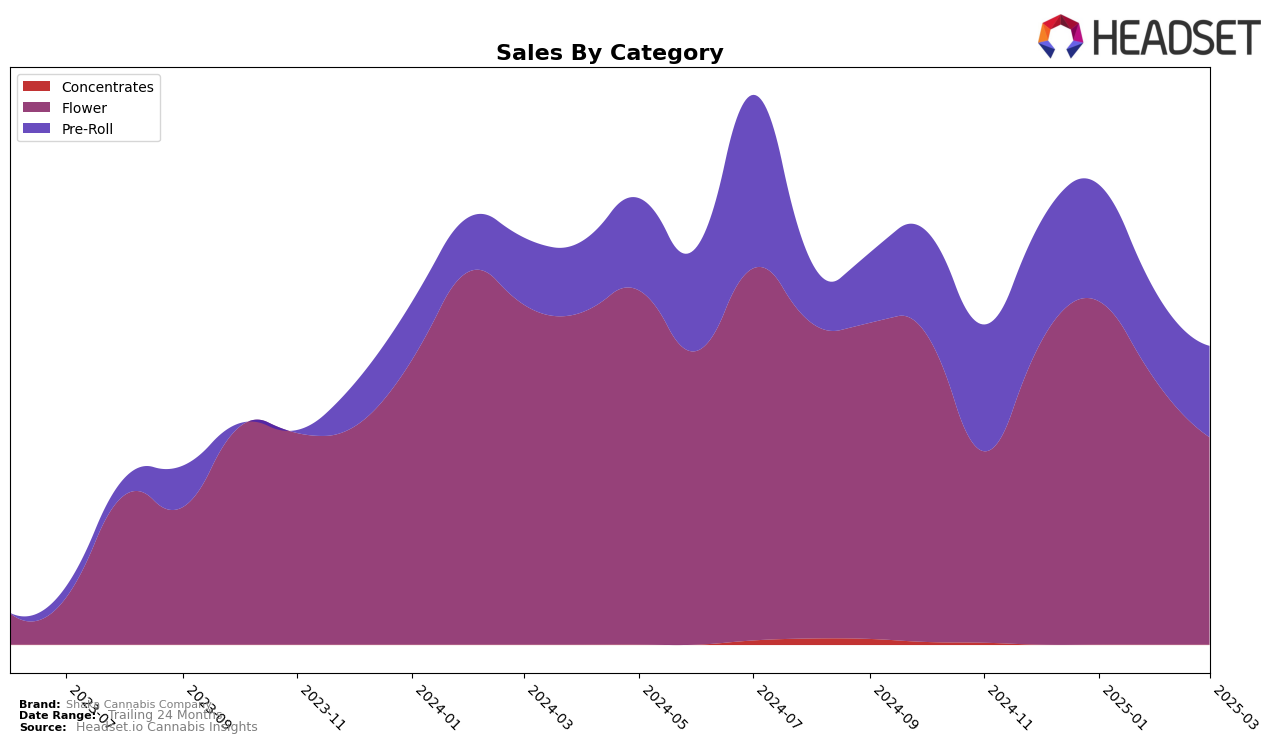

Shaka Cannabis Company has shown varied performance across different categories and states, with notable movements in Massachusetts. In the Flower category, the brand started strong in December 2024, holding the 14th position, and climbed to the 12th spot in January 2025. However, by March 2025, it slipped to 19th place, indicating a downward trend. This decline in ranking is mirrored by a decrease in sales from January to March, suggesting potential challenges in maintaining market share. The Pre-Roll category also reflected a similar trend, where Shaka Cannabis Company began at the 20th rank in December, improved slightly to 17th in January, but then dropped to 27th by March. This movement out of the top 20 could signal increased competition or shifting consumer preferences.

While Shaka Cannabis Company managed to stay within the top 30 brands in Massachusetts for both the Flower and Pre-Roll categories, the lack of presence in other states or categories could be a cause for concern or an opportunity for expansion. The absence of rankings in other states suggests that the brand either does not operate there or has not yet broken into the top 30, highlighting potential areas for growth. The fluctuations in their rankings in Massachusetts might prompt the brand to reassess its strategies to regain or improve its standing, especially as they face competitive pressures in a dynamic market. The insights from these movements can be critical for stakeholders looking to understand the brand's positioning and strategize accordingly.

Competitive Landscape

In the competitive landscape of the flower category in Massachusetts, Shaka Cannabis Company has demonstrated resilience and adaptability amidst fluctuating market dynamics. As of March 2025, Shaka Cannabis Company experienced a slight decline in rank, moving from 12th in January to 19th, yet it maintained a competitive edge over brands like INSA, which climbed from 51st to 21st, indicating a significant upward trend. Despite this, Shaka's sales performance remained robust, outperforming competitors such as Old Pal, which saw a drop from 13th to 20th, and Cheech & Chong's, which consistently hovered around the 17th to 19th ranks. Notably, Shaka Cannabis Company's sales figures were consistently higher than South Shore Plug, which fluctuated outside the top 20 in January and February before returning to 18th in March. This competitive analysis underscores Shaka's strong market presence and its ability to sustain sales momentum in a challenging and evolving market.

Notable Products

In March 2025, Hypothermia #1 Pre-Roll (1g) emerged as the top-performing product for Shaka Cannabis Company, maintaining its leading position from February with sales of 9,643 units. Chocolate Milk Pre-Roll (1g) ranked second, a drop from its top position in February, with a notable decline in sales to 7,455 units. Gush Mints S1 #4 Pre-Roll (1g) secured the third spot, showing a positive shift from being unranked in February. Cadillac Rainbows Pre-Roll (1g) ranked fourth, consistent with its position from January, albeit with fluctuating sales figures over the months. Hypothermia #1 (3.5g) made its debut at fifth place, indicating a growing interest in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.