Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

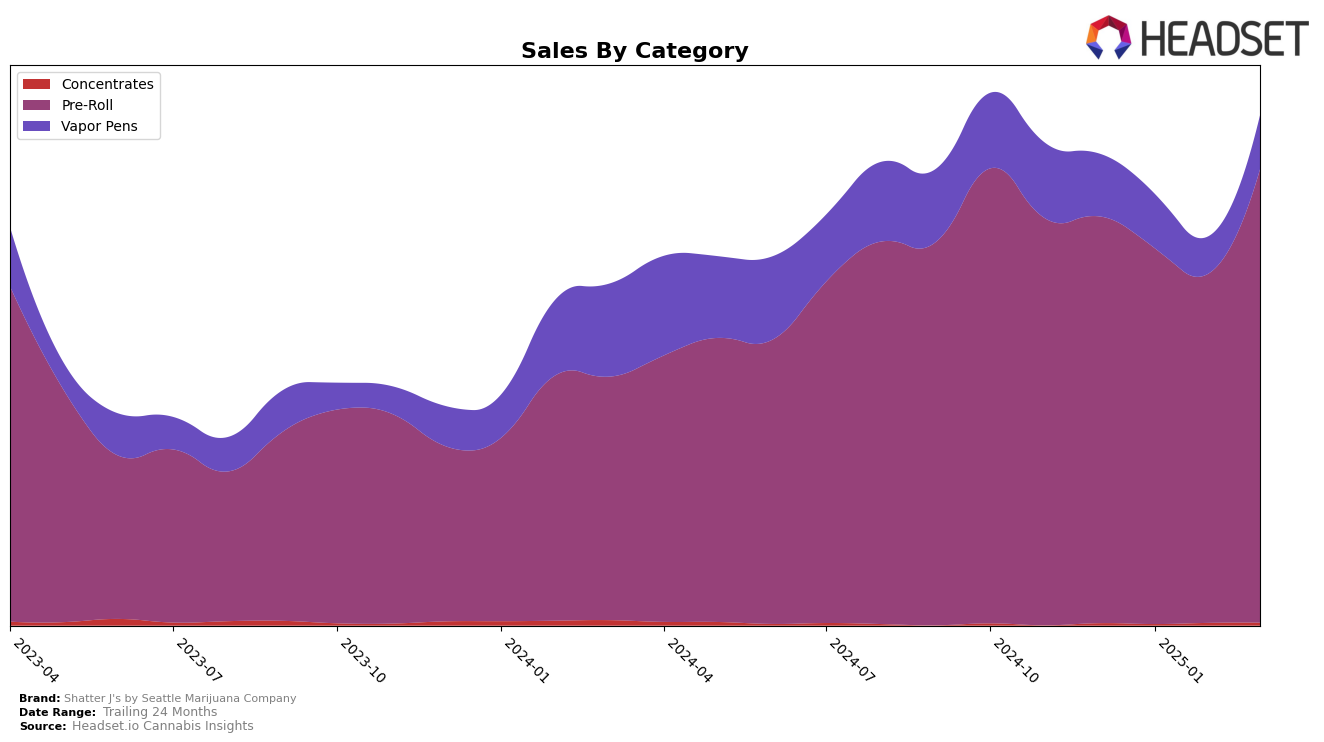

Shatter J's by Seattle Marijuana Company has shown a noteworthy trajectory in the Washington market, particularly in the Pre-Roll category. Over the span from December 2024 to March 2025, the brand managed to climb from a rank of 32 to 28. This upward movement indicates a positive reception and growing popularity among consumers in the state. Notably, the brand was not initially in the top 30, highlighting their recent success in breaking into this competitive segment. The shift from 32 to 28 suggests strategic improvements or increased consumer demand that could be explored further.

In terms of sales figures, Shatter J's experienced a fluctuation in revenue across the months. While there was a dip in sales from December 2024 to February 2025, the brand saw a significant rebound in March 2025. This rebound in sales volume might be indicative of successful marketing strategies or product launches that resonated well with the audience. The absence of Shatter J's in the top 30 rankings prior to March 2025 in the Pre-Roll category in Washington underscores the competitive landscape they are navigating. Understanding the factors behind this resurgence could provide valuable insights into consumer preferences and market dynamics.

Competitive Landscape

In the Washington pre-roll market, Shatter J's by Seattle Marijuana Company has shown a promising upward trend in rank, moving from 32nd in December 2024 to 28th by March 2025. This improvement is notable, especially when compared to competitors like Sky High Gardens, which fluctuated between 19th and 26th, and Torus, which saw a decline from 24th to 30th over the same period. Despite a dip in sales in January and February, Shatter J's rebounded strongly in March, closing the gap with competitors such as Treats, which maintained a relatively stable rank. This suggests that Shatter J's is gaining traction and could continue to climb the ranks if the current momentum is sustained, making it a brand to watch in the coming months.

Notable Products

In March 2025, the top-performing product from Shatter J's by Seattle Marijuana Company was the Pina Colada Infused Pre-Roll (1g), which climbed from the third position in February to rank first, with notable sales of 1963 units. The Washington Apple Infused Pre-Roll (1g) maintained a strong performance, holding steady in second place, despite a slight decrease in sales from January. Blackberry Pie Shatter & Distillate Infused Pre-Roll (1g) slipped from its top position in February to third place in March, indicating a shift in consumer preference. Creme Brulee Flavored Infused Pre-Roll (1g) improved its ranking from fifth in February to fourth in March, suggesting a positive trend. New to the rankings, Mango Mimosa Infused Pre-Roll (1g) debuted in fifth place, showing potential for growth in the upcoming months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.