Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

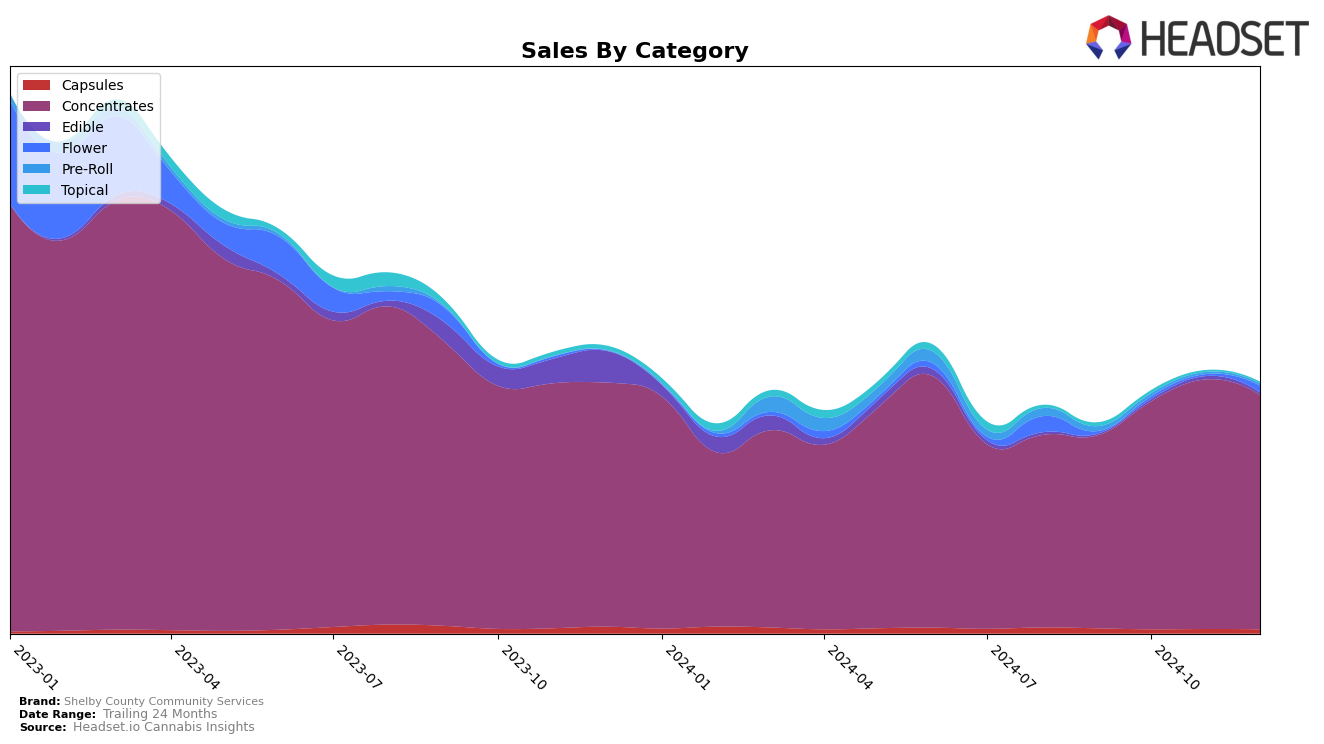

Shelby County Community Services has shown a notable performance in the concentrates category in Illinois over the last few months of 2024. The brand maintained a consistent ranking, hovering around the 11th and 13th positions from September to December. This stability in the top 15 indicates a strong foothold in the Illinois concentrates market, despite a slight dip in December back to the 13th position. This fluctuation suggests a competitive landscape, where maintaining a top position requires constant innovation and customer engagement.

Interestingly, Shelby County Community Services did not appear in the top 30 rankings in any other states or provinces across the same period, which can be seen as a missed opportunity for market expansion. This absence could be a strategic focus on strengthening their presence in Illinois or perhaps a challenge in penetrating other markets. The increase in sales from September to November, with a peak in October, reflects a positive growth trend, although the slight decline in December could indicate seasonal factors or increased competition. Understanding these dynamics could be crucial for stakeholders looking to capitalize on the brand's strengths and identify areas for growth.

Competitive Landscape

In the Illinois concentrates market, Shelby County Community Services has shown notable fluctuations in its ranking over the last quarter of 2024. Despite a strong performance in October and November, where it climbed to the 11th position, it slipped back to 13th in December. This indicates a competitive landscape where brands like Cresco Labs and nuEra consistently maintain a higher rank, with Cresco Labs ending December at 11th and nuEra at 12th. Interestingly, Amber and Remedi have shown significant movements, with Amber improving from 28th in September to 15th in December, and Remedi climbing from 19th to 14th in the same period. These shifts suggest that while Shelby County Community Services is holding its ground against some competitors, it faces pressure from both established and emerging brands in the market.

Notable Products

In December 2024, the top-performing product from Shelby County Community Services was 9lb Hammer CO2 Oil RSO Syringe (1g) in the Concentrates category, maintaining its number one rank from November with notable sales of 1180 units. Blackberry OG CO2 Oil RSO (1g) held steady at the second position, showing a slight decline in sales to 592 units compared to previous months. Galactic Jack CO2 Oil RSO Syringe (1g) rose to third place, despite a decrease in sales to 457 units. Cuvee CO2 Oil RSO Syringe (1g) improved its rank from fifth in November to fourth in December. Strawberry Pancakes CO2 Oil RSO Syringe (1g) entered the rankings for the first time in December, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.