Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

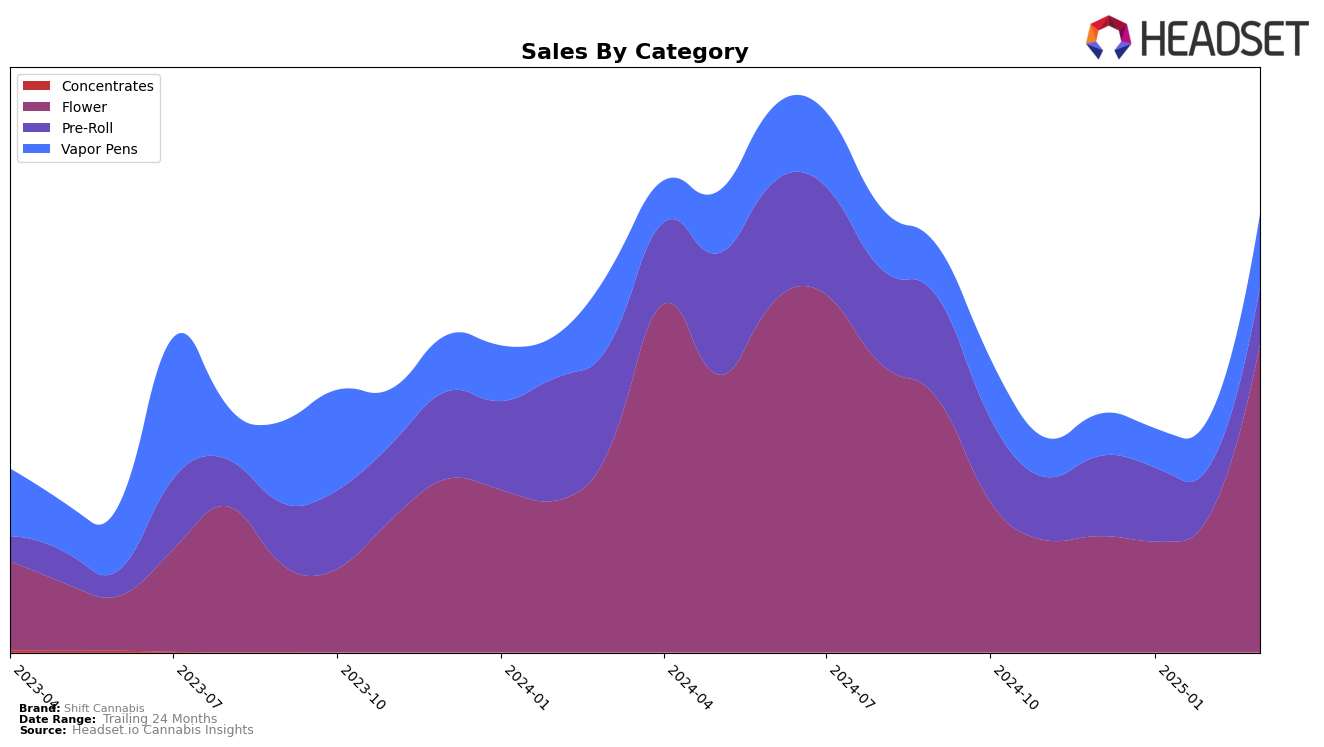

Shift Cannabis has shown significant progress in the Colorado market, particularly within the Flower category. Over a span of four months, the brand has climbed from a rank of 41 in December 2024 to an impressive 11 by March 2025. This upward trajectory indicates a strong market presence and growing consumer preference. On the other hand, their performance in the Pre-Roll category has been mixed, starting at rank 24 in December 2024, dropping to 38 in February 2025, and then slightly recovering to 37 in March 2025. This suggests potential challenges in maintaining a competitive edge in this segment.

In the Vapor Pens category, Shift Cannabis has consistently improved its position, moving from rank 60 in December 2024 to 46 by March 2025 in Colorado. Despite not breaking into the top 30, this steady improvement signals a positive trend. However, the fact that Shift Cannabis did not rank in the top 30 for any category in certain months could be a point of concern, indicating areas where the brand might need to focus more effort. The fluctuating rankings across categories highlight both the competitive nature of the market and the opportunities for Shift Cannabis to further solidify its standing.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Shift Cannabis has shown a remarkable upward trajectory in recent months. Starting from a rank of 41 in December 2024, Shift Cannabis climbed to the 11th position by March 2025, indicating a significant improvement in market presence. This upward movement is particularly notable when compared to competitors like Billo, which maintained a relatively stable position around the 11th to 13th rank, and Antero Sciences, which experienced fluctuations but ultimately improved to the 10th rank by March 2025. Meanwhile, Vera and TREES also showed competitive performances, with TREES consistently ranking within the top 10. Shift Cannabis's ascent in rank coincides with a notable increase in sales, particularly in March 2025, suggesting effective strategies in capturing market share and consumer interest. This trend positions Shift Cannabis as a formidable player in the Colorado flower market, with potential for continued growth and influence.

Notable Products

In March 2025, Granola Funk (Bulk) from Shift Cannabis emerged as the top-selling product, securing the number one rank in the Flower category with impressive sales of 5913 units. The Mixed Sativa Pre-Roll (1g) maintained a strong presence, ranking second after holding the top spot in February. Florida Wedding Cake Pre-Roll (1g) climbed to the third position, showcasing a significant increase from its previous fifth place in January. Strawberry Watermelon Pre-Roll (1g) made a notable entry into the rankings at fourth place. Juicee J (Bulk) rounded out the top five, dropping from its February position of third, yet still achieving considerable sales growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.