Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

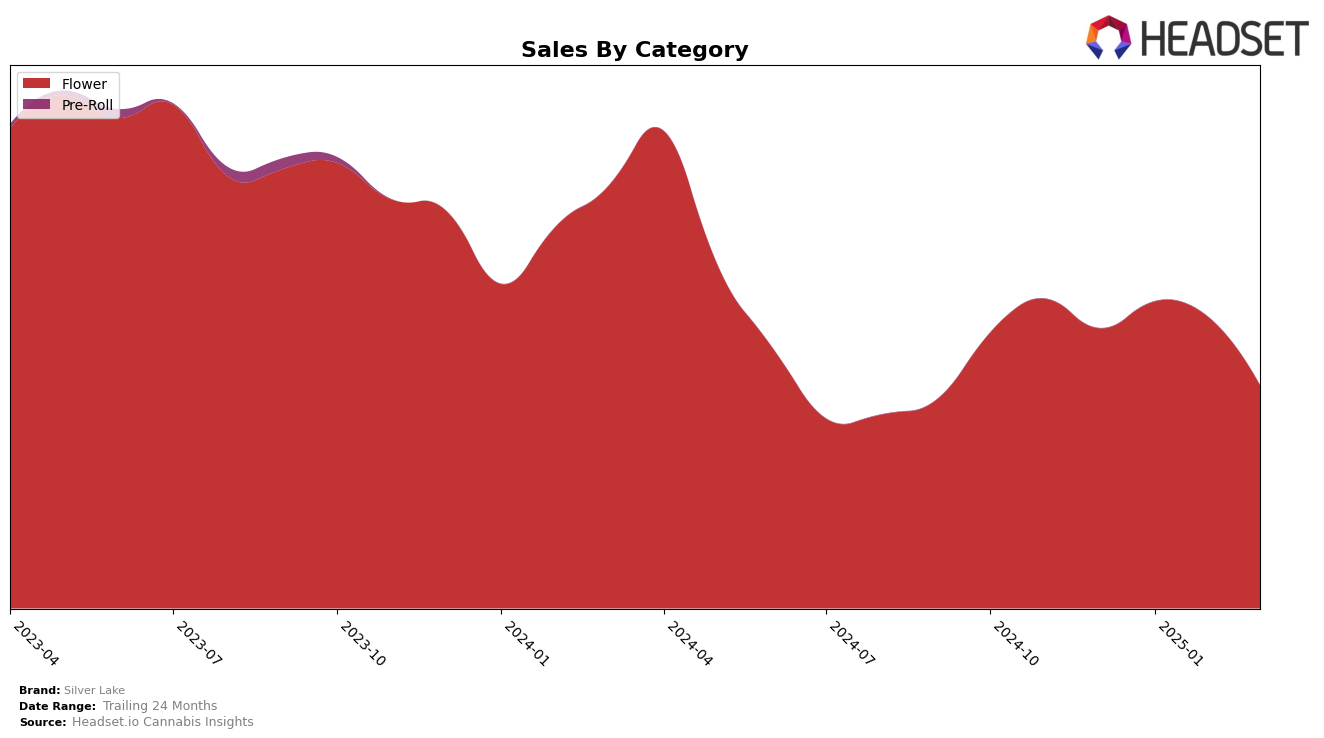

Silver Lake has shown a varied performance across different states and categories, with a notable presence in the Flower category in Colorado. In December 2024, the brand held the 7th position, improving to 6th place in January and February 2025, before dropping to 8th in March. This fluctuation indicates a strong but slightly volatile position in the Colorado market, suggesting potential competitive pressure or seasonal demand shifts. The absence of Silver Lake from the top 30 brands in other states or categories during these months points to a more localized strength, which might be a strategic focus or an area for growth.

Despite the dip in March, Silver Lake's sales trajectory in Colorado initially showed an upward trend from December to January, before experiencing a decline in February and March. This pattern could reflect market dynamics such as price changes, consumer preferences, or new product introductions by competitors. The lack of rankings in other states and categories suggests that Silver Lake's influence is currently concentrated, offering room for expansion and diversification. Understanding these movements can provide insights into the brand's strategic priorities and potential areas for development, especially in untapped markets where they are not yet ranked.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Silver Lake experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 7th in December, Silver Lake climbed to 6th place in January and February, before dropping to 8th in March. This decline coincided with a significant decrease in sales, suggesting potential challenges in maintaining consumer interest or market share. Meanwhile, 710 Labs showed a strong upward trend, improving its rank from 9th in December to 6th in March, indicating a potential threat to Silver Lake's position. TREES also demonstrated competitive strength, peaking at 5th place in January and February, before falling to 9th in March, yet still maintaining a competitive edge. In contrast, Antero Sciences and Dro experienced more volatility, with Antero Sciences not ranking in the top 20 in January and Dro dropping to 17th place in the same month, before both brands improved their standings by March. These dynamics highlight the competitive pressures Silver Lake faces in sustaining its market position amidst fluctuating consumer preferences and rival strategies.

Notable Products

In March 2025, Orange Push Pop (Bulk) maintained its top position as the leading product for Silver Lake, despite a decrease in sales to 19,613 units. Lemon Pound Cake (Bulk) rose to the second spot, showing a slight increase in sales from the previous month. Fruity Pebbles (Bulk) climbed to third place, marking a return to the top rankings after not being listed in February. Tangilope (Bulk) dropped one place to fourth, following its debut in the rankings in February. Fruity Pebbles OG (Bulk) entered the rankings for the first time in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.