Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

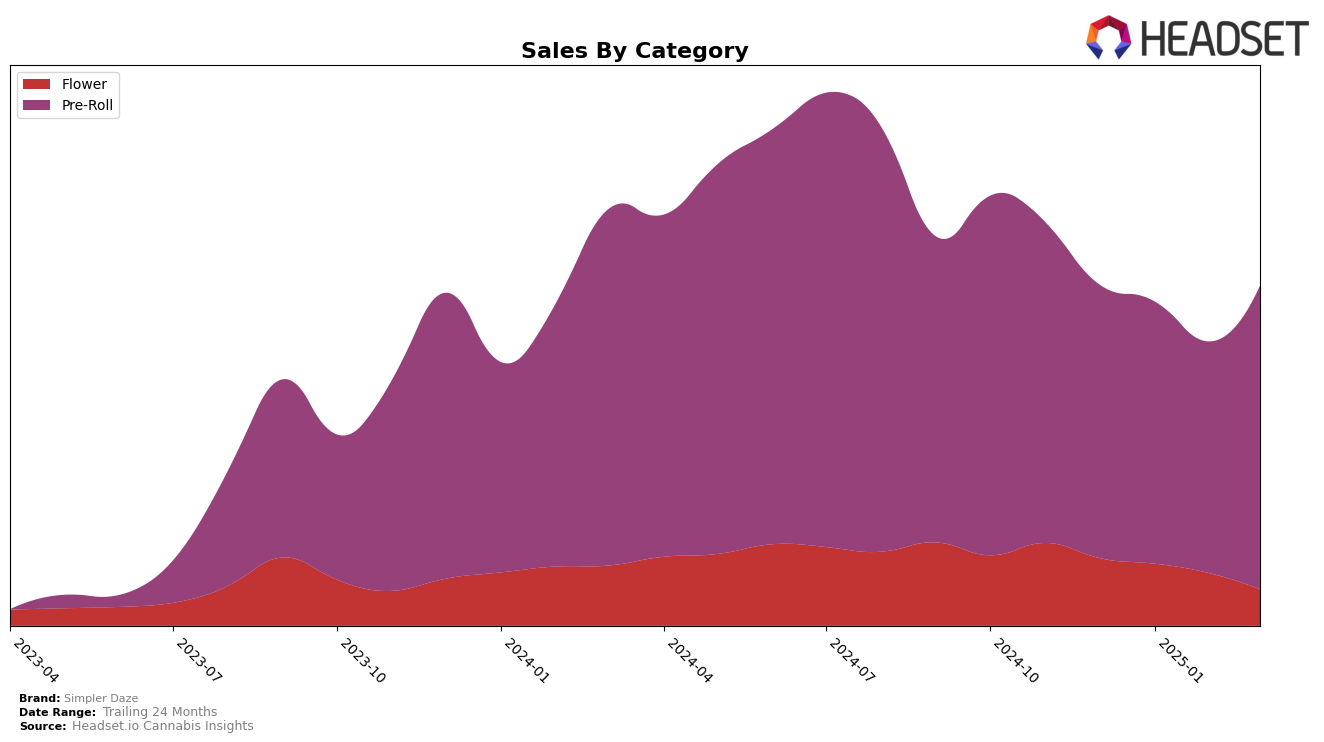

Simpler Daze has shown varied performance across different categories and states. In the Massachusetts market, the brand has maintained a strong presence in the Pre-Roll category, consistently ranking in the top 6 throughout the observed months, with a notable return to the 5th position in March 2025. However, their performance in the Flower category has seen a decline, dropping from 23rd place in December 2024 to 42nd by March 2025, indicating a significant decrease in market presence. This downward trend in the Flower category might suggest shifts in consumer preferences or increased competition in the market.

In Michigan, Simpler Daze has demonstrated resilience in the Pre-Roll category, where it improved its ranking from 7th in February 2025 to 5th in March 2025. This upward movement suggests a positive reception of their products or effective market strategies in the state. Notably, the brand's absence from the top 30 in other categories or states could be seen as a potential area for growth or a reflection of a focused product strategy. The contrasting performance across states and categories might provide insights into regional consumer behavior and the brand's strategic positioning within the cannabis market.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Simpler Daze has shown a promising trajectory, particularly in the first quarter of 2025. While it started December 2024 in 7th place, it climbed to 6th in January, briefly dropped back to 7th in February, and then achieved a notable rise to 5th place by March 2025. This upward trend in rank is indicative of a strong performance in sales, outpacing brands like STIIIZY, which remained relatively stable in the 6th and 7th positions during the same period. However, Simpler Daze still faces stiff competition from top contenders such as Goodlyfe Farms and Dragonfly Cannabis, which consistently held higher ranks. Notably, Mitten Extracts made a significant leap from 26th to 6th place in March, suggesting a dynamic and competitive market environment. The data underscores Simpler Daze's potential for continued growth and highlights the importance of strategic positioning to maintain and improve its standing in the Michigan pre-roll market.

Notable Products

In March 2025, the top-performing product for Simpler Daze was the Fire Styxx - Grape Escape THCA Infused Pre-Roll in the Pre-Roll category, maintaining its consistent first-place ranking from the previous months with a notable sales figure of $58,229. Following closely, the Fire Styxx - Unicorn Tears THCA Infused Pre-Roll held its second-place position, showcasing steady demand. The Fire Styxx- Tigers Breath Infused Pre-Roll remained in third place, indicating stable sales performance over the months. The Fire Styxx - Razzberry Diesel Infused Pre-Roll, which appeared in the rankings in February, maintained its fourth position in March. Lastly, the Fire Styxx - Midnight Berry Infused Pre-Roll debuted in the rankings at fifth place, suggesting a positive reception since its introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.