Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

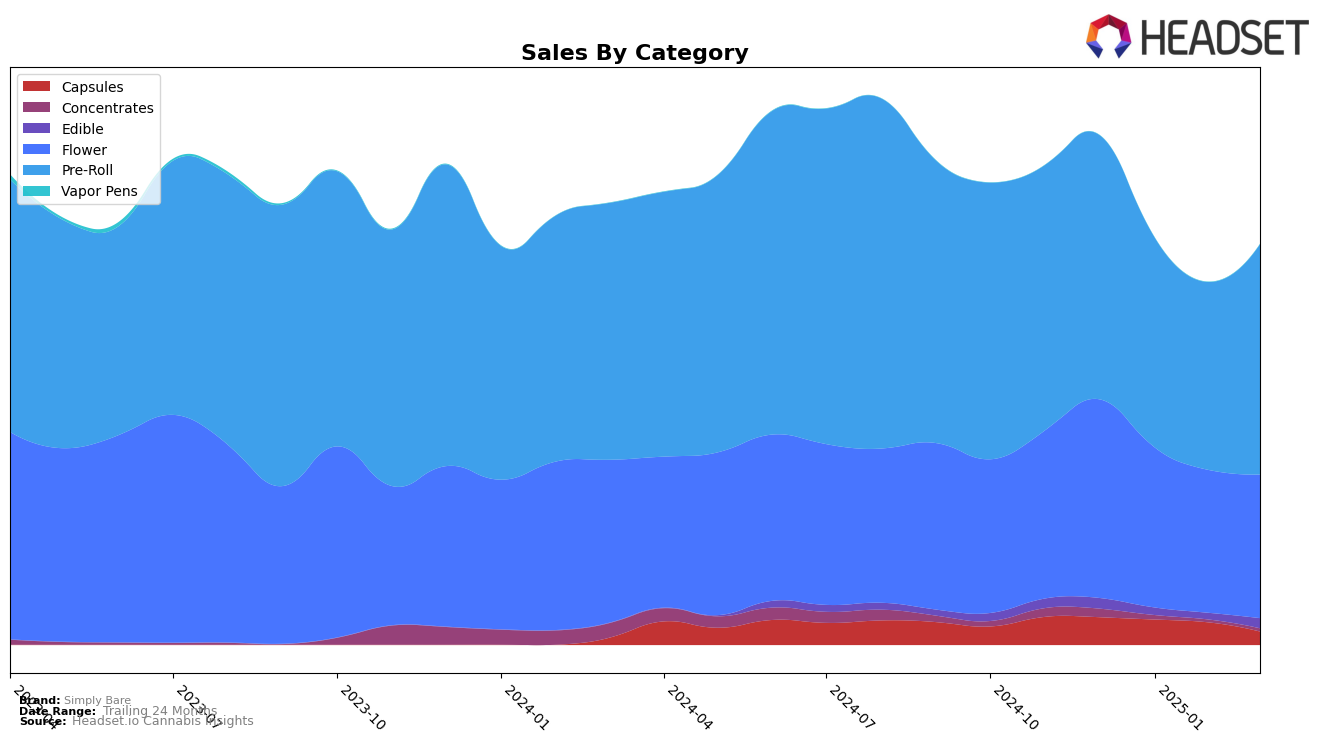

Simply Bare has experienced notable fluctuations in its performance across various categories and regions. In Alberta, the brand's Flower category has seen a gradual decline in rankings from 19th in December 2024 to 25th by March 2025, accompanied by a steady decrease in sales. Conversely, the Pre-Roll category in Alberta presents a different narrative, where Simply Bare managed to climb from 37th in January 2025 to 31st in February, before stabilizing at 32nd by March, reflecting a resurgence in consumer interest. Meanwhile, in British Columbia, the Capsules category maintained a consistent 5th place ranking through February 2025, though there is a lack of March data, which could indicate a possible drop from the top 30. This consistency in rankings highlights a stable demand for Simply Bare's Capsules in this province.

In Ontario, the brand's performance in the Flower category has been more volatile, with rankings shifting from 63rd in December 2024 to 62nd by March 2025, suggesting a slight improvement. The Pre-Roll category in Ontario similarly shows positive momentum, improving from 39th in December to 35th by March. Simply Bare's Capsules in Ontario have remained consistently ranked at 10th place, indicating a steady market presence. However, the Flower category in British Columbia did not perform as well, as it fell out of the top 30 rankings, which may be a point of concern for the brand in that particular market. These movements across different regions and categories highlight the varying consumer preferences and market dynamics that Simply Bare navigates.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Simply Bare has experienced a fluctuating but generally improving rank from December 2024 to March 2025. Starting at 39th place in December, Simply Bare climbed to 35th by March, indicating a positive trend in market positioning. This improvement is noteworthy, especially when compared to Color Cannabis, which saw a decline from 22nd to 37th place over the same period. Meanwhile, The Loud Plug and The Original Fraser Valley Weed Co. also experienced rank fluctuations, with the latter dropping from 25th to 34th. Despite these shifts, Sheeesh! maintained a relatively stable position, ending March in 33rd place. Simply Bare's sales figures show a dip in January and February, but a recovery in March, which aligns with its improved ranking. This suggests that Simply Bare's strategic adjustments may be yielding positive results in a competitive market.

Notable Products

In March 2025, the top-performing product from Simply Bare was the Fruit Loopz Pre-Roll 5-Pack (1.5g), maintaining its first-place ranking for the fourth consecutive month with sales reaching 10,924 units. The BC Organic Fruit Loopz Pre-Roll (0.5g) secured the second position, consistently holding this rank since January 2025. The Craft Flight Variety Pre-Roll 3-Pack saw a notable rise, moving up to third place from fifth in the previous months. BC Organic - Fire OG Rosin Infused Pre-Roll (0.5g) made its debut in the rankings at fourth place, indicating strong initial sales. Lastly, BC Organic - Fruit Loopz (3.5g) slipped to fifth place, a slight decline from its steady fourth position earlier in the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.