Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

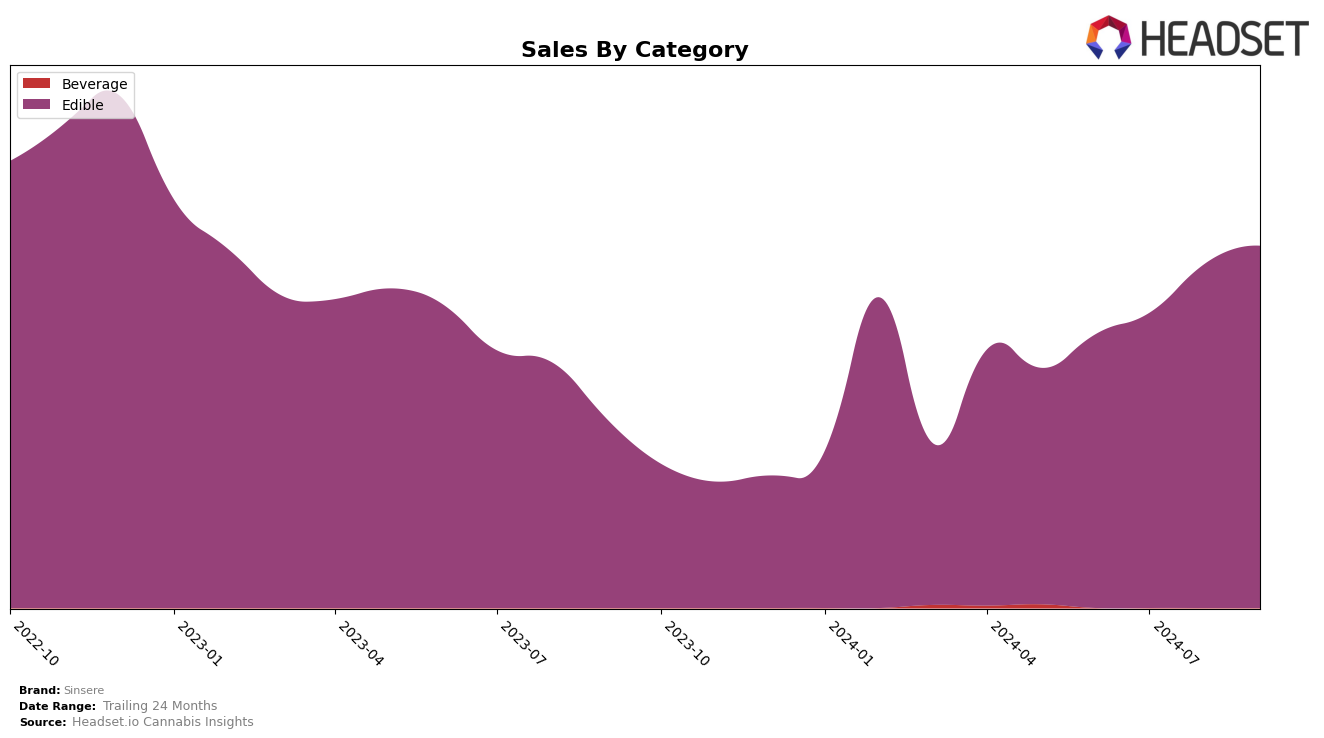

Sinsere has shown a notable upward trajectory in the Edible category within Colorado. Over the summer months, the brand improved its ranking from 35th in June to breaking into the top 30 by September. This consistent climb in rankings indicates a growing consumer preference or effective market strategies that have bolstered their presence in the competitive landscape of edibles. The sales figures reflect this trend, with a steady increase each month, suggesting that Sinsere's products are gaining traction among consumers in this state.

While the performance in Colorado is encouraging, it's important to note that Sinsere did not appear in the top 30 rankings in other states or categories during this period. This absence could suggest either a lack of market penetration or a highly competitive environment where Sinsere has yet to establish a strong foothold. The focus on Colorado might indicate a strategic choice to concentrate efforts in a market where they see the most potential for growth, which could pave the way for future expansions into other regions or categories if this upward momentum continues.

```Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, Sinsere has shown a steady improvement in its ranking from June to September 2024, moving from 35th to 30th place. This upward trend in rank is indicative of a positive trajectory in sales performance, contrasting with brands like Sweet Mary Jane, which experienced a decline in rank from 23rd to 29th, and Spinello Cannabis Co., which fluctuated and ended September in a lower position than in June. Meanwhile, Happy Fruit made a notable leap from 36th to 28th, suggesting a competitive edge in sales growth that Sinsere must contend with. Despite these challenges, Sinsere's consistent climb in rank highlights its growing presence and potential in the market, setting it apart from competitors like ROBHOTS, which remained outside the top 30 throughout the period. This analysis underscores the dynamic nature of the edible category in Colorado and the importance of strategic positioning for Sinsere to maintain its upward momentum.

Notable Products

In September 2024, Sinsere's top-performing product was Caramel Peanut Bites (100mg) in the Edible category, maintaining its number one rank for the fourth consecutive month with sales reaching 722 units. Following closely, Peanut Butter Chocolate Bites (100mg) also held steady in second place, experiencing a notable increase in sales from 414 units in August to 501 units in September. Mint Dark Chocolate Bar (100mg) re-entered the rankings at third place after missing an entry in August, with sales of 194 units. Black Forest Cherry Chocolate Bar 10-Pack (100mg) climbed to fourth place, showing a significant improvement from its absence in August, achieving 187 units sold. The Milk Chocolate Bar (100mg) entered the rankings for the first time at fifth place, highlighting its growing popularity with 120 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.