Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

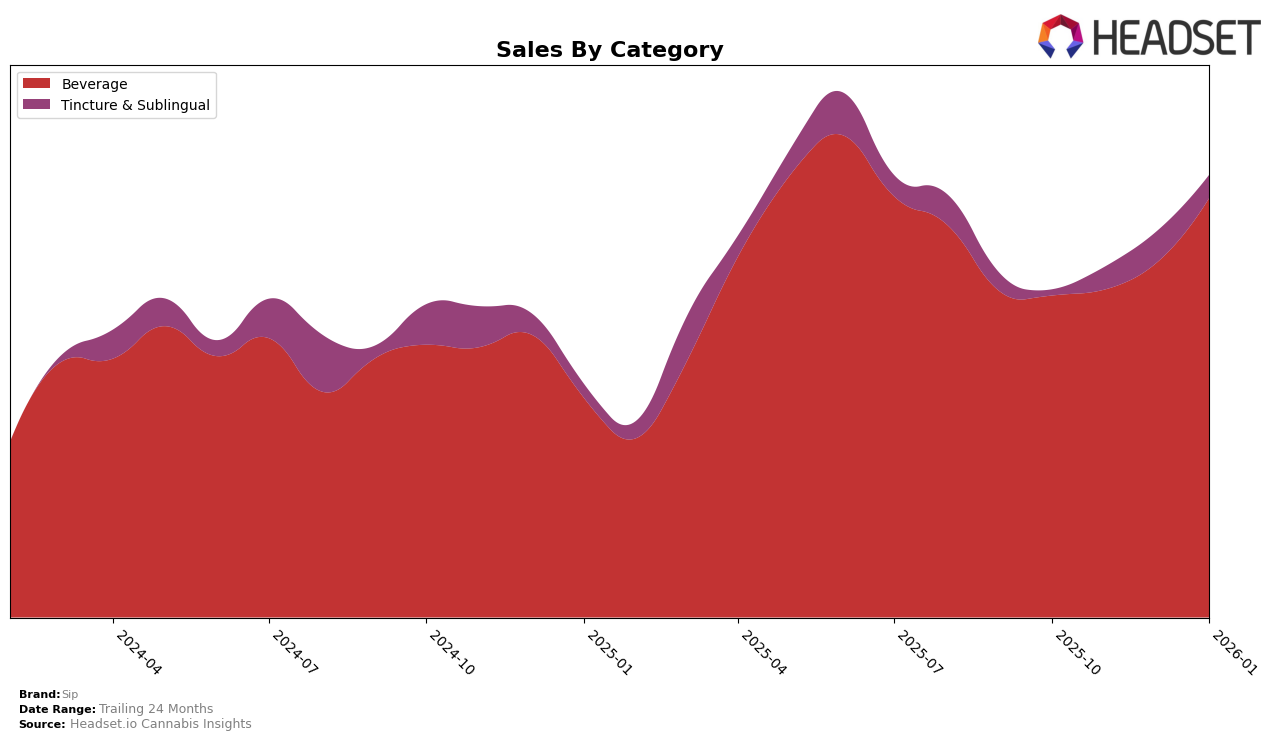

Sip has shown a notable performance in the Massachusetts market, particularly in the Beverage category. From October 2025 to January 2026, Sip maintained a consistent presence in the top 10, improving its rank from 10th to 8th place. This upward trend is complemented by a steady increase in sales, culminating in January 2026. The brand's ability to climb the ranks while boosting sales indicates a strong consumer demand and effective market strategies in the state. Conversely, in the Tincture & Sublingual category, Sip did not appear in the top 30 in October 2025, but by November, it secured the 8th position and maintained it through January 2026. This suggests a significant strategic shift or introduction of new products that resonated well with consumers in this category.

While the Beverage category's performance is impressive, the Tincture & Sublingual category's breakthrough is particularly noteworthy. Despite not being ranked in the top 30 in October, Sip's rapid ascent to the 8th position by November highlights a successful entry or enhanced focus in this segment. This achievement is underscored by a consistent sales performance, although there was a slight dip in January 2026 compared to December 2025. This fluctuation might suggest seasonal trends or competitive pressures that the brand is navigating. Overall, Sip's performance across these categories in Massachusetts illustrates a dynamic market presence, leveraging both stability in beverages and newfound growth in tinctures and sublinguals.

Competitive Landscape

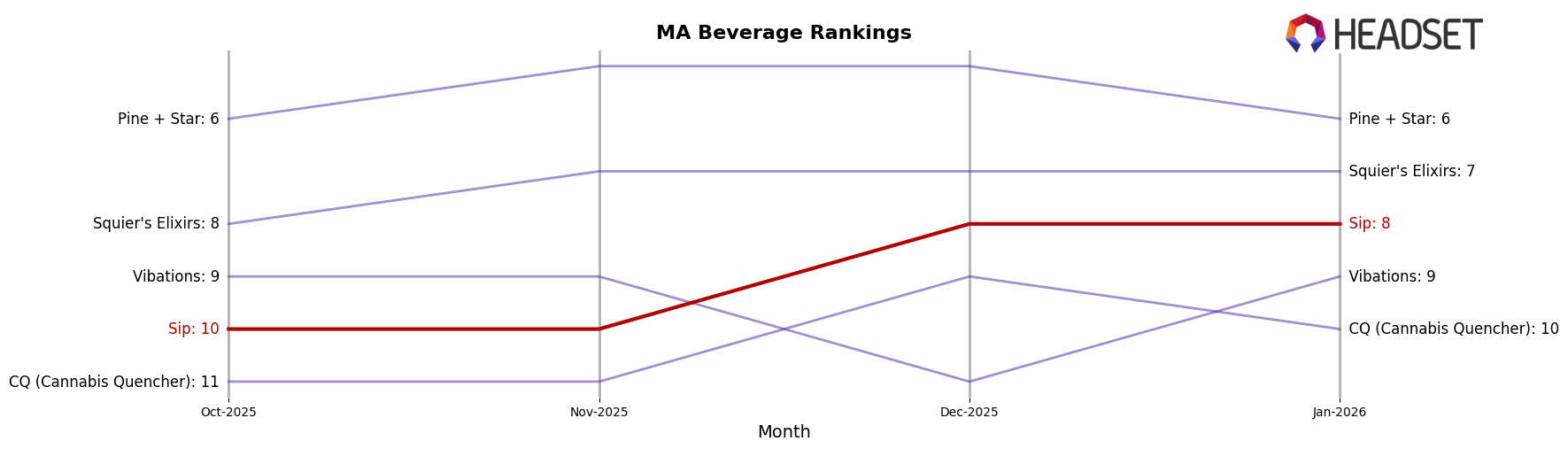

In the Massachusetts beverage category, Sip has shown a promising upward trend in its rankings and sales over the recent months. Starting from the 10th position in October 2025, Sip improved its rank to 8th by December 2025 and maintained this position into January 2026. This consistent rise is indicative of a positive reception in the market, as reflected by a notable increase in sales from October's figures to January 2026. In comparison, CQ (Cannabis Quencher) remained relatively stable, hovering around the 9th to 11th positions, while Vibations experienced fluctuations, dropping to 11th in December before climbing back to 9th in January. Meanwhile, Pine + Star consistently outperformed Sip, maintaining a top 6 position, though it saw a dip in January sales. Squier's Elixirs also held a steady rank, slightly ahead of Sip, but with a less pronounced sales growth trajectory. These dynamics suggest that while Sip is gaining momentum, it faces stiff competition from established brands, making its recent performance all the more commendable.

Notable Products

In January 2026, Sip's CBD/THC/CBN 5:5:1 Sugar Free Couchlock Grape Infused Soda maintained its position as the top-performing product, with sales reaching 2943 units. The CBD/THC 1:1 Watermelon Lemonade Infused Seltzer held steady at the second rank, showing a significant increase in sales from the previous month. Cranberry Highway Soda climbed to the third position, improving from its fifth-place rank in November 2025. Energy - Orange Sugar-Free Soda experienced a slight drop, moving from third place in December 2025 to fourth place in January 2026. Rootbeer Soda entered the rankings for the first time in January 2026, securing the fifth position with notable sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.