Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

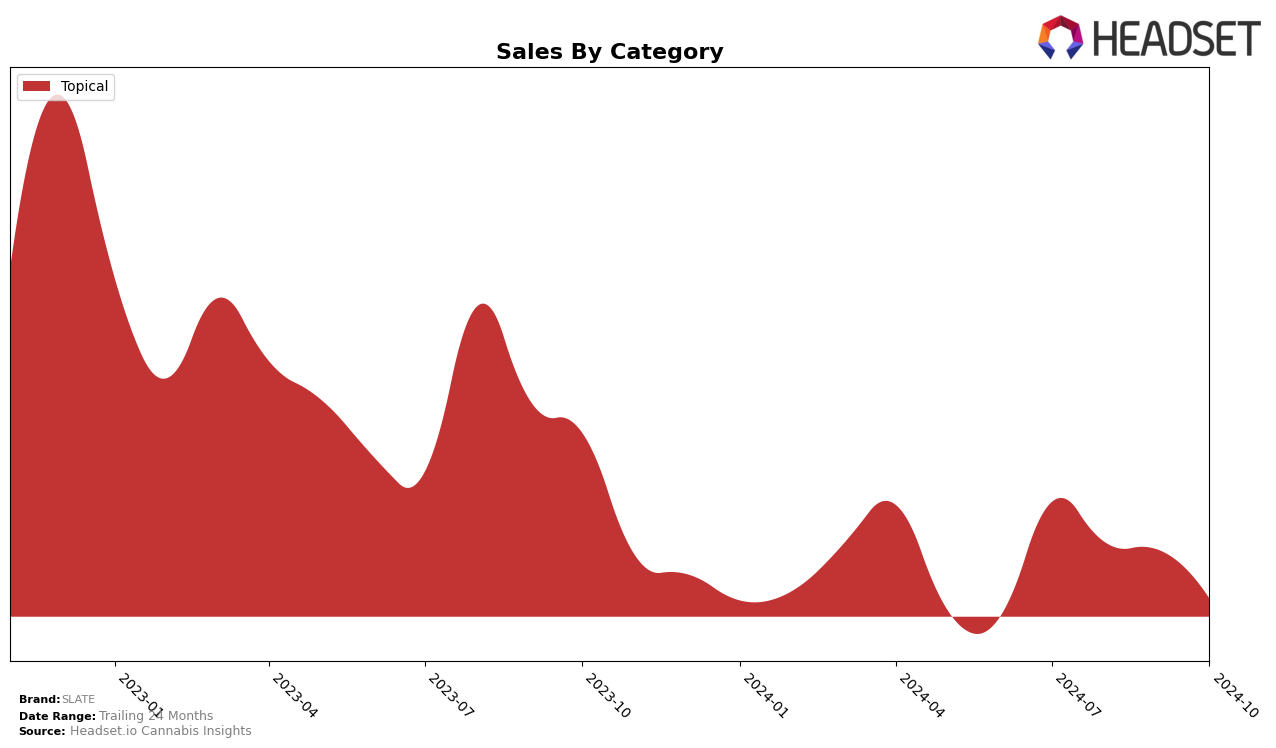

SLATE has demonstrated a fluctuating performance across different states and categories, with notable movements in certain areas. For instance, in the state of Massachusetts, SLATE maintained a ranking of 11th in the Topical category as of July 2024, with sales reaching $10,578. However, in the subsequent months of August, September, and October, SLATE did not maintain a position within the top 30 brands in this category, indicating a decline in their market presence or possibly increased competition. This drop-off in ranking could imply challenges in sustaining consumer interest or a need for strategic adjustments in their approach within Massachusetts.

Across other states and categories, SLATE's presence is either not prominent enough to enter the top 30 rankings or data is unavailable for analysis, which can be interpreted as a potential area for growth or an indication of limited market penetration. The absence of SLATE in the top rankings in other states suggests that while they have a foothold in Massachusetts, their influence and success in other regions might not be as strong. This disparity in performance highlights the importance of regional strategies and the necessity for SLATE to possibly reevaluate their market strategies to enhance their competitive edge and expand their footprint in other promising markets.

Competitive Landscape

In the Massachusetts Topical category, SLATE experienced a notable shift in its competitive standing from July to October 2024. Initially ranked 11th in July, SLATE did not maintain a position within the top 20 for the subsequent months, indicating a potential decline in market visibility or sales performance. In contrast, The Heirloom Collective improved its rank from 10th in July to 9th in August, suggesting a strengthening market presence. Meanwhile, Wellman Farm demonstrated significant progress, moving from outside the top 20 in July to 8th place by September and maintaining that position in October, reflecting a robust upward trend. BeachGrass Topicals showed fluctuating performance, peaking at 5th in August but settling back to 9th by October. These dynamics suggest that SLATE faces increasing competition, particularly from brands like Wellman Farm, which are gaining traction and potentially capturing market share in the Massachusetts Topical market.

Notable Products

In October 2024, SLATE's CBD/THC 1:1 Wonder Balm (600mg CBD, 600mg THC, 6oz) maintained its position as the top-performing product in the Topical category, despite a decrease in sales to 60 units. This product has consistently held the number one rank from July through October, showcasing its sustained popularity. The consistency in ranking suggests a strong customer base and high product satisfaction. Other products from SLATE saw shifts in their rankings, with some experiencing a decline in sales, indicating potential market saturation or increased competition. Overall, SLATE's Wonder Balm remains a standout performer, leading its category with a notable sales figure.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.