Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

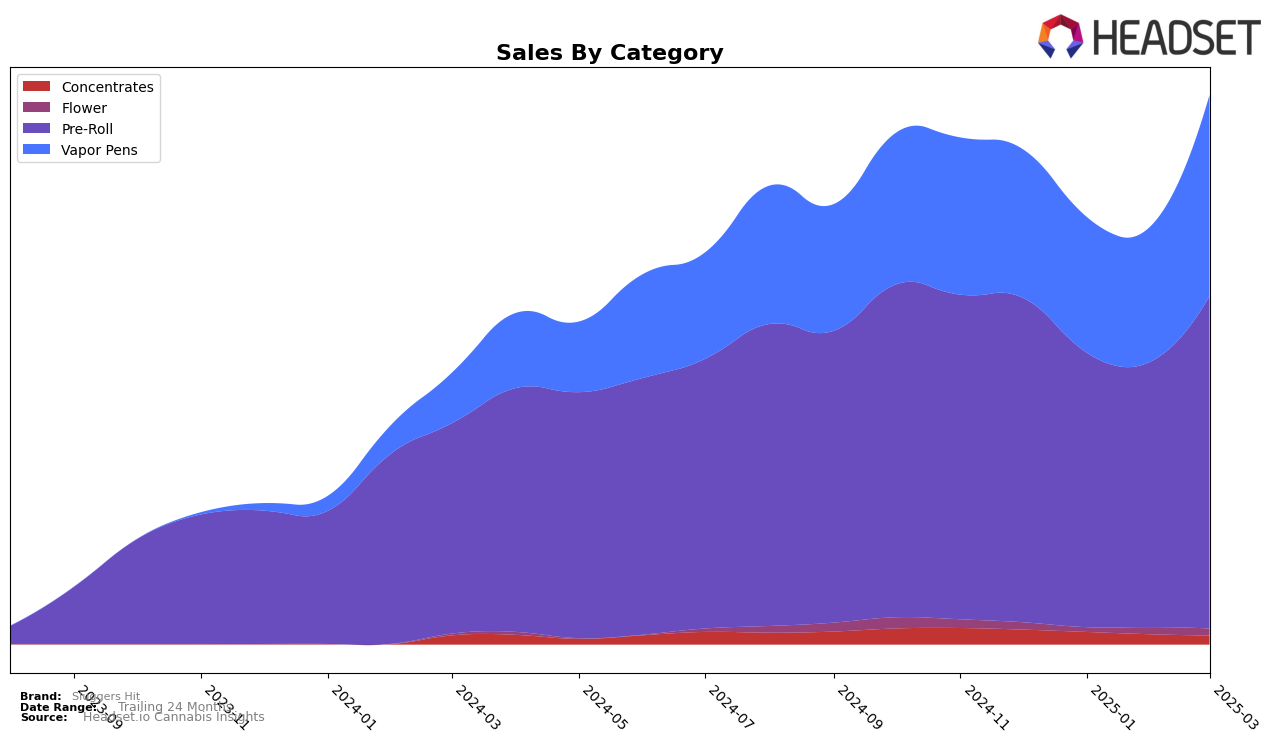

In the state of Arizona, Sluggers Hit has shown promising progress in the cannabis market, particularly in the Pre-Roll category. By March 2025, they achieved a notable position, ranking 7th, which indicates a strong market presence and consumer preference for their products. However, in the Vapor Pens category, they ranked 18th in March 2025, suggesting room for growth and potential market expansion. The absence of rankings in prior months for both categories could either highlight a late entry into the market or a significant improvement in their market strategy, reflecting positively on their recent performance.

In California, Sluggers Hit has maintained a consistent presence in the Pre-Roll category, with rankings fluctuating slightly but remaining within the top 10. This stability suggests a strong foothold in this category, despite a slight dip from 5th to 8th place over the observed months. Conversely, their performance in the Concentrates category was less favorable, as they did not break into the top 30 by March 2025, indicating a potential area for improvement. In the Vapor Pens category, Sluggers Hit maintained a steady presence, consistently ranking around the 25th position, which may suggest a stable but less dominant position compared to their Pre-Roll offerings.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Sluggers Hit has experienced notable fluctuations in its ranking from December 2024 to March 2025. Initially ranked 5th in December 2024, Sluggers Hit saw a decline to 7th in January 2025, a slight recovery to 6th in February, and then a drop to 8th by March. This downward trend in rank coincides with a decrease in sales over the same period, suggesting increased competition and market pressure. Notably, Kingpen consistently maintained a strong position, fluctuating between 5th and 7th place, while Pacific Stone showed an upward trajectory, moving from 8th to 6th place by March, potentially capturing market share from Sluggers Hit. Meanwhile, Quickies Prerolls demonstrated significant growth, climbing from 19th to 10th place, indicating a rising competitor that could further impact Sluggers Hit's market position. These dynamics highlight the need for Sluggers Hit to strategize effectively to regain its competitive edge in the California pre-roll category.

Notable Products

In March 2025, the top-performing product from Sluggers Hit was the Baby Griselda Infused Pre-Roll 5-Pack (3.5g) in the Pre-Roll category, climbing from a rank of 3 in February to secure the top spot. The Euphoria Live Resin Diamond Disposable (1g) maintained its position at rank 2 in the Vapor Pens category from February. The Euphoria Infused Pre-Roll 5-Pack (3.5g) entered the rankings at position 3, indicating a strong market entry. Meanwhile, Rainbow Road Live Resin Diamonds Disposable (1g) held steady at rank 4 in the Vapor Pens category across the months. Notably, the 33 Live Resin Diamonds Disposable (1g) experienced a drop from rank 2 in January to rank 5 in March, with sales figures reaching 2694 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.