Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

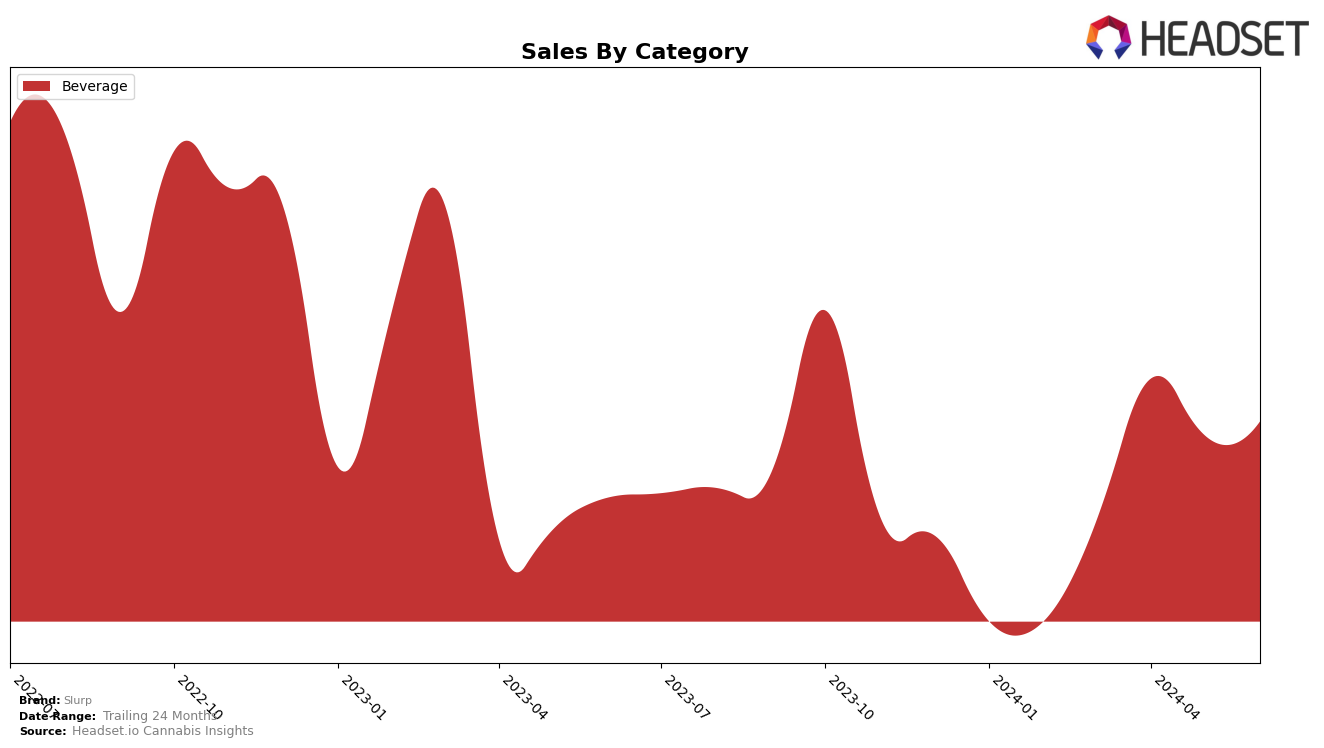

Slurp has demonstrated a dynamic performance in the beverage category within Oregon. Notably, the brand made a significant appearance in April 2024, securing the 10th position, which it maintained through June 2024. This consistent ranking indicates a stable presence in the market, although Slurp did not appear in the top 30 in March and May, which could suggest variability in consumer demand or distribution challenges during those months. Such fluctuations are critical for stakeholders to monitor as they reflect both opportunities and potential vulnerabilities in market positioning.

While the sales figures reveal a slight decrease from April to June, with sales dropping from $11,330 to $10,024, the brand's ability to re-enter the top 10 in June after an absence in May is a positive indicator of resilience and effective market strategies. However, the absence of Slurp from the top 30 in March and May is a point of concern that needs addressing to ensure consistent market penetration. These insights should prompt further analysis into the factors influencing these ranking shifts and sales performance, providing a nuanced understanding of Slurp's market dynamics in Oregon.

Competitive Landscape

In the Oregon beverage category, Slurp has shown fluctuating performance in recent months, impacting its rank and sales. In April 2024, Slurp was ranked 10th but did not appear in the top 20 in March and May, indicating inconsistent market presence. However, it returned to the 10th position in June 2024. This inconsistency contrasts with competitors like High Desert Pure, which maintained a stable rank around 8th and 9th, and Fruit Lust, which consistently ranked between 6th and 8th. The steady performance of these competitors suggests they have a more reliable customer base, which may be contributing to their higher sales figures compared to Slurp. Notably, Verdant Leaf Farms ranked 8th in March but did not appear in the top 20 in subsequent months, showing a decline similar to Slurp's. Meanwhile, Medicine Farm Botanicals showed an upward trend, moving from 11th in April to 10th in May, suggesting growing market traction. These dynamics highlight the competitive volatility in the Oregon beverage category and suggest that Slurp needs to focus on stabilizing its market presence to improve its rank and sales.

Notable Products

In June 2024, the top-performing product for Slurp was Mango Syrup (1000mg) in the Beverage category, securing the first rank with a notable sales figure of 177 units. Following closely, Grape Drink Syrup (1000mg) took the second spot, while Blue Raspberry Cannabis Syrup (1000mg) and Tropical Punch Cannabis Syrup (1000mg) tied for the third rank. Mango Syrup made a significant leap from its previous unranked status, showing a remarkable increase in sales. Grape Drink Syrup also saw substantial growth, moving from an unranked position in the previous months to second place. Blue Raspberry Cannabis Syrup maintained a consistent presence in the top ranks, although it dropped slightly from its second position in May to third in June.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.