Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

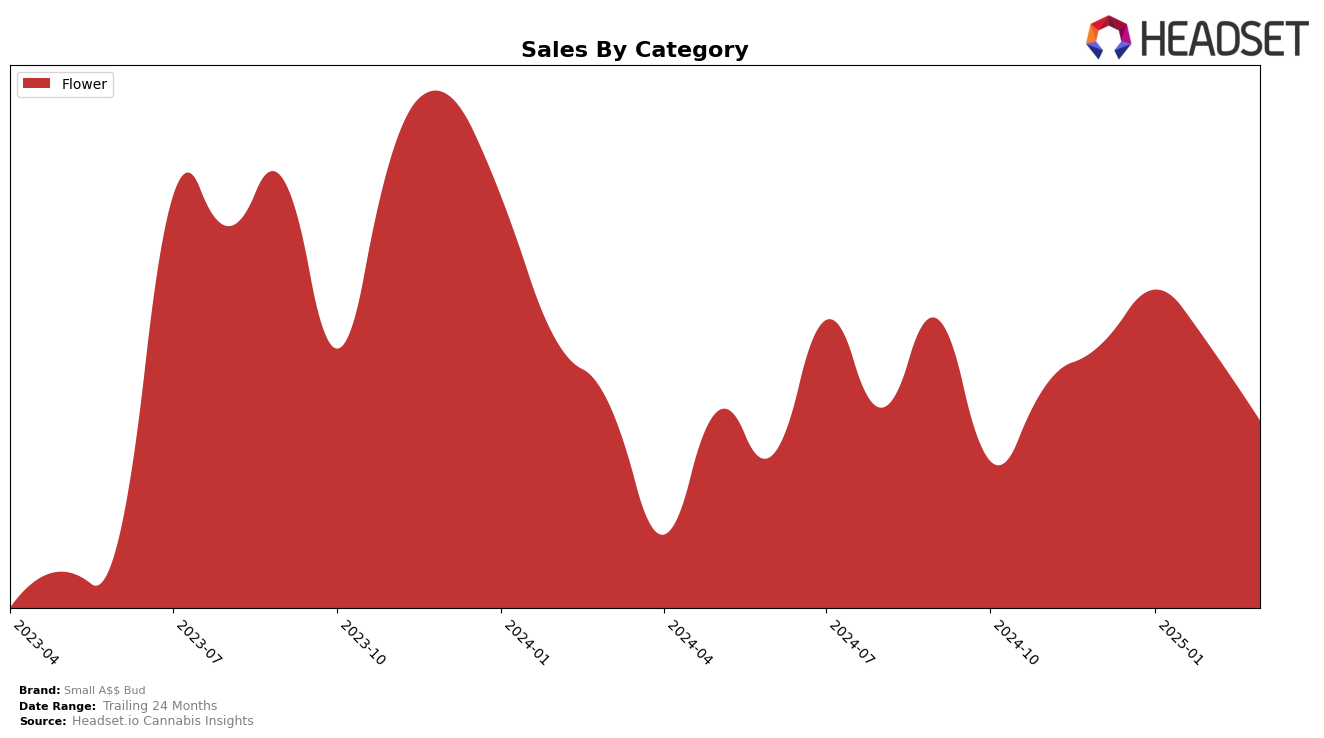

In Maryland, Small A$$ Bud experienced notable fluctuations in their brand ranking within the Flower category over the past few months. Starting at the 28th position in December 2024, they improved to 25th in both January and February 2025, before slipping back to 29th in March 2025. This movement indicates a temporary boost in the early months of 2025, possibly driven by strategic marketing or product launches, but the subsequent drop suggests challenges in maintaining that momentum. The sales figures reflect this volatility, with a peak in January followed by a decline in the following months, hinting at potential market saturation or increased competition.

Across other states, Small A$$ Bud's presence in the top 30 for the Flower category is absent, which could be interpreted as either a strategic focus on Maryland or challenges in penetrating other markets. The absence from the top 30 in other states may highlight areas for growth or the need for enhanced distribution strategies. While the data from Maryland provides insights into the brand's performance in a specific market, it also raises questions about their broader market strategy and potential areas for expansion. Understanding these dynamics could be crucial for stakeholders looking to capitalize on the brand's strengths or address its weaknesses.

Competitive Landscape

In the competitive landscape of the flower category in Maryland, Small A$$ Bud has experienced notable fluctuations in its market position over the first quarter of 2025. Despite starting strong with a rank of 25 in January, it slipped to 29 by March, indicating a potential challenge in maintaining its competitive edge. Meanwhile, brands like Verano and Cultivar Collection have shown upward momentum, improving their ranks from 36 to 27 and 39 to 30, respectively, over the same period. This suggests that these competitors are gaining traction, possibly at the expense of Small A$$ Bud. Additionally, Grass also demonstrated a strong performance, peaking at rank 22 in February before slightly declining to 28 in March. The sales trends for these competitors indicate a growing consumer preference, which could be a critical factor for Small A$$ Bud to address in order to regain its footing and improve its market share in the coming months.

Notable Products

In March 2025, the top-performing product for Small A$$ Bud was Gorilla Glue (14g) in the Flower category, maintaining its position as the number one seller for four consecutive months, despite a sales figure of 540.0. GMO Punch (14g) emerged as the second-best seller, marking its first recorded ranking. Duct Tape (14g) secured the third spot, having previously been ranked first in December 2024 but unranked in the subsequent months. Flap Jacks (14g) also entered the rankings in March 2025, tying with Duct Tape with a similar sales figure. Fried Ice Cream (14g) appeared in the fourth position, indicating a diverse preference for Flower products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.