Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

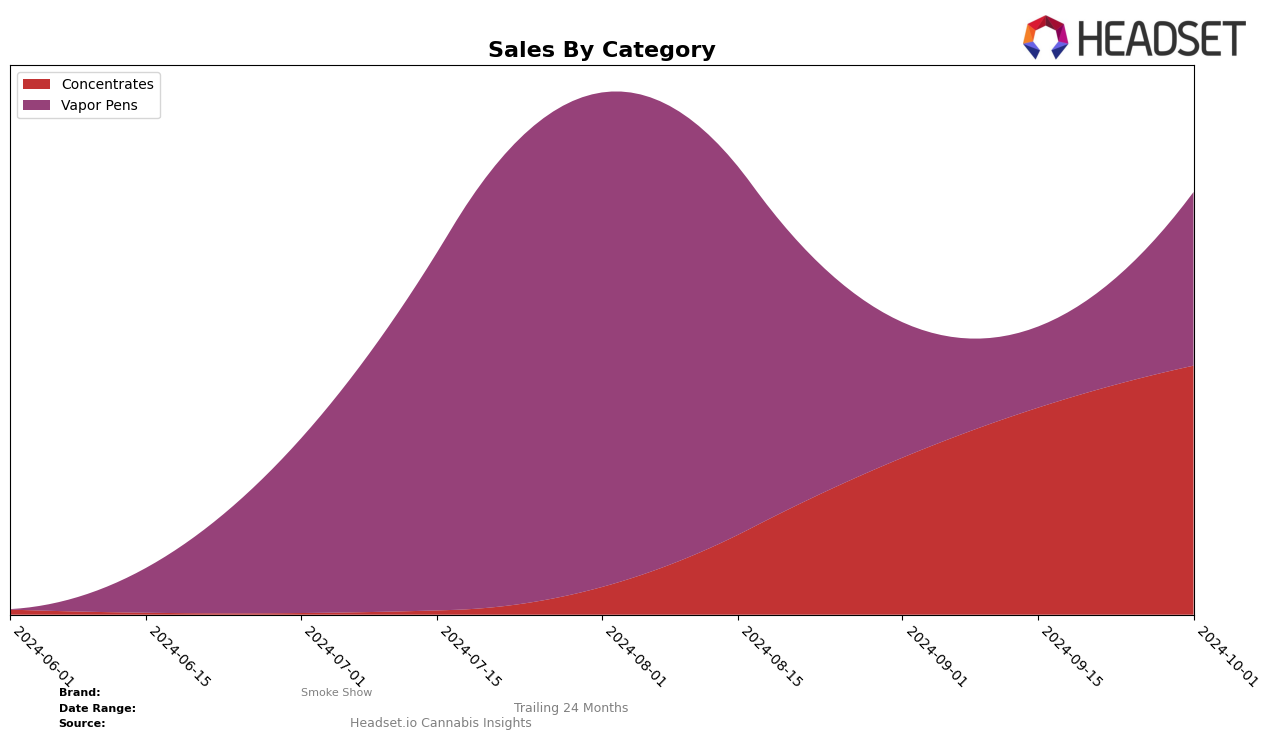

Smoke Show has shown notable progress in the concentrates category in Alberta. Over the last four months, the brand climbed from a ranking of 37 in July 2024 to break into the top 30 by October 2024. This upward trajectory is complemented by a steady increase in sales, with October 2024 sales reaching a significant figure. This consistent improvement indicates a strengthening market presence and suggests effective strategies in product offerings or distribution. However, in the vapor pens category, the brand has faced challenges, with rankings fluctuating and failing to secure a spot in the top 50 for some months. Despite a brief improvement in August, the brand's position remains volatile, highlighting potential areas for growth or reevaluation.

The performance of Smoke Show in Alberta across different categories reveals both opportunities and challenges. While the brand's ascent in the concentrates category is promising, the inconsistent rankings in vapor pens suggest a need for strategic adjustments. The inability to consistently rank within the top 30 in vapor pens could be indicative of strong competition or a mismatch in consumer preferences. This contrast between categories underscores the importance of targeted marketing and product innovation. Observing these patterns, stakeholders can glean insights into consumer behavior and market dynamics, enabling them to make informed decisions for future endeavors.

Competitive Landscape

In the Alberta concentrates market, Smoke Show has demonstrated a notable upward trajectory in its rankings and sales over the past few months. Starting from a rank of 37 in July 2024, Smoke Show climbed to 30 by October 2024, showcasing a consistent improvement. This positive trend is significant when compared to competitors like 7 Acres, which saw a decline from rank 27 to 33 in the same period, and Ellevia, which fluctuated without significant rank improvement. Meanwhile, Greybeard maintained a relatively stable position, moving from 31 to 25, and Freedom Cannabis showed a slight decline from 24 to 26. Smoke Show's sales have also been on an upward trend, contrasting with the declining sales of 7 Acres and the fluctuating sales of Ellevia. This suggests that Smoke Show is gaining traction in the market, potentially due to increased consumer interest or effective marketing strategies, positioning it as a brand to watch in the Alberta concentrates category.

Notable Products

In October 2024, Lemon OG Live Resin Diamonds (1g) maintained its position as the top-performing product for Smoke Show, leading the Concentrates category with sales reaching 717 units. This product consistently improved its ranking over the months, moving from second place in July and August to first in September and October. Juicy Fruit OG Live Resin Cartridge (1g) ranked second in the Vapor Pens category, following a slight drop from its first-place position in July and August. Notably, this product achieved a peak sales figure of 1,014 units in August before stabilizing at 603 units in October. Overall, the rankings illustrate a strong performance for Smoke Show's concentrates, with Lemon OG Live Resin Diamonds showing significant growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.