Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

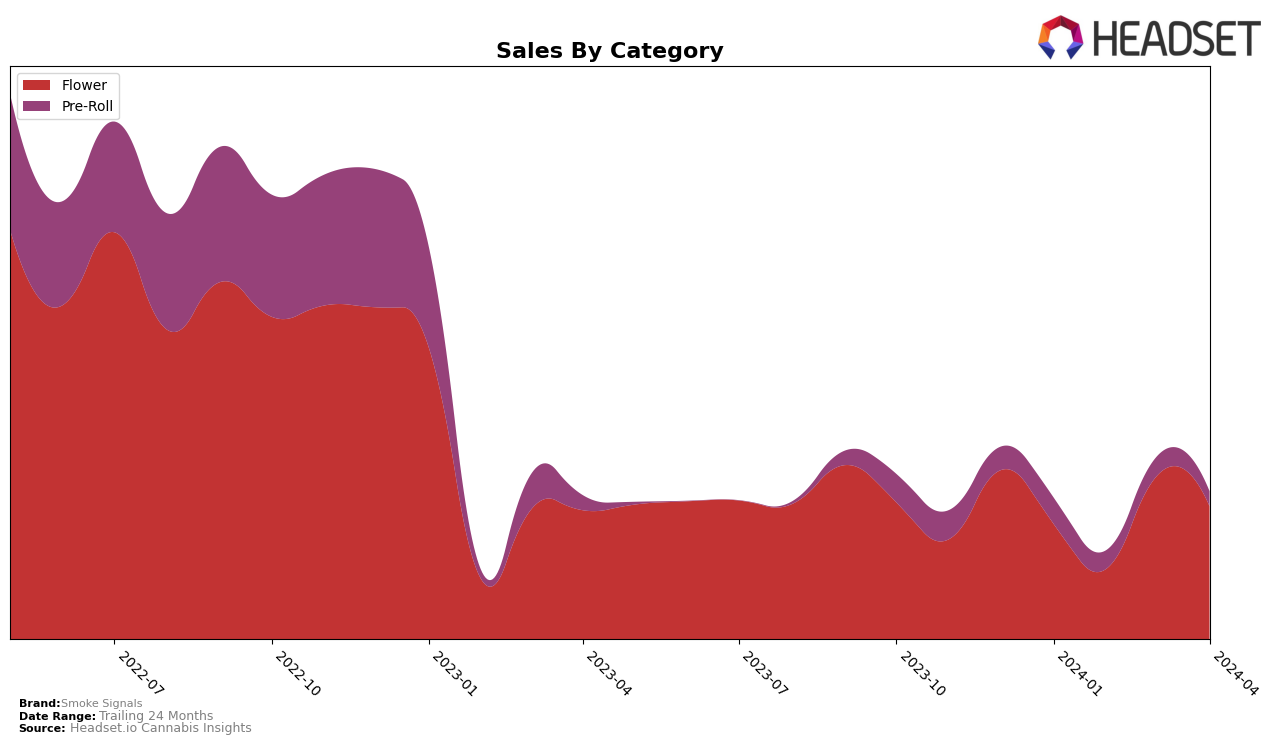

In Nevada, Smoke Signals has shown a fluctuating but notable presence in the competitive cannabis market, particularly within the Flower and Pre-Roll categories. For the Flower category, their ranking experienced a significant improvement from February to March 2024, jumping from 44th to 22nd position, which indicates a strong performance and consumer preference during this period. However, this positive trend did not fully sustain into April, as they slightly dropped to 29th. This kind of movement suggests that while Smoke Signals has the capability to capture market interest, maintaining a consistent top-tier ranking poses a challenge. The sales in January for the Flower category were reported at 243,036 dollars, showcasing a significant revenue potential for the brand in Nevada's market.

On the other hand, the performance of Smoke Signals in the Pre-Roll category within the same state tells a story of struggle and potential underperformance. Starting at 27th in January, their ranking slipped to 36th in February, and despite a slight improvement in March to 33rd, they further fell to 38th in April. This downward trend in rankings, especially in a market as competitive as Nevada's, could be indicative of challenges in brand visibility or consumer loyalty within the Pre-Roll category. The consistent presence in the top 30 across both categories, however, does affirm Smoke Signals' ability to stay relevant in the market, albeit with room for improvement in strategizing for better positioning and market capture.

Competitive Landscape

In the competitive Nevada flower market, Smoke Signals has shown a notable fluctuation in its ranking over the recent months, indicating a dynamic performance amidst its competitors. Starting off at a rank of 28 in January 2024, it experienced a dip to 44 in February, before making a significant leap to 22 in March, and slightly adjusting to a rank of 29 by April. This trajectory suggests a recovery and potential growth in market share, especially when considering the sales increase from February to March. Competitors such as Grassroots and Hustler's Ambition have also shown significant movements, with Grassroots climbing to a higher rank by March and maintaining a strong position into April, and Hustler's Ambition making a dramatic entrance from being unranked to securing a top 30 position by February and improving further by April. Meanwhile, Cookies and Good Green have experienced fluctuations in both rank and sales, indicating a highly competitive and volatile market. Smoke Signals' performance, especially in terms of sales recovery and rank improvement, positions it as a resilient brand in the face of stiff competition, highlighting its potential for further growth and market penetration in Nevada's cannabis flower category.

Notable Products

In April 2024, Smoke Signals saw the OG18 Pre-Roll (0.7g) leading their sales chart with an impressive figure of 1054 units sold, marking it as the top-performing product for the month. Following closely, the LA Confidential Pre-Roll (0.7g) and DR. Teeth Pre-Roll (0.7g) secured the second and third positions, respectively, without specific sales figures disclosed. The Banana Punch Pre-Roll (0.7g) and Chemdawg Pre-Roll (0.7g) rounded out the top five, indicating a strong preference for Pre-Roll products among consumers. Notably, this month's rankings represent a fresh lineup as there were no previous rankings for these products from January to March 2024. This suggests a significant shift in consumer preferences or possibly new product introductions within the Smoke Signals portfolio.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.