Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

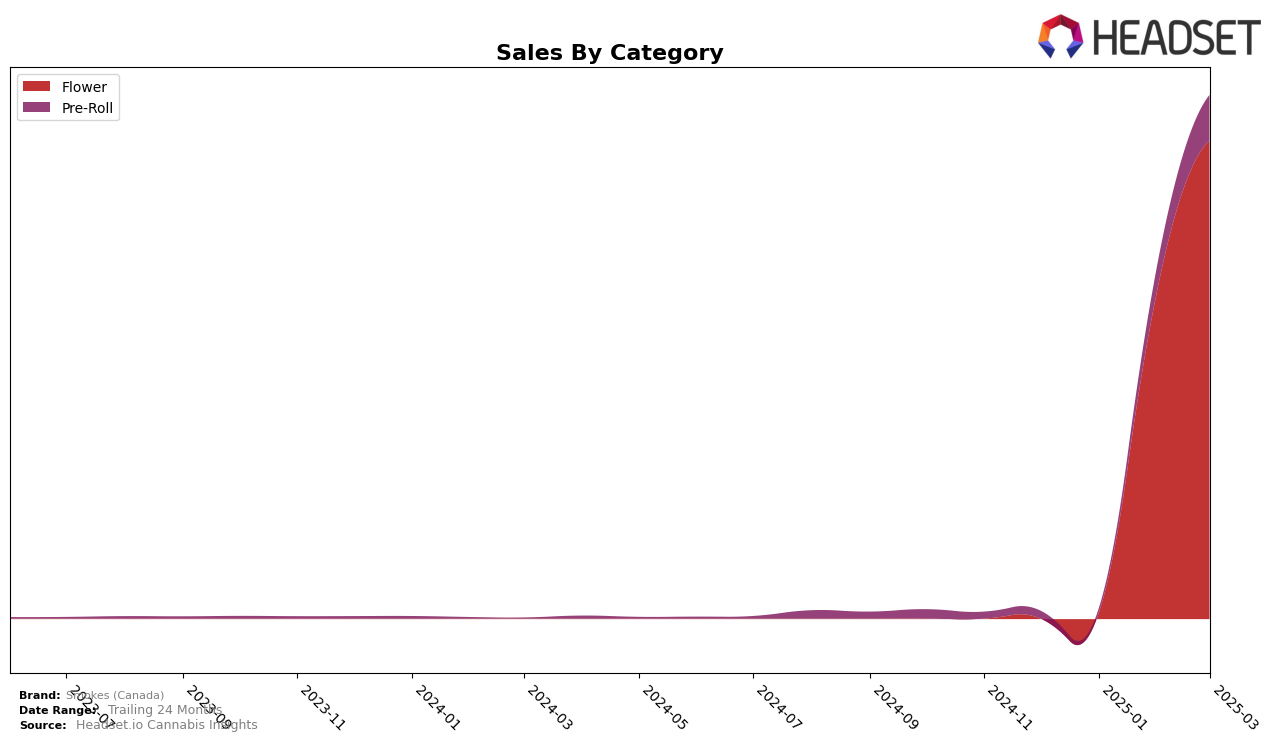

In the burgeoning cannabis market of New York, Smokes (Canada) has shown notable progress in the Flower category. After not being ranked in the top 30 brands in December 2024 and January 2025, Smokes made a significant leap to 18th position in February 2025 and further climbed to 14th in March 2025. This upward trajectory indicates a strong market acceptance and growing consumer preference for their products. Despite not being in the top 30 initially, Smokes' ability to secure a position in the rankings highlights a positive trend and potential for further growth in this competitive market segment.

In contrast, the Pre-Roll category in New York presents a different story for Smokes (Canada). While they did not make it to the top 30 in December 2024 and January 2025, they managed to enter the rankings at 77th in February 2025 and improved to 55th by March 2025. Although this progress is commendable, the brand is still far from the top contenders in this category. The movement in rankings suggests a potential for increased market share, but it also highlights the challenges Smokes faces in establishing a stronger foothold in the Pre-Roll segment. This varied performance across categories underscores the importance of strategic positioning and targeted marketing efforts to enhance brand presence in different product lines.

Competitive Landscape

In the competitive landscape of the New York flower category, Smokes (Canada) has shown significant upward momentum, climbing from outside the top 20 in December 2024 to a commendable 14th position by March 2025. This ascent is particularly notable when compared to competitors like Electraleaf, which maintained a steady rank around 16th, and The Botanist, which only broke into the top 20 in March 2025. Smokes (Canada)'s sales growth trajectory is impressive, with a marked increase in sales from February to March 2025, suggesting a strong market reception and effective brand strategies. In contrast, Heady Tree and Back Home Cannabis Co. have maintained stable positions within the top 15, indicating consistent performance but not matching the rapid growth of Smokes (Canada). This dynamic shift highlights Smokes (Canada)'s emerging influence in the New York market, suggesting potential for further growth and competitive edge.

Notable Products

In March 2025, the top-performing product for Smokes (Canada) was Tropic Thunder Infused Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with a notable sales figure of 627 units. Following closely was Watermelon Zlushie Infused Pre-Roll (1g), which secured the second position with 625 units sold. Runtz (28g) in the Flower category dropped to the third rank from its top position in February. Gary Payton (28g) entered the top ranks at fourth place, marking its first appearance in the rankings. Bomb Pop Infused Pre-Roll (1g) experienced a decline, moving from second place in February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.