Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

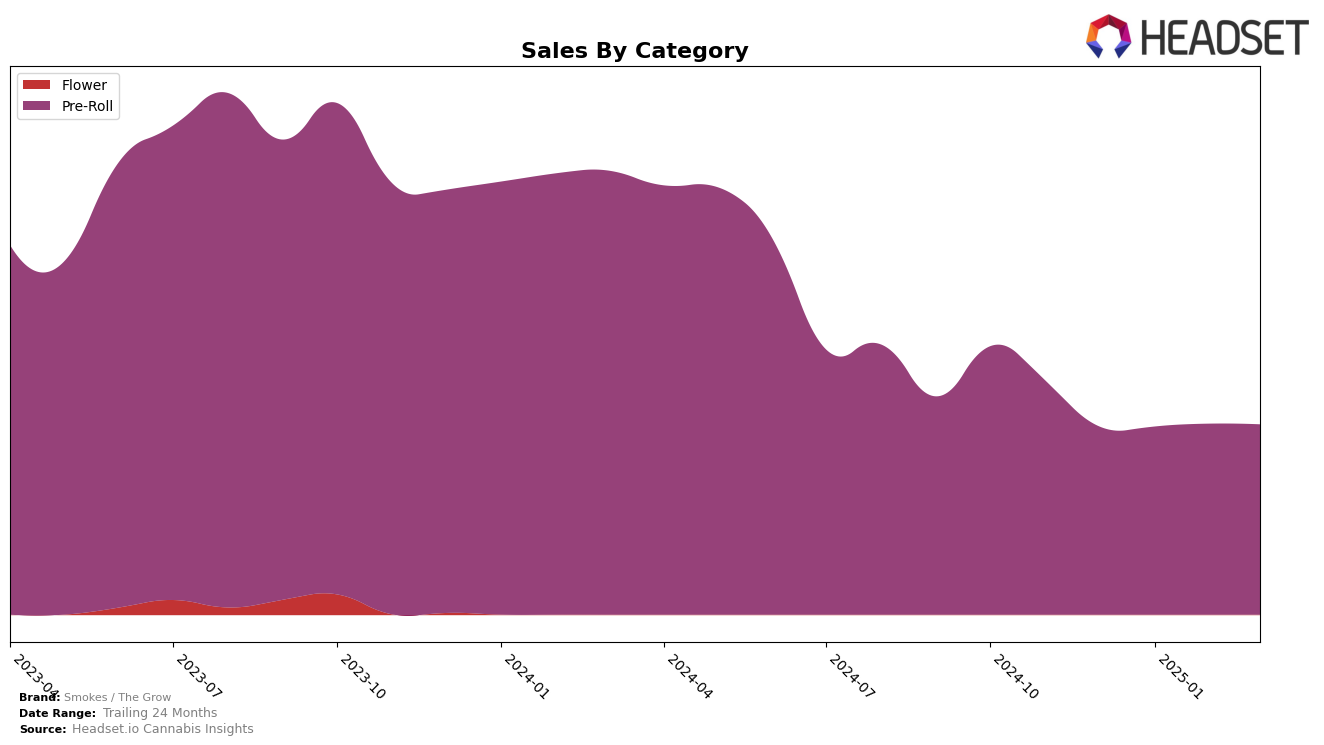

Smokes / The Grow has demonstrated a consistent presence in the Oregon Pre-Roll category, maintaining a rank within the top 30 brands over the past few months. From December 2024 to March 2025, the brand's ranking fluctuated slightly, moving from 24th to 23rd position. This indicates a stable performance with minor improvements, suggesting that the brand is effectively maintaining its market presence in a competitive category. While the sales figures show a slight increase from December to February, the subsequent dip in March could be an area to watch for potential strategic adjustments.

Interestingly, Smokes / The Grow's ability to stay within the top 30 brands in Oregon highlights its resilience in a crowded market. However, the brand's absence from the top 30 in other states or categories might suggest a need for expansion or targeted marketing efforts beyond its current stronghold. The consistent ranking in Oregon's Pre-Roll category could serve as a foundation for exploring new opportunities and replicating successful strategies in other regions. This performance analysis indicates both strengths and potential areas for growth that Smokes / The Grow could capitalize on in the future.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll market, Smokes / The Grow has demonstrated a steady performance, maintaining its rank within the top 25 brands from December 2024 to March 2025. Despite facing competition from brands like Bigfoot Bud Co and Piff Stixs, which have consistently ranked higher, Smokes / The Grow has shown resilience by improving its rank from 24th in December 2024 to 21st in February 2025, before slightly dropping to 23rd in March 2025. This indicates a competitive positioning that is stable yet challenged by fluctuating market dynamics. Notably, while Emerald Extracts and Dougie have shown upward trends in sales, Smokes / The Grow has maintained a consistent sales volume, suggesting a loyal customer base despite the competitive pressures. This stability in sales amidst a dynamic ranking environment highlights the brand's potential to leverage its current market position to strategize for growth and increased market share.

Notable Products

In March 2025, the top-performing product for Smokes / The Grow was Baby Yoda Pre-Roll 10-Pack (5g) in the Pre-Roll category, securing the number one spot with sales of 775 units. Goat Reaper Pre-Roll 10-Pack (5g) climbed to second place, showing a significant increase from its fifth position in February 2025. Brain Drain & Mule Fuel Pre-Roll 10-Pack (5g) held steady in third place for March 2025. Mystery Haze Pre-Roll 10-Pack (5g) and Smarties Pre-Roll 10-Pack (5g) followed in fourth and fifth positions, respectively, maintaining their rankings from February 2025. This month marked a notable sales boost across the top products, particularly for Goat Reaper, which showed a marked improvement in its ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.