Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

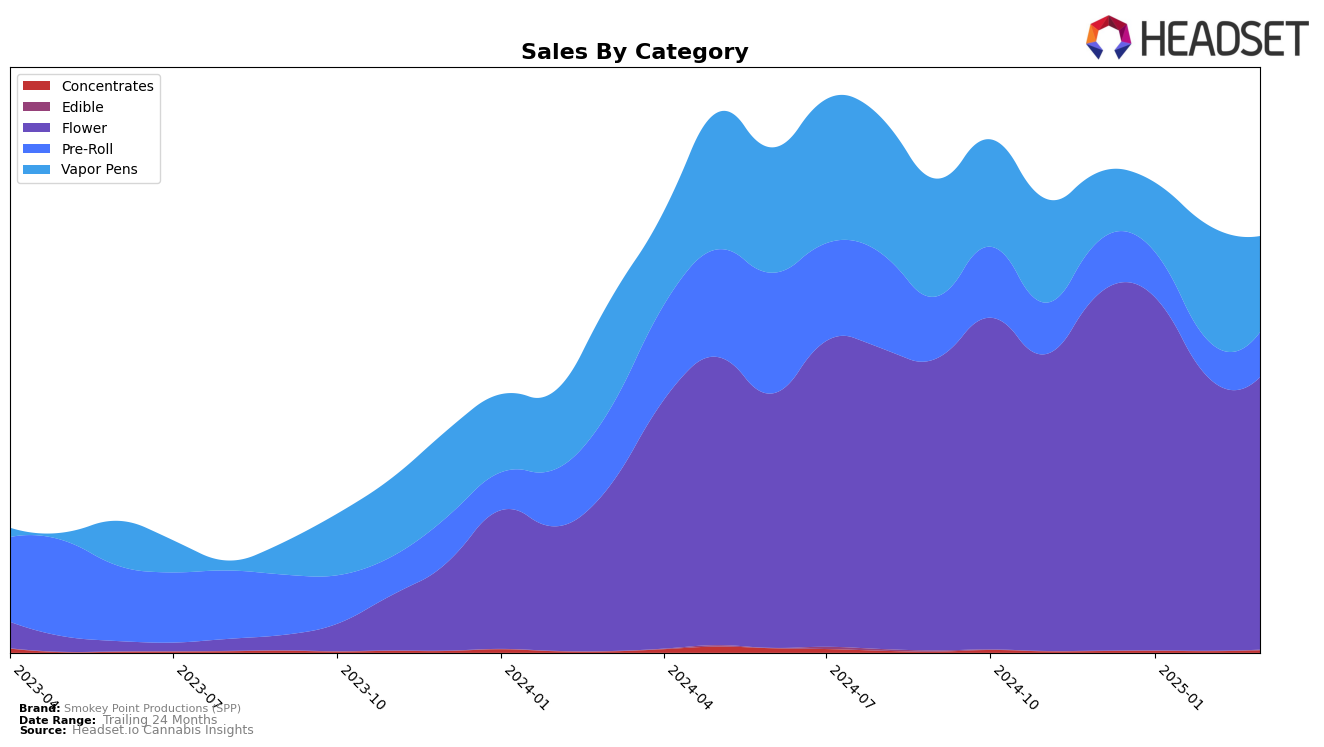

In Washington, Smokey Point Productions (SPP) has demonstrated varied performance across different cannabis categories. Their Flower category saw a slight decline in rankings, moving from 14th in December 2024 to 21st by March 2025. This downward trend might indicate increased competition or shifts in consumer preferences. In contrast, the Vapor Pens category showed a notable improvement, climbing from 64th in December 2024 to 42nd by February 2025, before slightly dropping to 51st in March. This suggests a potential growth area for SPP, as they managed to break into the top 50, indicating a positive reception in the market.

The Pre-Roll category presents a mixed picture for SPP in Washington. While they were not in the top 30 brands, their rankings fluctuated, starting at 69th in December 2024 and ending at 68th in March 2025. This slight improvement could be seen as a positive sign, but the brand still faces significant challenges in gaining a stronger foothold in this category. The overall sales figures reflect these trends, with Vapor Pens showing a significant increase in sales during February, which may have contributed to their improved ranking. Meanwhile, Flower sales experienced a dip, aligning with their declining rank in the category.

Competitive Landscape

In the competitive landscape of the Washington Flower category, Smokey Point Productions (SPP) has experienced notable shifts in its market position from December 2024 to March 2025. Starting at rank 14 in December 2024, SPP has seen a gradual decline, slipping to rank 21 by March 2025. This downward trend in rank correlates with a decrease in sales over the same period. In comparison, Agro Couture maintained a stronger position, initially ranking 12th and only dropping to 20th by March, while SKÖRD showed a recovery from a low rank of 39 in January to 22 in March. Meanwhile, Torus consistently improved its sales, reflected in a stable rank of 23 in March, and Momma Chan Farms notably rose to rank 19 in March, indicating a positive sales trajectory. These dynamics suggest that while SPP faces challenges in maintaining its rank, competitors like Agro Couture and Momma Chan Farms are capitalizing on market opportunities, potentially impacting SPP's market share and necessitating strategic adjustments to regain competitive ground.

Notable Products

In March 2025, Smokey Point Productions (SPP) saw the Sangria Sunset Live Resin Cartridge (1g) climb to the top spot in the Vapor Pens category, achieving the highest sales with 1,054 units sold. The Kashmiri Hashplant Live Resin Cartridge (1g) followed closely, securing the second position. The Blueberry Muffin Shatter Infused Pre-Roll 2-Pack (1g), previously ranked first in January and February, slipped to third place in March. Blueberry Muffin (3.5g) in the Flower category improved its position from fifth in December and January to fourth in March. Gelato Punch Smalls (7g) maintained a steady presence, ranking fifth in March, showing consistent performance despite not being ranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.