Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

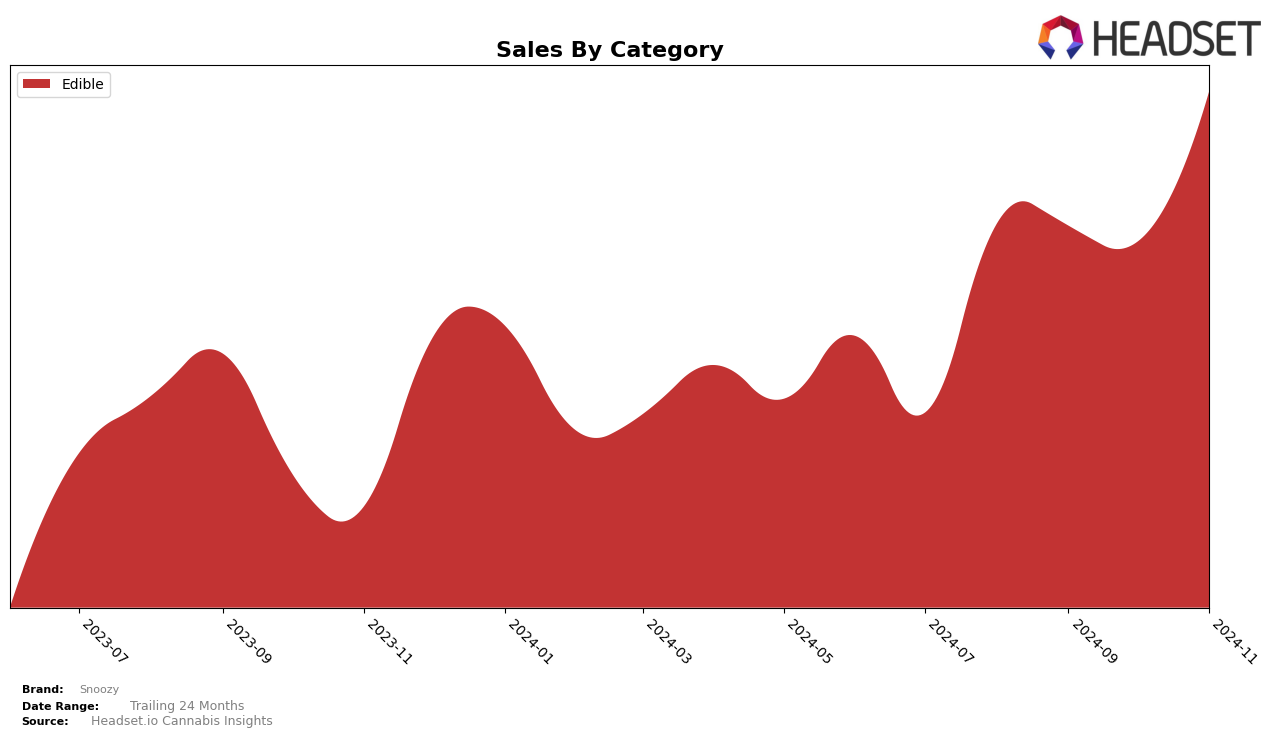

Snoozy has shown a consistent presence in the New York cannabis market, particularly in the Edible category. Over the past few months, Snoozy has managed to maintain a steady ranking, oscillating between 15th and 17th place. This stability is indicative of a solid consumer base and consistent product appeal. Notably, the brand saw an upward movement in November 2024, climbing to the 15th position, which suggests a positive reception to their offerings or an effective marketing push during that period. This movement is significant, considering the competitive nature of the Edible category in New York.

While Snoozy's performance in New York is commendable, it's important to note that the brand has not appeared in the top 30 rankings in other states or provinces for the same category during these months. This absence could indicate either a lack of market penetration or a strategic focus on the New York market. The sales figures in New York, particularly the notable increase in November, suggest that the brand might be prioritizing this region for growth. However, without presence in other states, it raises questions about their broader market strategy and potential for expansion beyond New York.

Competitive Landscape

In the competitive landscape of the New York edible cannabis market, Snoozy has shown a notable upward trend in its ranking from August to November 2024. Initially ranked 17th in August, Snoozy improved to 15th by November, indicating a positive shift in market position. This rise in rank is particularly significant when considering the performance of competitors like Eaton Botanicals, which maintained a steady 13th position, and Generic AF, which fluctuated but ended up just one rank below Snoozy in November. Meanwhile, The Bettering Company experienced a decline, dropping to 17th in November, which may have contributed to Snoozy's improved rank. Additionally, Foy demonstrated a significant climb, surpassing Snoozy to secure the 14th position. Despite these competitive pressures, Snoozy's sales trajectory shows a substantial increase from October to November, suggesting effective strategies in capturing market share and resonating with consumers. This dynamic environment underscores the importance for Snoozy to continue leveraging its strengths to maintain and enhance its competitive edge in the New York edible market.

Notable Products

In November 2024, the top-performing product from Snoozy was the CBD/THC/CBN 10:10:5 Raspberry Flavored Bedtime Chews 20-Pack, maintaining its first-place ranking for four consecutive months with a notable sales figure of 2181 units. The CBD/THC 4:1 Strawberry Flavored Relief Chews 20-Pack consistently held the second position, showing a steady increase in sales over the months. The CBD/CBG/THC 1:1:1 New Morning Highs Orange Flavored Daytime Gummies 20-Pack remained in third place, with sales also improving compared to previous months. Sleep with Benefits - CBD/THC/CBN 1:1:1 Raspberry Flavored Bedtime Gummies 20-Pack saw significant growth, remaining in the fourth position but with a marked increase in sales. Lastly, the CBD/THC 4:1 Love is All You Need Peach Flavored Intimacy Gummies maintained its fifth-place ranking, continuing its upward sales trend since its introduction in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.