Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

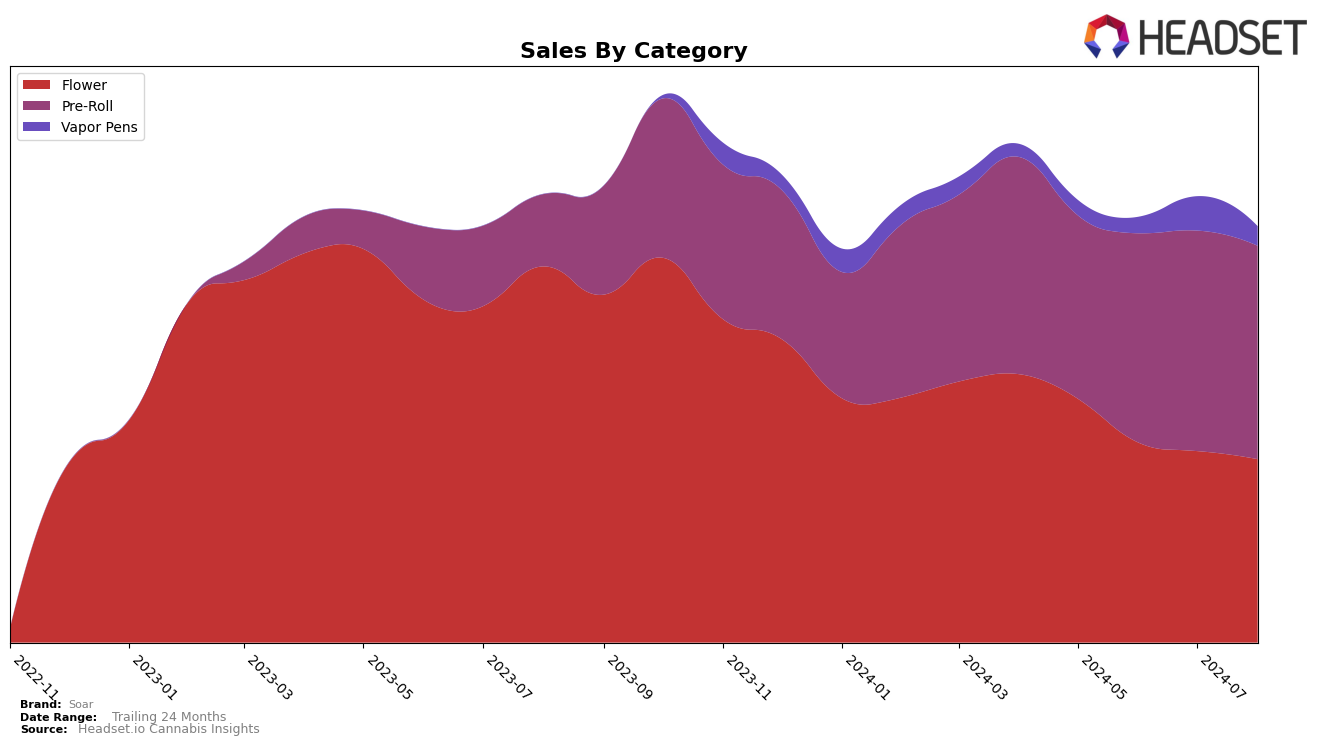

Soar's performance across various categories and regions has seen notable shifts over recent months. In Alberta, the brand's Flower category has experienced a downward trend, with rankings slipping from 56th in May 2024 to 68th by August 2024. This decline is mirrored by a decrease in sales, suggesting a potential challenge in maintaining market share. Conversely, Soar's Pre-Roll category in Alberta has shown more resilience, with relatively stable rankings, though it still hovers outside the top 30 brands, indicating room for improvement.

In British Columbia, Soar's Flower category has also seen a decline, dropping from 29th in May 2024 to 38th in August 2024. However, the Pre-Roll category tells a different story, with Soar improving its position to reach 20th in July 2024 before slightly falling back to 24th in August. This performance highlights a strong presence in the Pre-Roll market, despite some fluctuations. In Ontario, Soar's entry into the Vapor Pens category in July 2024 at 49th place, followed by a drop to 65th in August, indicates a challenging start in this segment. Overall, these movements suggest varied performance across different product lines and regions, with specific areas showing potential for growth and others requiring strategic adjustments.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Soar has experienced fluctuations in its rank and sales over the past few months. Notably, Soar's rank dropped from 30th in May 2024 to 34th in June 2024, and despite a slight improvement to 33rd in July 2024, it fell back to 34th in August 2024. This indicates a struggle to maintain a stable position within the top 20 brands. In comparison, Canaca showed a relatively stable performance, maintaining a rank within the top 32, while Highly Dutch demonstrated a more consistent upward trend, improving from 34th in May 2024 to 31st in August 2024. Meanwhile, Color Cannabis and BC OZ have shown more volatility, with BC OZ notably dropping out of the top 40 in July 2024. These dynamics suggest that while Soar is facing competitive pressure, particularly from brands like Highly Dutch, there is potential for recovery if strategic adjustments are made to stabilize and boost its market presence.

Notable Products

In August 2024, the top-performing product for Soar was Pineapple God Pre-Roll (1g), maintaining its consistent first-place ranking with sales of 17,088 units. Electric Grapefruit Pre-Roll (1g) held steady in second place, showing strong but slightly decreased sales compared to previous months. Tropic Crush Infused Blunt (1g) climbed to third place, continuing its upward trend with notable sales growth. Pineapple God (7g) secured the fourth position, reflecting a slight decline in sales rank since May. Citrus Cyclone Infused Blunt (1g) dropped to fifth place, indicating a decrease in sales momentum from earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.