Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

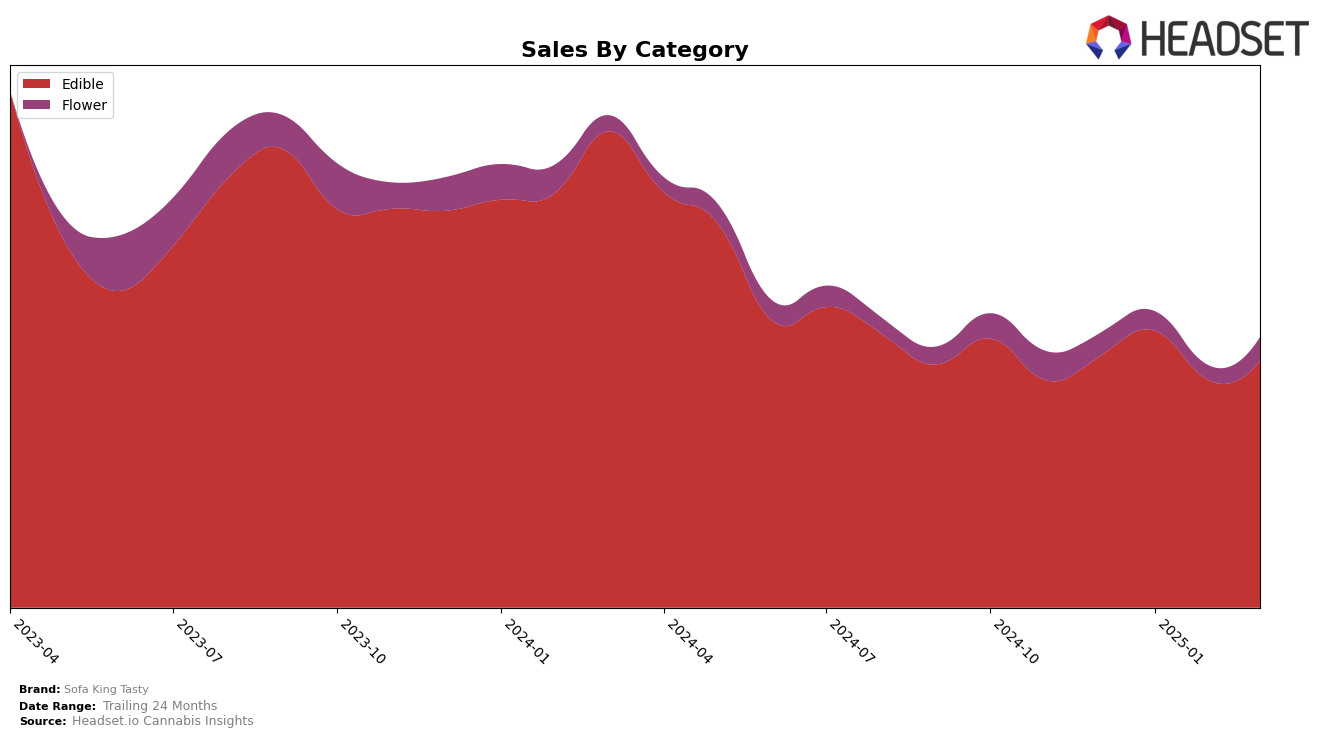

Sofa King Tasty has shown a consistent presence in the Arizona edible market, maintaining a position within the top 15 brands over the past four months. The brand experienced a slight fluctuation in its ranking, moving from 14th in December 2024 to 13th in January 2025, before settling back to 15th in both February and March 2025. This suggests a stable performance in a competitive market segment, although the slight dip in February sales indicates potential market challenges or increased competition. Despite these fluctuations, the brand's ability to remain in the top rankings highlights its resilience and popularity among consumers in Arizona.

However, Sofa King Tasty's absence from the top 30 rankings in other states and categories could be seen as a limitation in its market reach or brand recognition beyond Arizona. This absence might suggest that the brand has yet to establish a significant foothold in other regions or diversify its product offerings effectively. The lack of presence in other states could also indicate an opportunity for growth and expansion, should the brand choose to leverage its existing success in Arizona to explore new markets. By focusing on strategic marketing and product development, Sofa King Tasty could potentially enhance its brand visibility and performance across a broader geographic landscape.

Competitive Landscape

In the competitive landscape of the edible category in Arizona, Sofa King Tasty has demonstrated a relatively stable performance in recent months, maintaining its rank around the 13th to 15th positions. Despite a slight dip in February 2025, where it fell to 15th place, the brand managed to recover and hold its position in March 2025. This stability is noteworthy given the dynamic shifts among competitors. For instance, Zenzona consistently outperformed Sofa King Tasty, maintaining a higher rank and showing a strong recovery in March 2025 with a move to 13th place. Meanwhile, Vital showed impressive growth, climbing from 17th in December 2024 to 12th by February 2025, indicating a significant upward trend in both rank and sales. On the other hand, Sublime experienced a decline, dropping to 18th place by March 2025. Sofa King Tasty's ability to maintain its rank amidst these fluctuations suggests a resilient market presence, though it faces challenges from rapidly ascending competitors like Vital.

Notable Products

In March 2025, the top-performing product for Sofa King Tasty was Sativa Cherry Gummies (100mg) in the Edible category, maintaining its number one rank from the previous months with a sales figure of 2,595 units. Following closely, Sativa Watermelon Gummies (100mg) also held steady at the second position, showing consistent performance across the months. Skunkee (1g) in the Flower category rose to the third rank, improving from its fifth position in January 2025. Hybrid Orange Gummies (100mg) experienced a slight drop, moving from third to fourth rank. Meanwhile, Bite Me Brownies (100mg) remained stable in the fifth position, indicating steady sales throughout the period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.