Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

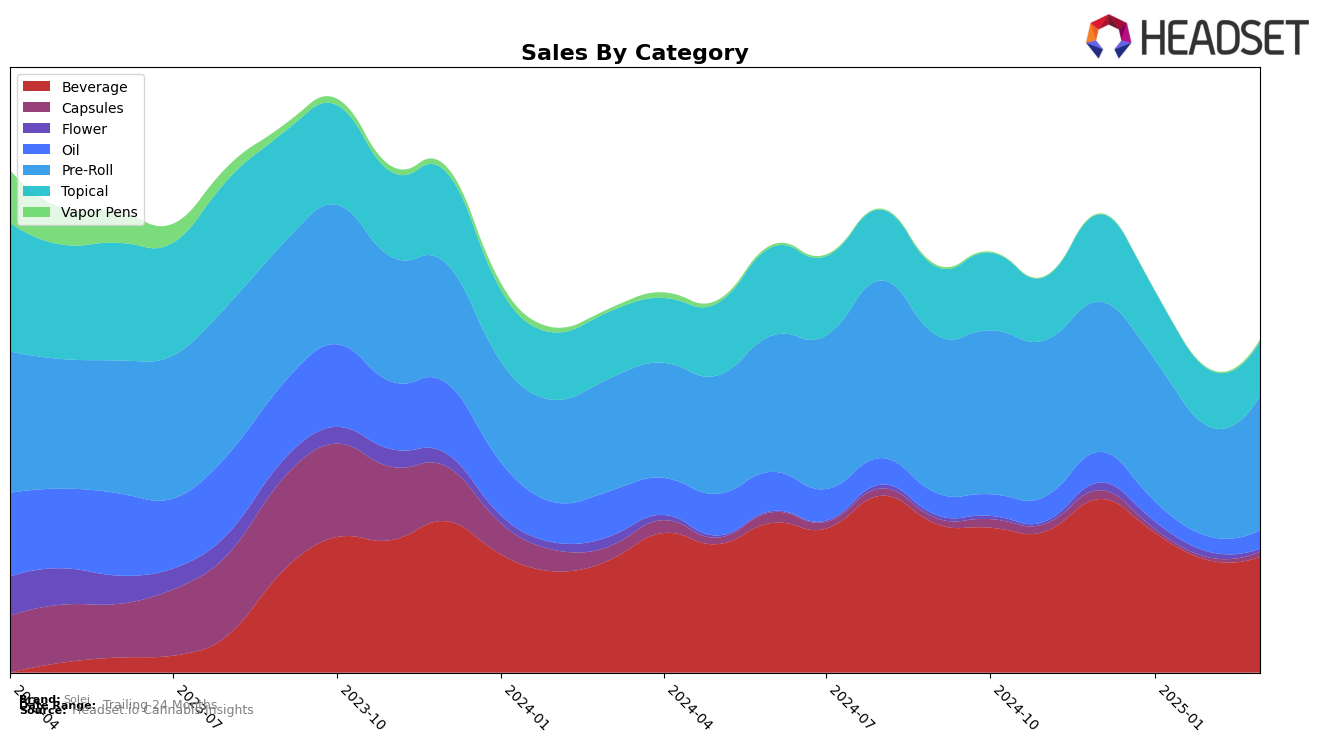

In Alberta, Solei has shown a consistent performance in the Beverage category, maintaining its position at rank 10 from January to March 2025, slightly improving from rank 11 in December 2024. This stability suggests a strong foothold in the market despite a dip in sales from January to February. However, in the Pre-Roll category, the brand struggles to break into the top 70, with rankings consistently in the 70s and 80s, indicating potential challenges in capturing consumer interest in this segment. Meanwhile, Solei's Topical products have maintained a solid rank of 4 throughout the same period, underscoring their popularity and consistent demand in the province.

In Ontario, Solei's performance in the Beverage category has remained relatively stable with a slight dip in ranking from 10 in December and January to 11 in February and March 2025. The Oil category shows a minor improvement, with the brand moving up from rank 19 in December to consistently holding the 14th and 15th positions in subsequent months, suggesting a gradual strengthening of its market position. In Saskatchewan, Solei's Topical category has been performing exceptionally well, holding the top rank in December and January before moving to rank 3 in March. However, the brand's presence in the Pre-Roll category is less prominent, only emerging in the rankings at position 55 in March, indicating a potential area for growth or increased market penetration.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Solei has maintained a steady position, ranking 10th in December 2024 and January 2025, before slightly dropping to 11th in both February and March 2025. Despite this minor decline in rank, Solei's sales performance shows a more nuanced picture, with a notable dip from December 2024 to January 2025, followed by a gradual recovery in the subsequent months. In comparison, Bubble Kush consistently holds the 9th position throughout the same period, indicating a stable market presence with higher sales figures. Meanwhile, TeaPot shows a positive trend, moving up from 11th to 10th rank by February 2025, suggesting a competitive edge over Solei in recent months. Additionally, Keef Cola reappears in March 2025 at the 12th position after missing ranks in January and February, indicating potential volatility. Solei's performance amidst these competitors highlights the importance of strategic positioning and market adaptation to maintain or improve its standing in the Ontario beverage market.

Notable Products

In March 2025, Solei's top-performing product was CBD Dragonfruit Watermelon Sparkling Water (25mg CBD) in the Beverage category, maintaining its consistent first-place ranking from previous months with a sales figure of 8684. Slims - Balance Pre-Roll 10-Pack (4g) debuted strongly in March, securing the third position in the Pre-Roll category. Meanwhile, CBD Mango Passionfruit Sparkling Soda (25mg CBD) held steady in second place, reflecting stable demand. Slims - Free Pre-Roll 10-Pack (4g) ranked fourth, showing a slight decline from its peak third position in February. Lastly, Slims - Balance Pre-Roll 10-Pack (4.4g) entered the list at fifth, indicating growing interest in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.