Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

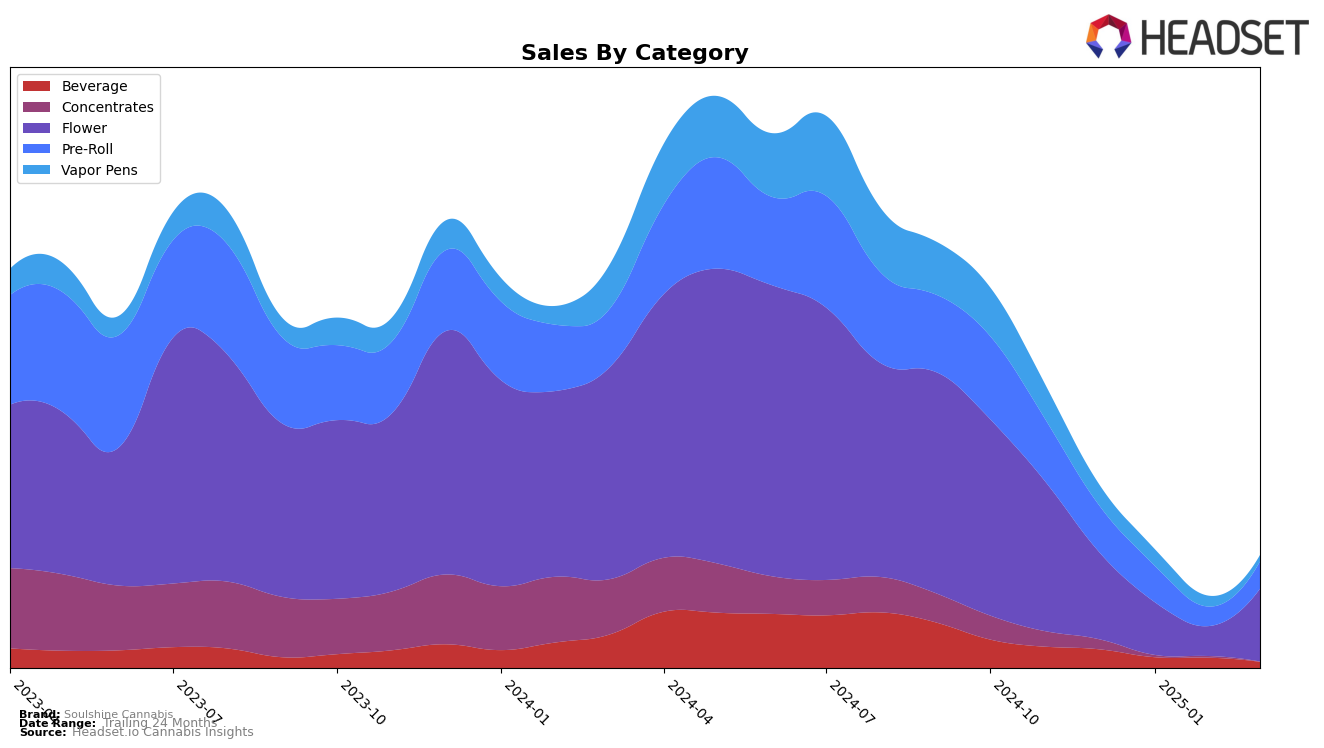

In the state of Washington, Soulshine Cannabis showed a promising performance in the Beverage category as recently as December 2024, securing the 16th spot. However, the absence of rankings for the subsequent months suggests that the brand did not maintain a position within the top 30, which may indicate a decline in their competitive stance or market share in this category. This shift could be attributed to various factors, such as increased competition, changes in consumer preferences, or supply chain dynamics.

Despite the lack of ranking in the months following December 2024, Soulshine Cannabis's initial placement in the top 20 highlights their potential in the Beverage category within Washington. The brand's sales figures in December 2024, which amounted to $11,514, reflect a noteworthy presence in the market. However, the subsequent absence from the top 30 rankings suggests challenges that the brand might be facing in sustaining its growth momentum. This performance underscores the importance of strategic adaptations to maintain relevance and competitiveness in the dynamic cannabis market.

Competitive Landscape

In the Washington beverage category, Soulshine Cannabis experienced a notable decline in its competitive standing, as evidenced by its absence from the top 20 brands from January to March 2025, after holding the 16th position in December 2024. This drop suggests a significant challenge in maintaining market presence amidst strong competition. Notably, CQ (Cannabis Quencher) consistently ranked higher, maintaining positions between 12th and 13th, with a visible upward trend in sales from December to February, before a slight dip in March. Similarly, Swell Edibles held steady at 14th place throughout the same period, indicating stable performance despite a slight fluctuation in sales. Meanwhile, Mobius, which was ranked 15th in December, also did not appear in the top 20 in subsequent months, suggesting a similar challenge to Soulshine Cannabis. These dynamics highlight the competitive pressure Soulshine Cannabis faces in regaining its market position and the importance of strategic adjustments to enhance its sales performance and brand visibility in the Washington beverage market.

Notable Products

In March 2025, the top-performing product for Soulshine Cannabis was the Lodi Dodi Pre-Roll 2-Pack (1g) in the Pre-Roll category, securing the first rank with sales of 418 units. Following closely was Narnia (3.5g) in the Flower category, which ranked second. The Narnia Pre-Roll 2-Pack (1g) maintained its third position from February, showcasing consistent performance. Lodi Dodi (3.5g) experienced a drop, moving from first place in February to fourth in March. Notably, the Lava Cake Hash Infused Pre-Roll 2-Pack (1g) entered the top five, ranking fifth for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.