Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

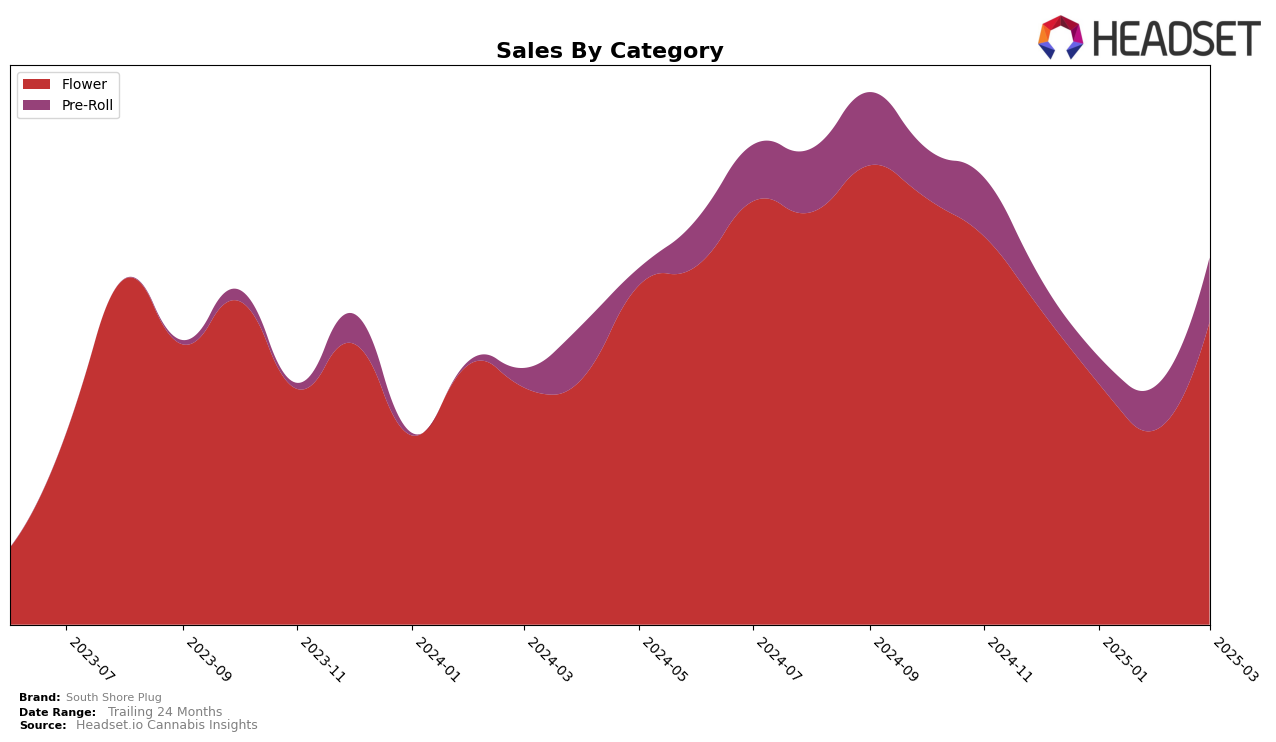

South Shore Plug has shown noteworthy fluctuations in its performance across different categories and states. In the Massachusetts flower category, the brand experienced a dip in rankings from December 2024 to February 2025, dropping from 18th to 28th place. However, it made a strong comeback in March 2025, regaining its 18th position. This rebound suggests a potential recovery in consumer demand or strategic adjustments by the brand. The sales figures corroborate this trend, with a dip in January and February followed by a significant increase in March. Such movements indicate the brand's resilience and ability to adapt to market dynamics within the flower category.

In the pre-roll category, South Shore Plug's performance in Massachusetts is marked by an upward trajectory. Starting from the 82nd rank in December 2024, the brand climbed to the 47th position by March 2025. This consistent improvement over the months highlights a growing consumer preference or effective marketing strategies that have enhanced the brand's visibility and appeal in the pre-roll segment. It's noteworthy that despite not making it to the top 30, the brand has shown a positive trend, which could potentially lead to further advancements in rank if the momentum is maintained. The increasing sales figures in this category support the brand's upward movement and suggest a promising future.

Competitive Landscape

In the Massachusetts flower category, South Shore Plug has experienced notable fluctuations in its ranking and sales performance over the past few months. In December 2024, South Shore Plug was ranked 18th, but it fell out of the top 20 in January and February 2025, before rebounding to 18th place in March 2025. This volatility in rank is mirrored in its sales, which saw a decline from December to February, followed by a recovery in March. In comparison, competitors like Old Pal and Shaka Cannabis Company maintained more consistent rankings within the top 20, although they also faced a downward trend in sales by March. Meanwhile, In House and Cheech & Chong's have shown resilience, with In House recovering to 16th place in March after dropping out of the top 20 in February. These dynamics suggest that while South Shore Plug has the potential to regain its market position, it faces stiff competition from brands that are managing to sustain their presence in the top ranks despite market challenges.

Notable Products

In March 2025, South Shore Plug's top-performing product was Raspberry Parfait Pre-Roll (1g) in the Pre-Roll category, reclaiming the number one rank with impressive sales of 8658 units. Ice Cream Cake Pre-Roll (1g) followed closely in the second position, maintaining its position from February 2025, with only a slight increase in sales. Poddy Mouth Pre-Roll 2-Pack (2g) debuted in the rankings at third place, indicating a strong market entry. Triangle Kush (3.5g) consistently held the fourth rank from January through March, showing steady demand. Notably, Dat Big Nasty (3.5g) entered the top five for the first time in March, suggesting a growing interest in this Flower category product.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.