Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

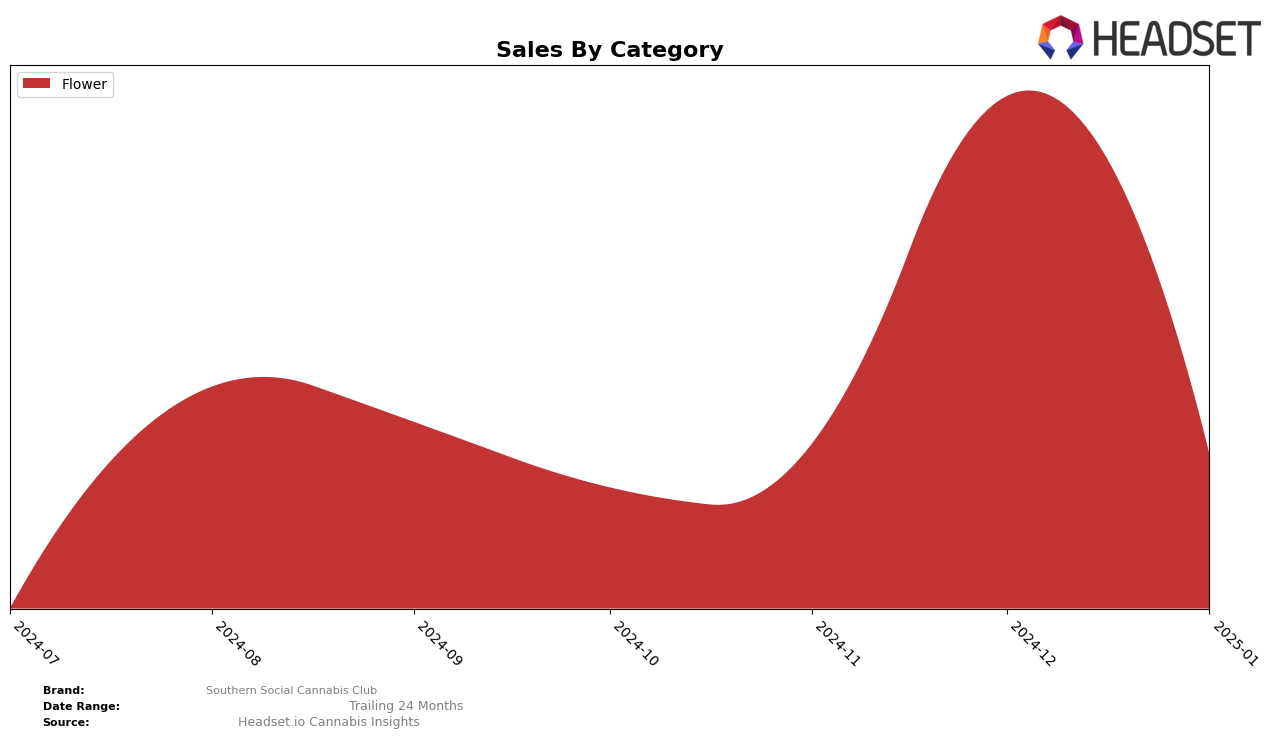

Southern Social Cannabis Club has shown a notable performance trajectory in the Missouri market, particularly within the Flower category. Starting from a rank of 38 in October 2024, the brand improved its standing to 21 by December, before slightly declining to 30 in January 2025. This fluctuation indicates a dynamic positioning strategy, possibly influenced by seasonal demand or competitive actions. The significant leap in December suggests a successful campaign or product launch, although the subsequent drop in January highlights the competitive challenges in maintaining top-tier rankings.

It's important to note that Southern Social Cannabis Club did not feature in the top 30 brands in Missouri's Flower category in October 2024, which marks a noteworthy improvement as they entered the list by November. This ascent into the rankings is a positive indicator of the brand's growing market presence and consumer acceptance. The brand's ability to climb the ranks, even if not consistently maintaining a top position, suggests potential for further growth if strategic adjustments are made. Observing these trends can provide insights into the brand's market adaptability and potential future performance.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Southern Social Cannabis Club has shown notable fluctuations in its market position over recent months. While it achieved a significant leap to rank 21 in December 2024, indicating a peak in sales performance, it experienced a slight decline to rank 30 by January 2025. This suggests a dynamic market presence, with sales peaking in December. In comparison, CAMP Cannabis maintained a relatively stable position, consistently ranking in the mid-20s, which could imply a steady consumer base. Meanwhile, Sublime saw a dramatic rise in November 2024, reaching rank 23, before settling around the 30s, indicating potential volatility or promotional activities. Honey Green showed a positive trajectory, climbing from rank 42 in October to 29 in January, suggesting growing consumer interest. These dynamics highlight the competitive pressures and opportunities for Southern Social Cannabis Club to leverage its peak performance periods and strategize for sustained growth in the Missouri flower market.

Notable Products

In January 2025, Southern Social Cannabis Club's top-performing product was Cheetah Piss (3.5g) in the Flower category, which maintained its leading position from November 2024 with a sales figure of 3,468 units. Member Berry (3.5g) followed closely in the second position, although it dropped from its top rank in December 2024. Cookies N' Cream (3.5g) moved up to the third position from fifth in December 2024, showing a consistent improvement in sales performance. Blue Gloo (3.5g) re-entered the rankings in fourth place, having not been ranked in the previous months. Dayger #2 (3.5g) made its debut in January 2025, securing the fifth spot in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.