Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

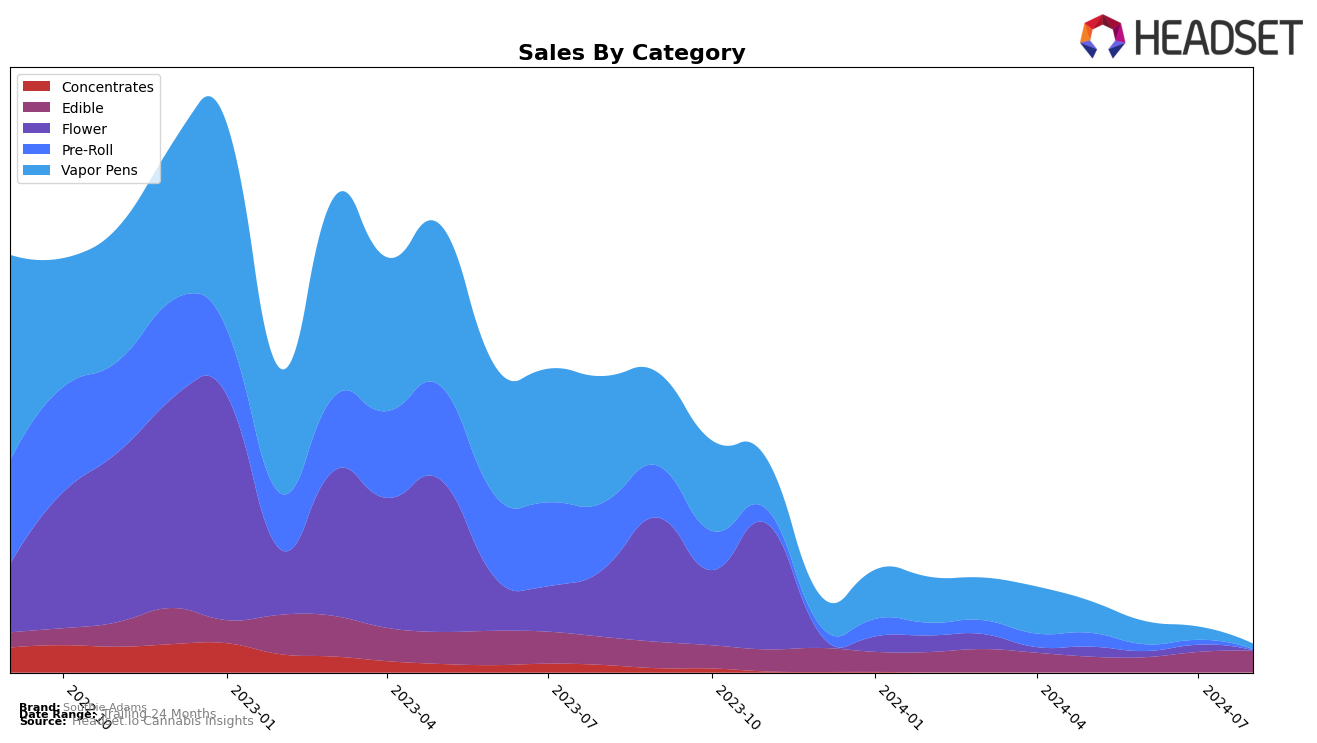

Southie Adams has shown notable performance across various product categories in Massachusetts. In the Edible category, the brand has made significant strides, moving from rank 34 in May 2024 to rank 27 by August 2024. This upward trend is a positive indicator, especially given the substantial increase in sales from $76,454 in May to $104,779 in August. On the other hand, the brand's performance in the Pre-Roll category has been less impressive, with rankings dropping from 79 in May to falling out of the top 30 by July and August. This decline suggests a need for strategic adjustments in this category to regain market presence.

The Vapor Pens category presents a mixed picture for Southie Adams. The brand started at rank 33 in May 2024 but experienced a steady decline, falling to rank 71 by August 2024. This downward trend is accompanied by a significant decrease in sales, from $155,383 in May to just $25,520 in August. The drop in rank and sales indicates potential challenges in maintaining market share and consumer interest in this category. Overall, while Southie Adams has shown promise in the Edible category, the brand faces hurdles in the Pre-Roll and Vapor Pens categories that require careful attention and strategic realignment.

Competitive Landscape

In the Massachusetts edible cannabis market, Southie Adams has shown a notable upward trend in its ranking and sales over the past few months. Starting from a rank of 34 in May 2024, Southie Adams climbed to 27 by July and maintained this position in August, reflecting a significant improvement in market presence. This positive trend contrasts with competitors like Joygum, which fluctuated between ranks 23 and 26, and Marmas, which saw a slight decline from rank 26 in July to 30 in August. Notably, Havn Extracts made a remarkable jump from rank 49 in June to 26 in August, potentially posing a future threat to Southie Adams' market position. Despite these competitive dynamics, Southie Adams' consistent rise in rank and sales, particularly the leap from 36 in June to 27 in July, underscores its growing consumer preference and market strength in the Massachusetts edible category.

Notable Products

In August 2024, the top-performing product for Southie Adams was the Sour Key Lime Fruit Chews 20-Pack (100mg), which ascended to the first rank with notable sales of 2217 units. The Sour Blood Orange Chews 20-Pack (100mg) held the second position, dropping from its top spot in July 2024. The Sour Guava Chews 20-Pack (100mg) occupied the third position, showing a consistent presence in the top three over the past months. Sour Blood Orange Gummies 20-Pack (100mg) remained at the fourth rank, maintaining a steady performance. Sour Guava Gummies 20-Pack (100mg) entered the rankings at the fifth position, marking its debut in the dataset.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.