Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

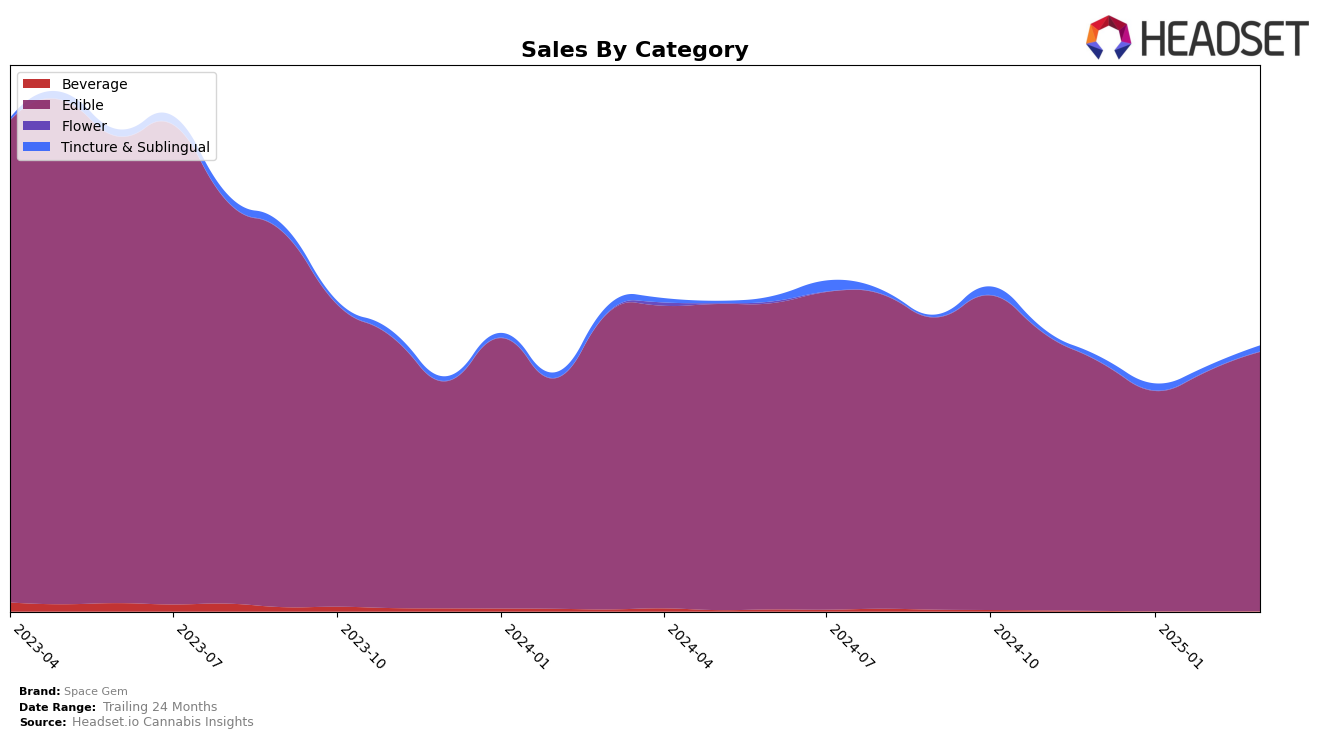

Space Gem has shown a consistent presence in the California market, particularly within the Edible category. Over the observed months from December 2024 to March 2025, the brand has maintained a ranking within the top 30, fluctuating slightly but always remaining competitive. Notably, Space Gem was ranked 23rd in December 2024, dropped to 26th in January 2025, and then improved to 22nd by March 2025. This indicates a positive trend in their market performance, suggesting a potential increase in consumer interest or effective marketing strategies. The slight dip in January could be attributed to seasonal factors or increased competition, but the subsequent recovery points to resilience and adaptability in their market approach.

In terms of sales, Space Gem's performance in California reflects a healthy growth trajectory, with sales figures rising from $221,241 in January 2025 to $260,486 by March 2025. This upward trend in sales is a promising indicator of the brand's growing popularity and market penetration. It is essential to note that while Space Gem has consistently ranked within the top 30 in California, their absence from the rankings in other states or categories might suggest areas for potential expansion or improvement. The steady presence in California's Edible category, however, underscores their strong foothold in this particular market segment.

Competitive Landscape

In the competitive California edible market, Space Gem has shown resilience despite facing stiff competition. Over the months from December 2024 to March 2025, Space Gem's rank fluctuated slightly, starting at 23rd, dipping to 26th in January, and then recovering to 22nd by February and March. This recovery is noteworthy as it coincides with an increase in sales from $221,241 in January to $260,486 in March, suggesting effective strategies to regain market share. Meanwhile, Happy Fruit consistently outperformed Space Gem, maintaining a higher rank and experiencing a slight sales decline, yet still leading with sales figures. Big Pete's Treats and Zen Cannabis also posed significant competition, with Zen Cannabis briefly surpassing Space Gem in February. However, Space Gem's ability to close the gap with these competitors by March highlights its potential for growth and adaptability in a dynamic market.

Notable Products

In March 2025, the top-performing product for Space Gem was Sour Space Drops Gummies 10-Pack (100mg), maintaining its leading position from February with sales reaching 5243 units. Sweet Space Drops Gummies 10-Pack (100mg) held steady at the second rank, showing a slight increase in sales compared to February. Premium Sour Assorted Made With Ice Water Gummy Drops 10-Pack (100mg) consistently ranked third throughout the months from December 2024 to March 2025. CBD/THC 1:1 SpaceDrops Ice Water Hash Gummies 10-Pack (50mg CBD, 50mg THC) improved its ranking to fourth place after dropping to fifth in February. Sour Apple Mind Expanding Belts 10-Pack (100mg) re-entered the rankings in March at fifth place, after not ranking in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.