Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

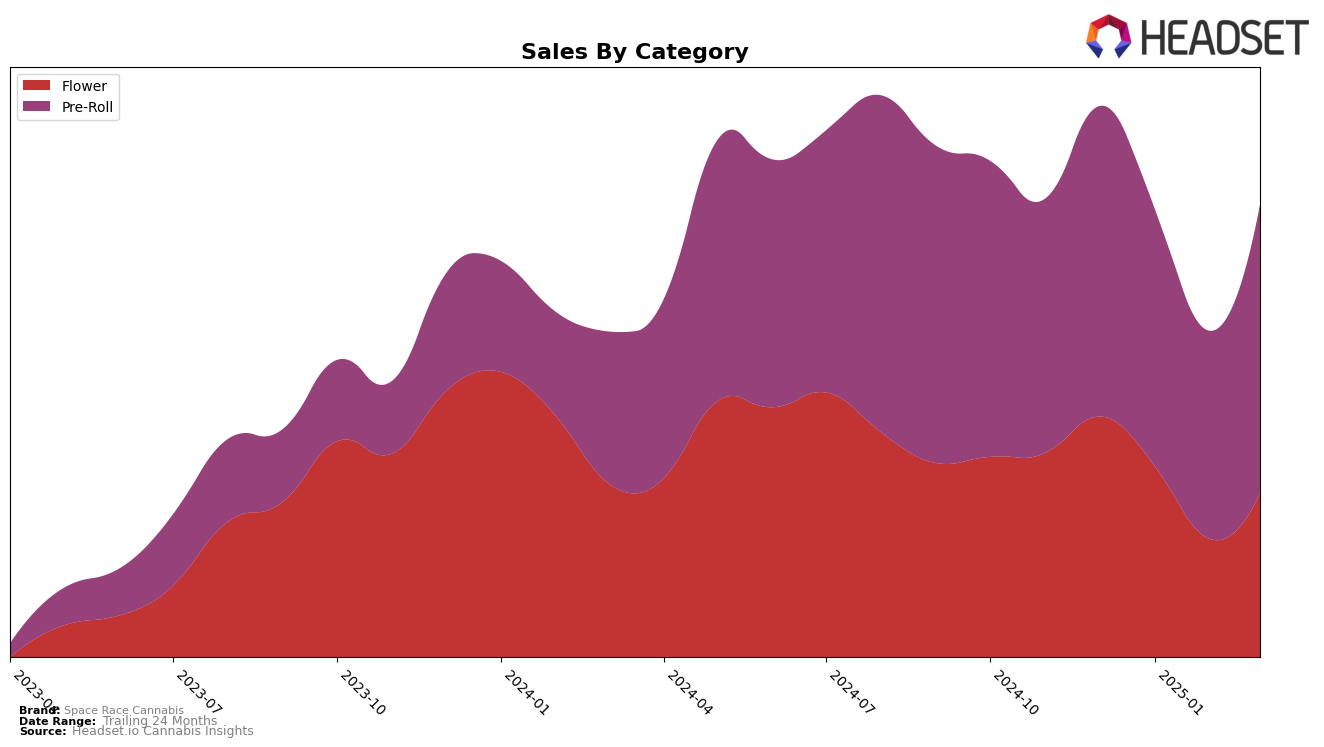

Space Race Cannabis has demonstrated a mixed performance across different categories and provinces. In Alberta, the brand has maintained a steady presence in the Flower category, holding the 9th and 10th positions consistently from December 2024 to March 2025. Despite this stable ranking, the sales figures indicate a decline from December to February, with a slight recovery in March. In contrast, the Pre-Roll category in Alberta shows a strong performance, with Space Race Cannabis moving up to the 3rd position in January and February before dropping to 4th in March. This category's sales trend suggests a temporary dip in February, followed by a rebound in March, indicating resilience in consumer demand.

In Ontario, Space Race Cannabis has struggled to break into the top 30 in the Flower category, with rankings fluctuating between the 90th and 98th positions. This suggests challenges in gaining a significant market share in this competitive region. Meanwhile, in Saskatchewan, the brand's performance in the Flower category has seen significant volatility, dropping to 19th in February before climbing back to 8th in March. This movement indicates potential market dynamics or shifts in consumer preferences. The Pre-Roll category in Saskatchewan shows a promising trend, where Space Race Cannabis improved its position from 18th in February to 9th in March, suggesting growing popularity and acceptance among consumers in this segment.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Space Race Cannabis has maintained a strong position, consistently ranking in the top four from December 2024 to March 2025. Despite a slight dip from third to fourth place in March 2025, Space Race Cannabis remains a formidable player. The brand's performance is particularly notable when compared to Spinach, which experienced more volatility, dropping to sixth place in February 2025 before recovering to third in March. Meanwhile, Claybourne Co. surged dramatically from being outside the top 20 in December to securing the second spot by February, indicating a significant market shift. Redecan and Back Forty / Back 40 Cannabis have shown consistency, but their sales figures suggest they trail behind Space Race Cannabis, which has managed to sustain higher sales despite the competitive pressure. These dynamics highlight Space Race Cannabis's resilience and strategic positioning in Alberta's Pre-Roll market.

Notable Products

In March 2025, the top-performing product from Space Race Cannabis was Apollo Pre-Roll (0.4g) in the Pre-Roll category, maintaining its consistent number one ranking from previous months with sales reaching 24,120 units. Sputnik Pre-Roll (0.4g) also held steady at the second position, showing a notable increase in sales to 23,557 units. Stargirl Pre-Roll (1g) remained in third place, experiencing a slight sales boost to 13,682 units. Starship Pre-Roll (1g), introduced in January, sustained its fourth-place ranking with sales rising to 12,938 units. Voyager Pre-Roll (0.4g) continued to hold the fifth spot, with its sales figures climbing to 11,617 units, reflecting a positive trend from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.