Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

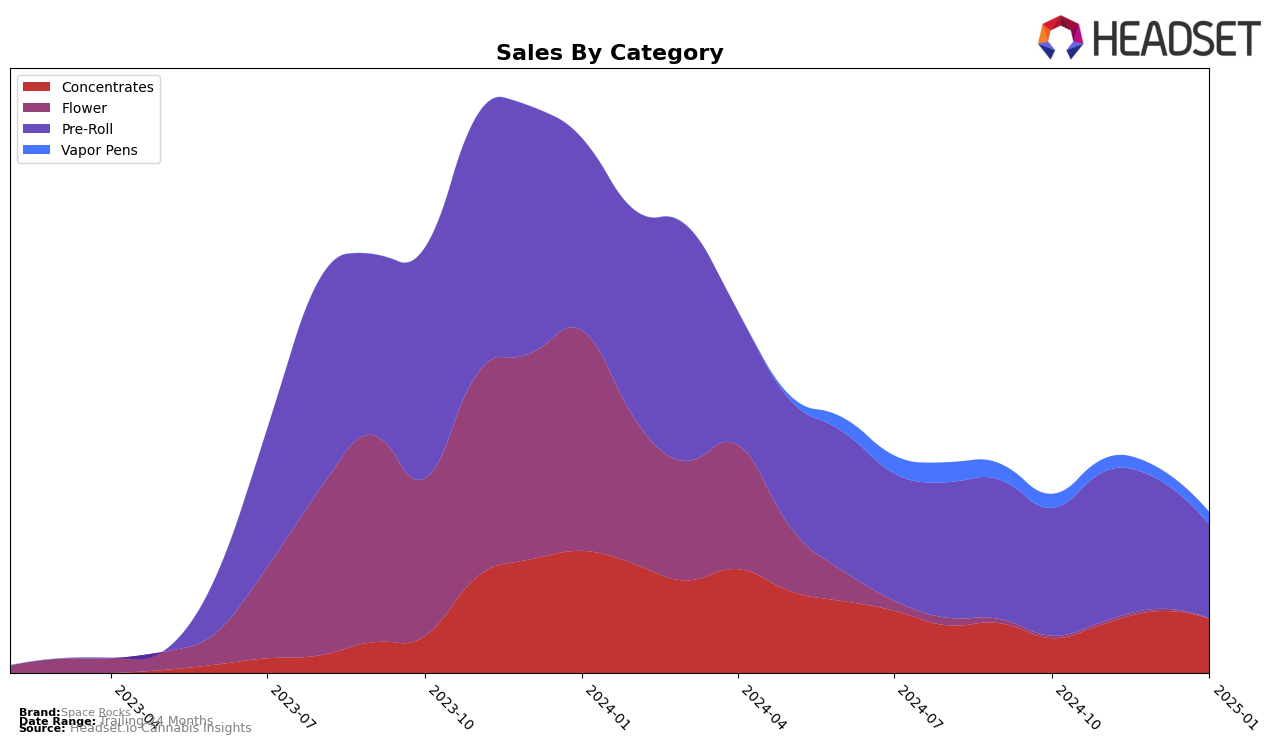

Space Rocks has demonstrated a notable trajectory in the Arizona market, particularly in the Concentrates category. The brand has shown a steady climb in rankings, moving from 31st in October 2024 to 23rd by January 2025. This upward movement is indicative of growing consumer preference and possibly effective marketing strategies or product innovations. In contrast, their performance in the Pre-Roll category experienced some fluctuations, with a peak in November 2024 at 18th place, followed by a decline to 26th by January 2025. Such a shift could suggest increased competition or changes in consumer demand. Interestingly, Space Rocks did not make it into the top 30 for the Vapor Pens category, hovering around the 70th position, indicating a potential area for improvement or a strategic reevaluation.

Examining the sales figures, Space Rocks' Concentrates saw a significant increase from October to December 2024, with sales peaking in December before a slight dip in January 2025. This trend highlights the brand's potential in capitalizing on the Concentrates market in Arizona. On the other hand, Pre-Roll sales peaked in November 2024 and then declined, which could be a reflection of seasonal purchasing patterns or shifts in consumer interest. Despite the challenges in the Vapor Pens category, maintaining a consistent presence, albeit outside the top 30, suggests a stable customer base that could be leveraged with targeted marketing efforts or product enhancements. Overall, while Space Rocks shows promising growth in certain areas, there are opportunities for strategic adjustments to enhance their market position across categories.

Competitive Landscape

In the competitive landscape of the pre-roll category in Arizona, Space Rocks has experienced notable fluctuations in its rank and sales over the past few months. Starting from October 2024, Space Rocks held the 20th position, but saw an improvement to 18th in November before slipping to 24th in December and further down to 26th by January 2025. This downward trend in rank coincides with a decrease in sales from November to January. In contrast, Presidential has consistently maintained a stronger position, starting at 17th in November and gradually declining to 25th by January, yet still outperforming Space Rocks. Meanwhile, Shorties (AZ) showed a positive trajectory, moving from 28th in October to 21st in December, before slightly declining to 24th in January, surpassing Space Rocks during this period. These dynamics suggest that while Space Rocks has faced challenges in maintaining its rank and sales, competitors like Presidential and Shorties (AZ) have either maintained or improved their standings, indicating a competitive market environment that Space Rocks must navigate to regain its footing.

Notable Products

In January 2025, the top-performing product for Space Rocks was Rocketz - King Louie Infused Pre-Roll (1g), which climbed to the number one rank with sales of 1,612 units. Rocketz - Wedding Gelato Diamond Infused Pre-Roll (1g) made a significant leap to second place with 1,195 units sold, having not been ranked in the previous months. Orbit Gas Infused Pre-Roll (1g) entered the rankings for the first time, securing the third position with 867 units sold. Rocketz - Guava RTZ Infused Pre-Roll (1g) saw a notable drop from first place in December 2024 to fourth, with sales declining to 739 units. Rocketz - Holy Modo Infused Pre-Roll (1g) rounded out the top five, maintaining a consistent presence in the top rankings over the past months despite a reduction in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.