Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

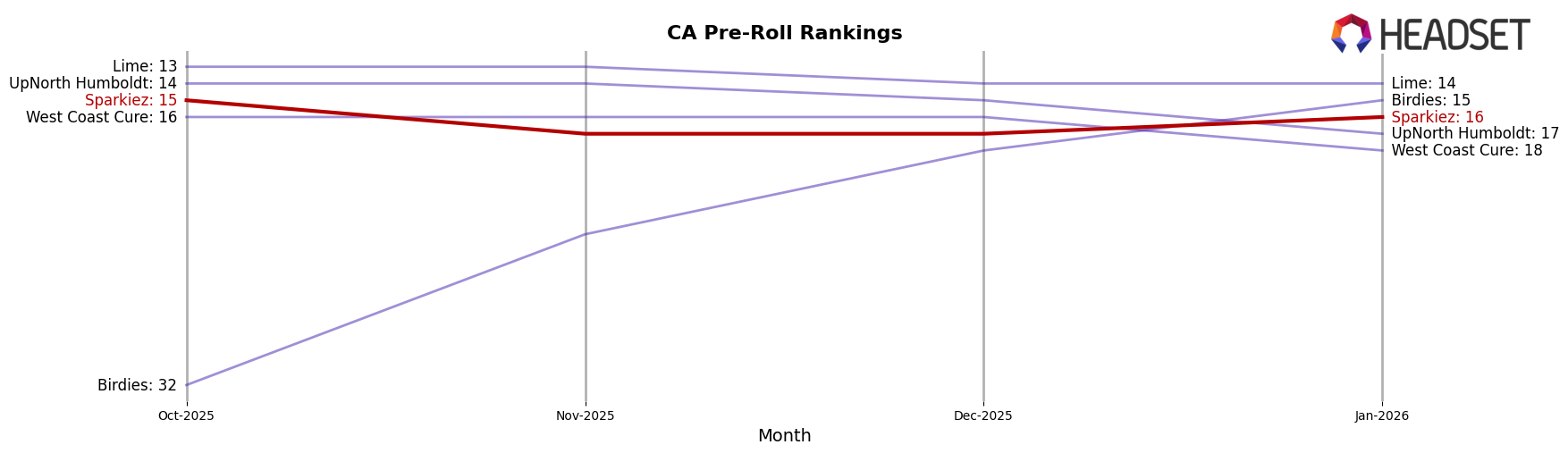

In the state of California, Sparkiez has shown a consistent presence in the Pre-Roll category, maintaining a position within the top 20 brands over the past few months. Starting at rank 15 in October 2025, the brand experienced a slight dip in November and December, settling at rank 17, before improving slightly to rank 16 in January 2026. This movement indicates a stable performance with minor fluctuations in their market position. Despite the slight drop in rank, Sparkiez did not fall out of the top 30, which is a positive sign of its resilience in a competitive market.

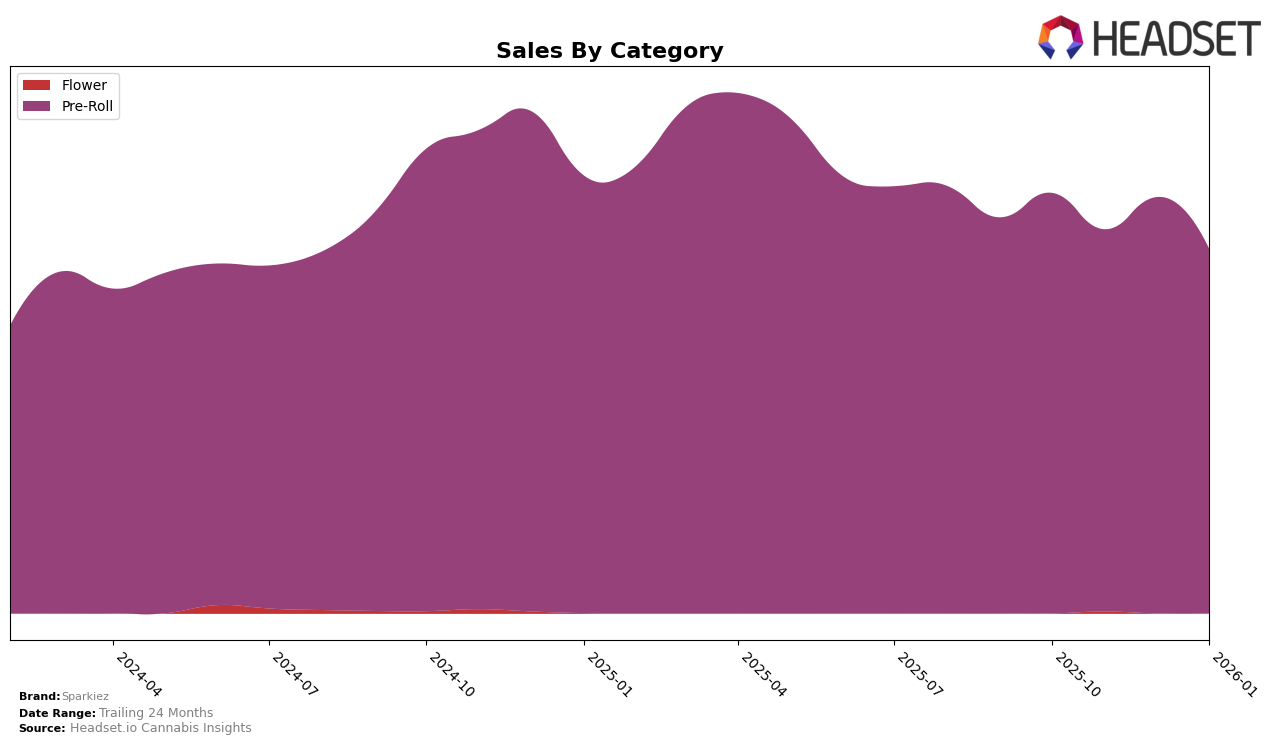

Sales figures for Sparkiez in California reveal a trend of slight decline from October to January, with a notable decrease in sales from $841,680 in October to $728,983 in January. This downward trend in sales might be a point of concern, but the brand's ability to maintain a consistent ranking suggests strong brand loyalty or effective strategies in place to counteract sales challenges. The absence of Sparkiez from the top 30 in any other state or category highlights the brand's concentrated focus and potential dominance in the California Pre-Roll market, while also indicating opportunities for expansion into other regions or product categories.

Competitive Landscape

In the competitive landscape of the California Pre-Roll category, Sparkiez has experienced fluctuations in its ranking and sales performance from October 2025 to January 2026. Sparkiez started at rank 15 in October 2025 but saw a dip to rank 17 in November and December, before slightly recovering to rank 16 in January 2026. This period of volatility in rank is mirrored in its sales figures, which peaked in December but showed a general decline over the four months. In contrast, Lime maintained a consistent rank of 13 and 14, with higher sales figures than Sparkiez throughout the period, indicating a stable market position. Meanwhile, Birdies demonstrated a remarkable upward trajectory, climbing from rank 32 in October to 15 in January, overtaking Sparkiez, and showing a strong increase in sales. This competitive pressure highlights the need for Sparkiez to strategize effectively to regain and sustain a higher market position amidst dynamic competitors like UpNorth Humboldt and West Coast Cure, which also showed varying ranks and sales trends during this period.

Notable Products

In January 2026, the Guava Pre-Roll 14-Pack (14g) emerged as the top-performing product for Sparkiez, maintaining its leading position from November 2025 with sales figures reaching 4078.0 units. The Guava Pre-Roll (1g) followed closely, moving up from its third position in December to second place, despite a slight dip in sales. The Jack Pre-Roll 14-Pack (14g) held steady in third place, showing consistent performance over the months. Hindu Kush Pre-Roll 14-Pack (14g) slipped to fourth place from its previous second position in October and November, reflecting a gradual decline in sales. Lastly, the Hindu Kush Pre-Roll (1g) re-entered the rankings in fifth place, after not being ranked in December, indicating a comeback in the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.