Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

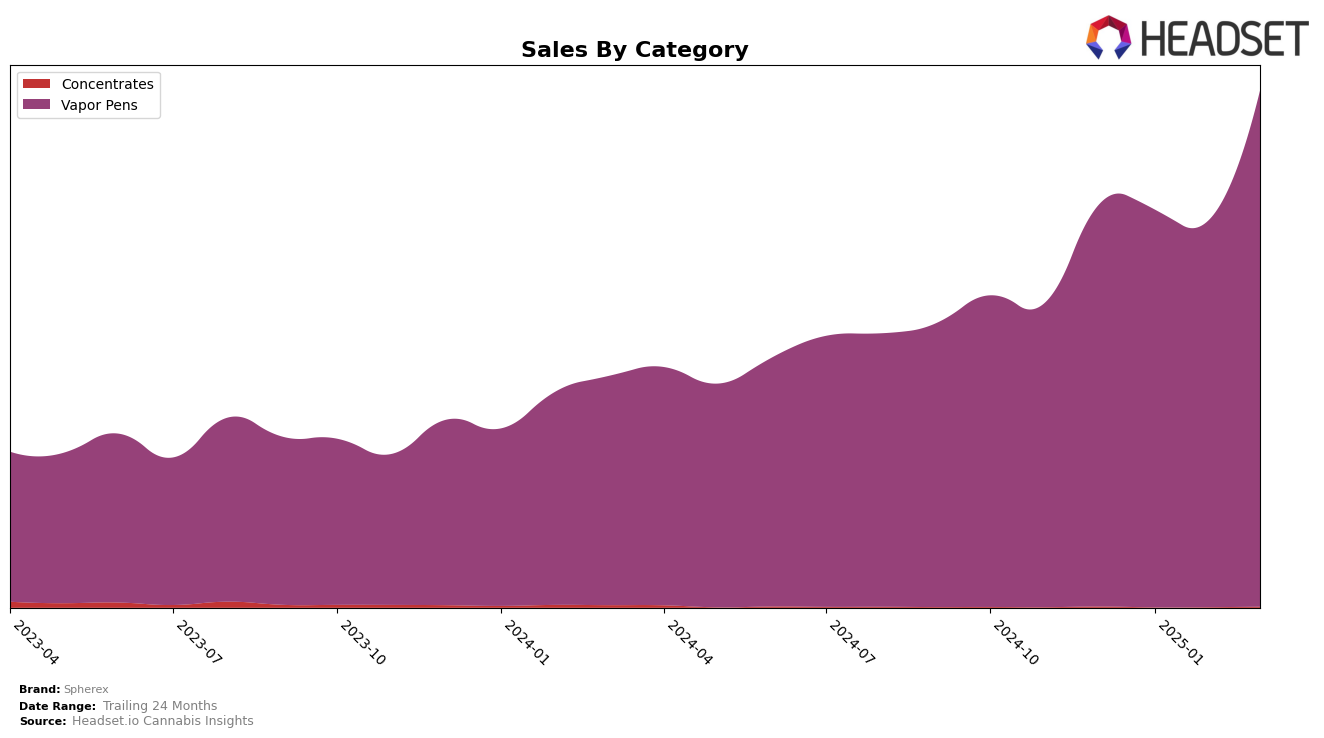

Spherex has demonstrated consistent dominance in the Vapor Pens category in Colorado, maintaining the top position from December 2024 through March 2025. This unwavering performance underscores the brand's strong market presence and consumer preference in the state. Interestingly, despite a slight dip in sales from December to February, there was a notable surge in March, indicating a potential rebound or strategic shift that could have driven consumer interest. The consistent number one ranking highlights Spherex's ability to sustain its leadership position in a competitive category.

In other states or provinces, Spherex's presence in the top 30 brands for Vapor Pens is not recorded, suggesting either a nascent market entry or a strategic focus primarily on Colorado. This absence in the rankings could be seen as a potential area for growth or an indication of regional market strategies that prioritize certain geographies over others. The brand's concentrated success in Colorado might suggest a tailored approach that capitalizes on local market dynamics, while the lack of presence elsewhere could be a strategic decision or a challenge that Spherex might need to address for broader market penetration.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Spherex has consistently maintained its top position from December 2024 through March 2025, showcasing its strong market presence and brand loyalty. Despite a slight dip in sales from December to February, Spherex experienced a significant rebound in March 2025, indicating a potential seasonal trend or successful promotional efforts. In contrast, the Bonanza Cannabis Company has held steady at the second rank, with sales fluctuating but not enough to challenge Spherex's dominance. Meanwhile, PAX has shown a steady climb in sales, maintaining its third position, which suggests a growing consumer interest that could pose a future threat if Spherex's sales momentum falters. This competitive analysis highlights the importance for Spherex to continue its innovative strategies to retain its leading position in the Colorado vapor pen market.

Notable Products

In March 2025, the top-performing product for Spherex was X - Cherry Kush Distillate Cartridge (1g) in the Vapor Pens category, achieving the number one rank with impressive sales of 38,693 units. X - Grape Punch Distillate Cartridge (1g), which held the top spot in January and February, moved to second place with sales of 28,013 units. X - Papaya Dream Distillate Cartridge (1g) made a strong comeback, securing the third position after being unranked in February. X - Strawguava Distillate Cartridge (1g) maintained a steady performance, climbing back to fourth place from fifth in February. Pink Lemonade Distillate Cartridge (1g) saw a slight decline, dropping to fifth place despite consistent sales growth over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.