Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

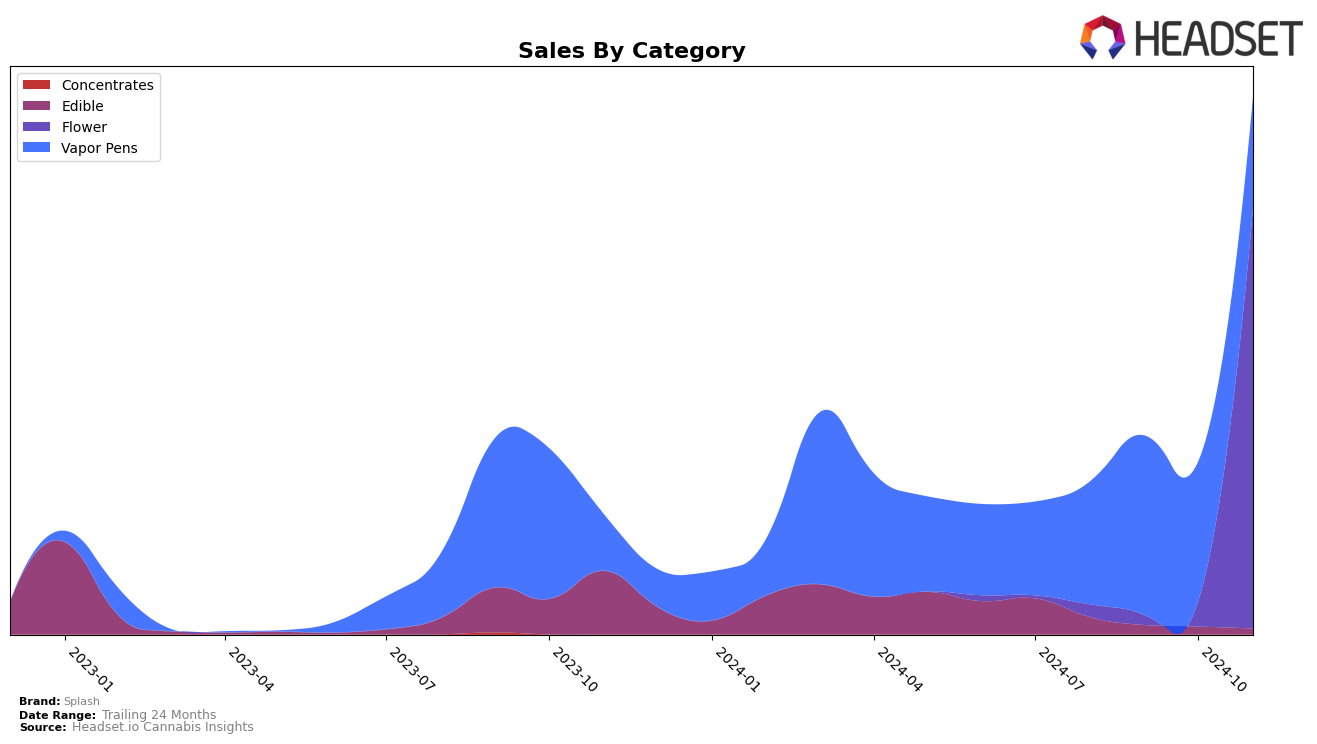

In the category of Vapor Pens, Splash has shown a fluctuating performance in Michigan over the past few months. Starting with a rank of 92 in August 2024, the brand improved to 72 in September, indicating a positive trend. However, the subsequent months saw a dip, with the rank stabilizing at 87 in both October and November. Despite these fluctuations, it's worth noting that Splash has managed to maintain a presence within the top 100, which suggests some level of consumer interest and market penetration. The sales figures reflect this variability, with a noticeable peak in September followed by a decline in the following months.

In the Flower category, Splash made a notable entry into the New York market, securing the 30th rank in November 2024. This debut in the top 30 is significant, as it marks the brand's emergence in a competitive category within a major market. The absence of rankings in the preceding months suggests that Splash was not among the top 30 brands, highlighting the importance of this recent achievement. The sales data for November underscores the potential for growth in this category, as the brand's entry into the rankings could indicate a strategic focus on expanding its presence in the Flower segment in New York.

Competitive Landscape

In the competitive landscape of the New York Flower category, Splash experienced a notable decline in its market presence, as evidenced by its absence from the top 20 rankings from August to November 2024. This contrasts with competitors like House of Sacci, which maintained a relatively stable position, fluctuating between 24th and 32nd place, and Etain, which consistently ranked in the top 35. Meanwhile, Honest Pharm Co made a significant leap from being outside the top 20 in August to securing the 28th position by October and November, indicating a strong upward trend. DEALR also showed variability, dropping drastically to 84th in October before recovering to 33rd in November. These shifts suggest that while Splash's sales might be lagging, competitors are either stabilizing or gaining ground, highlighting the need for Splash to reassess its market strategies to regain its competitive edge.

Notable Products

In November 2024, the top-performing product for Splash was Skyline Smoke (3.5g) in the Flower category, which secured the number one rank with sales figures reaching 1345 units. Banana Punch Muffin Live Resin Distillate Cartridge (1g) maintained its strong position in the Vapor Pens category, holding steady at the second rank for the third consecutive month with sales of 1238 units. City Lights (3.5g) also made a notable entry into the top three in the Flower category, climbing to the third rank. Steelhead Live Rosin Distillate Cartridge (0.5g) experienced a slight drop, moving from the third to the fourth position. Gas Line (3.5g) rounded out the top five in the Flower category, indicating a consistent demand for Flower products from Splash.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.