Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

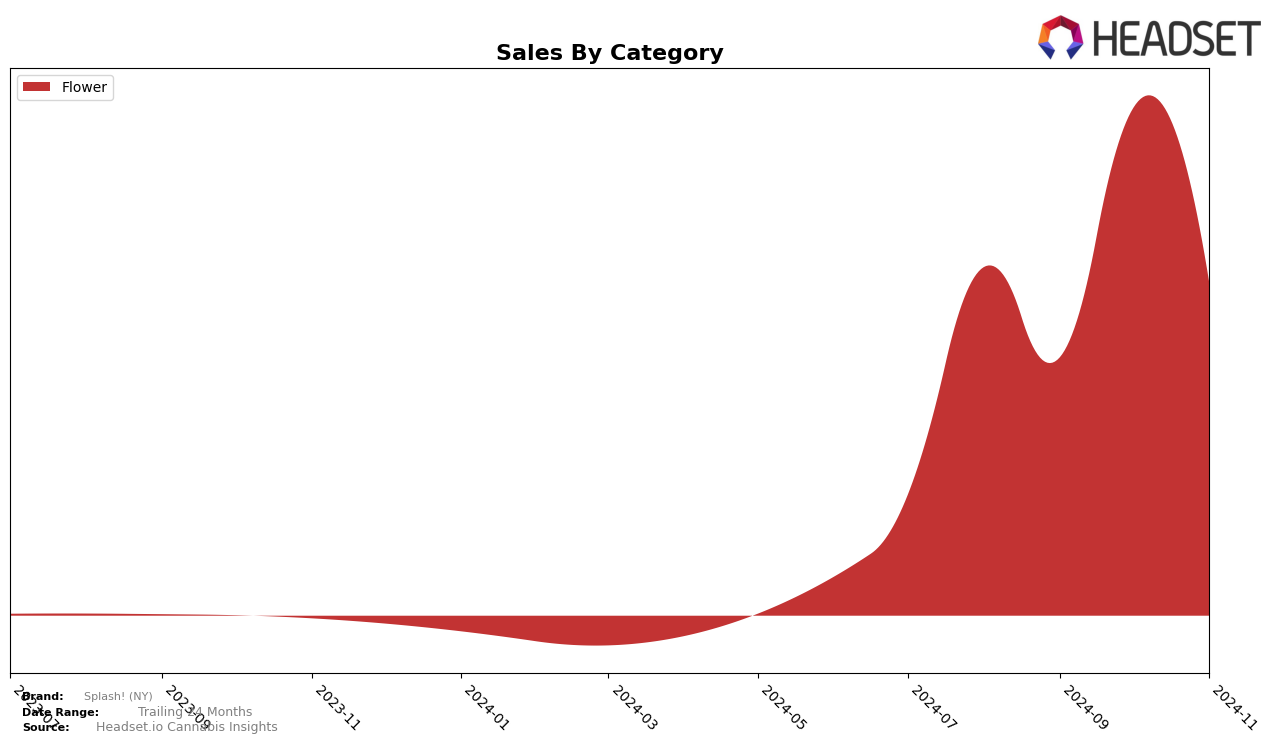

Splash! (NY) has shown a dynamic performance in the Flower category across several months in New York. In August 2024, the brand was ranked 24th, and although it slipped to 30th in September, it made a notable recovery by October, climbing to 19th place. However, by November, it had slightly dropped to the 22nd position. This fluctuation in rankings suggests a competitive market environment where Splash! (NY) is actively vying for a stronger foothold. The brand's sales trajectory mirrors its ranking movements, with a notable peak in October, indicating a potential seasonal or promotional influence on consumer purchasing behavior.

While Splash! (NY) has successfully remained within the top 30 Flower brands in New York throughout these months, the fact that it was at the 30th position in September highlights the challenges it faces in maintaining its market position. This period of lower ranking could be a critical point for the brand, suggesting the need for strategic adjustments to sustain and enhance its market presence. The overall performance across these months underscores the competitive nature of the cannabis market in New York, where brands must continuously innovate and adapt to consumer preferences to remain relevant and successful.

Competitive Landscape

In the competitive landscape of the New York flower category, Splash! (NY) has shown a notable fluctuation in its market position over the recent months. After starting at rank 24 in August 2024, Splash! (NY) made a significant leap to rank 19 in October, indicating a positive trend in sales performance during this period. However, by November, the brand experienced a slight decline to rank 22. This shift suggests a competitive pressure from brands like Dealer Cannabis Co., which saw a rise from rank 20 in August to 21 in November, and Live (NY), which maintained a relatively stable position around rank 20. Meanwhile, Florist Farms and Hepworth both dropped out of the top 20 by November, highlighting the dynamic shifts within the market. These movements underscore the competitive environment Splash! (NY) is navigating, emphasizing the need for strategic initiatives to maintain and improve its market standing.

Notable Products

In November 2024, the top-performing product for Splash! (NY) was Cherry Tart (3.5g), maintaining its number one rank from the previous month with sales of 5322 units. Following closely, NY GrapeZ (3.5g) held the second position, consistent with its October ranking. Secret Pie (3.5g) climbed back to the third spot after a dip in the previous month. Guava Hash (3.5g) experienced a slight decline, moving to fourth place from its previous third position in October. Notably, Tropical Splash (28g) entered the rankings at fifth place, showing a significant increase in sales compared to its initial introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.