Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

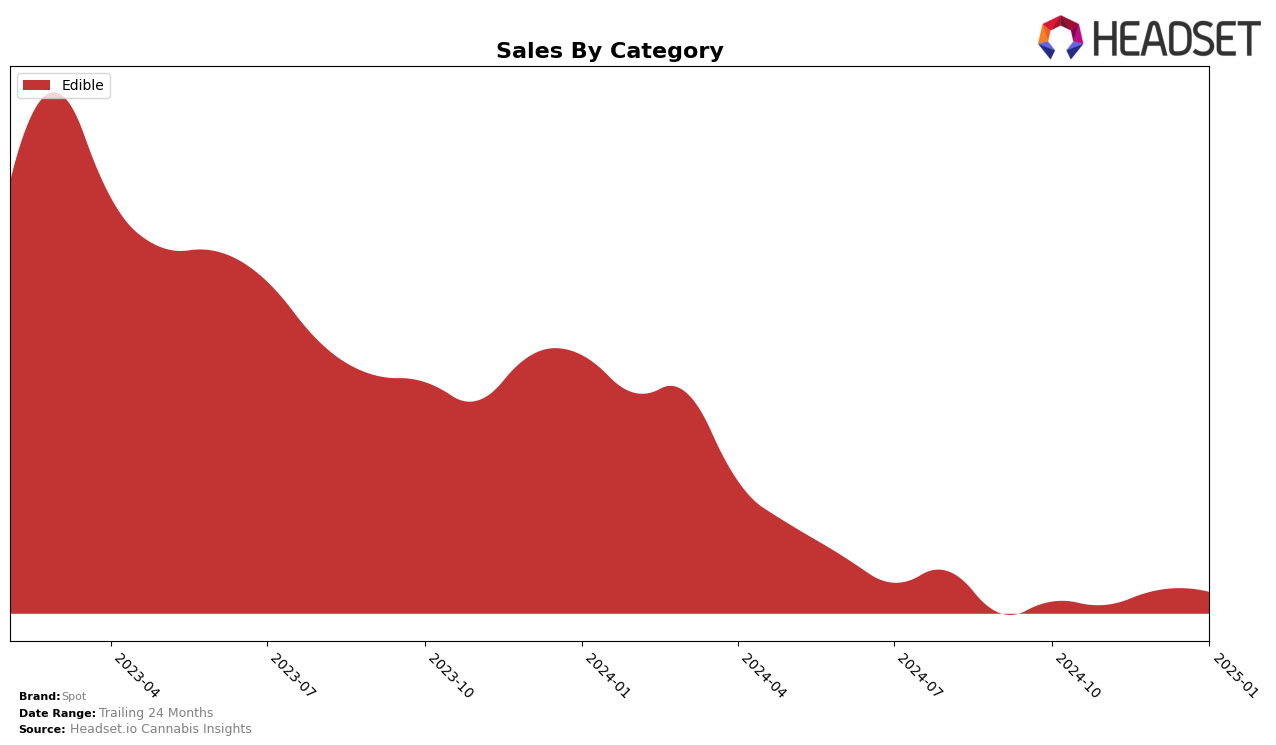

Spot has shown a steady performance in the Ontario market, particularly in the Edible category. Over the months from October 2024 to January 2025, Spot has improved its ranking from 27th to 24th. This upward trend indicates a positive reception and growing consumer base in Ontario. The brand's sales have also seen a notable increase from November to December, suggesting a strong holiday season performance. However, the fact that Spot is only just within the top 30 brands in this category highlights room for further growth and market penetration.

Despite Spot's presence in the Ontario Edible category, it is important to note that the brand does not appear in the top 30 rankings for other categories or states, indicating potential areas for expansion. This absence in other markets could be viewed as a missed opportunity or a strategic focus on strengthening its position in Ontario first. The consistent performance in Ontario suggests that Spot has a solid foundation to build upon, and exploring additional categories or states could further enhance its market presence. Observing Spot's strategies in the coming months will be key to understanding its growth trajectory.

Competitive Landscape

In the competitive landscape of the Edible category in Ontario, Spot has shown a gradual improvement in its rank from October 2024 to January 2025, moving from 27th to 24th position. This upward trend is indicative of a positive shift in market presence, despite being absent from the top 20 rankings in the initial months. Spot's sales figures have also seen a significant increase, particularly from November to December 2024. In comparison, Even Cannabis Company maintained a relatively stable rank, consistently outperforming Spot in sales, although it experienced a slight dip in January 2025. Meanwhile, Indiva held steady in 25th place, with fluctuating sales that ultimately declined in January. A-HA! experienced a downward trend, dropping to 26th place by January, which could potentially benefit Spot if this trend continues. Notably, Kinloch Wellness consistently ranked higher, with a strong sales performance, indicating a significant competitive pressure for Spot to contend with as it seeks to climb the ranks further.

Notable Products

In January 2025, the top-performing product for Spot was the CBG:THC 4:1 Gooseberry Soft Chews 2-Pack, which maintained its number one rank for the fourth consecutive month with sales of 4530 units. The Raspberry Soft Chews 2-Pack also held steady at the second position, though its sales figures have seen a decline over the months. The Adventure Blend - CBD/THC 3:10 Sativa Milk Chocolate Bar 10-Pack re-entered the rankings at position six, indicating a resurgence in interest. The Dark Chocolate Bar 10-Pack did not rank in January 2025, showing a drop from its previous third position in December 2024. Overall, Spot's edible category continues to dominate the sales charts with consistent top rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.