Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

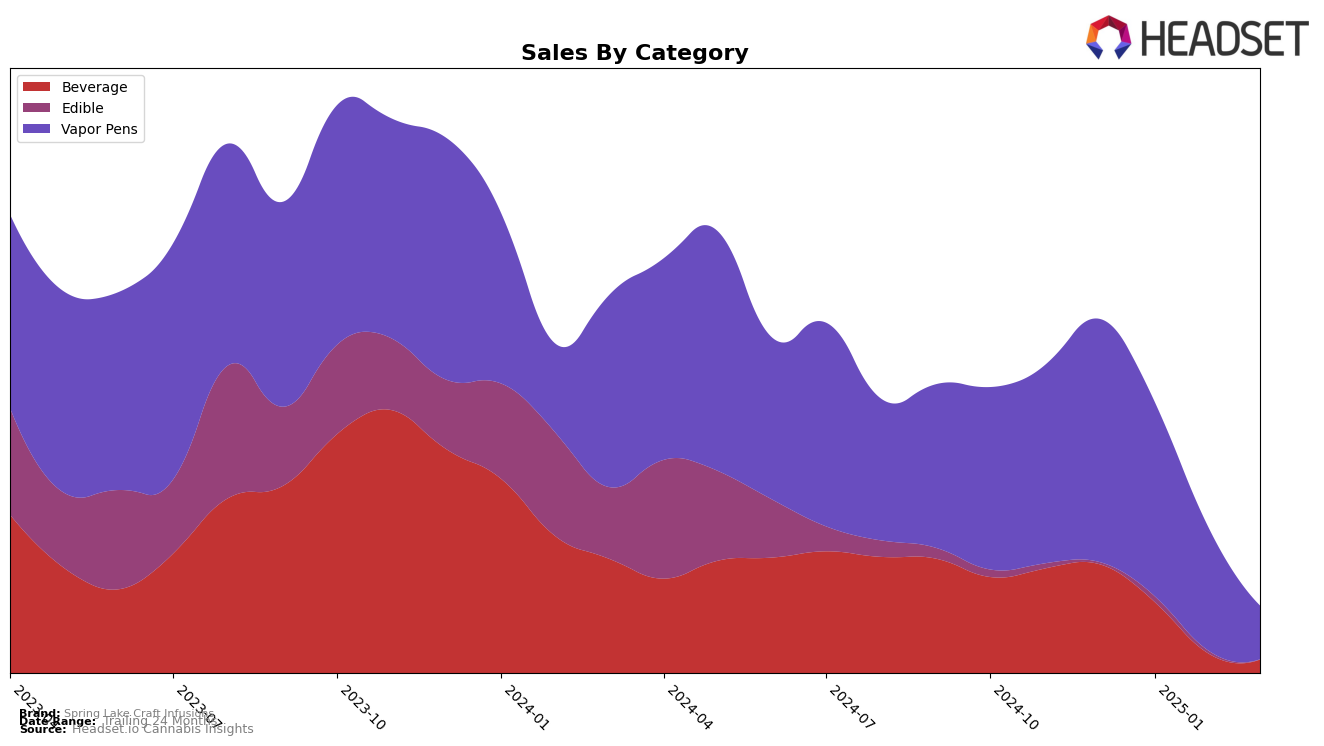

Spring Lake Craft Infusions has shown varied performance across different categories and states. In the beverage category, the brand has experienced a notable decline in Illinois, where it started strong at rank 7 in December 2024 but fell to rank 15 by March 2025. This downward trend is coupled with a significant drop in sales from $88,091 in December 2024 to $10,952 in March 2025. Such a decline in both ranking and sales might suggest increased competition or changing consumer preferences in the beverage category within Illinois.

In contrast, the vapor pens category presents a different challenge for Spring Lake Craft Infusions. In Illinois, the brand never broke into the top 30, starting at rank 40 in December 2024 and slipping further to rank 62 by March 2025. This consistent positioning outside the top 30 indicates that the brand is struggling to capture market share in the vapor pens category. The sales figures mirror this struggle, with a noticeable decline from $196,504 in December 2024 to $43,343 in March 2025. This data highlights the brand's need to reassess its strategy in this category to improve its market presence and performance.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Spring Lake Craft Infusions has experienced a notable decline in both rank and sales over the first quarter of 2025. Starting at rank 40 in December 2024, Spring Lake Craft Infusions dropped to rank 62 by March 2025, indicating a significant loss of market position. This decline is mirrored in their sales figures, which fell from a strong start in December to less than a quarter of that by March. In contrast, competitors such as Tyson 2.0 and Amber have maintained more stable positions, with Amber even experiencing a brief rise to rank 37 in February before dropping to 57 in March. Meanwhile, nuEra and Legacy Cannabis (IL) have remained outside the top 50 for most of this period, suggesting that Spring Lake Craft Infusions' challenges are not isolated but part of a broader competitive pressure in the Illinois vapor pen market. This trend highlights the need for Spring Lake Craft Infusions to reassess their market strategies to regain their competitive edge.

Notable Products

In March 2025, the top-performing product for Spring Lake Craft Infusions was the Banana Mango Distillate Cartridge (0.55g) in the Vapor Pens category, maintaining its position as the leading product from February. The Splash - Melon Bomb Distillate CO2 Cartridge (0.5g) followed closely, holding steady at the second position from the previous month. French Vanilla Surp Syrup (100mg) in the Beverage category showed a notable improvement, climbing to third place after not being ranked in February. Cherry Limeade Surp Syrup (100mg THC, 50ml) experienced a decline, moving from third in February to fourth in March. The newly introduced Splash - Banana Split Distillate CO2 Cartridge (0.5g) debuted in fifth place, marking its entry into the rankings.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.