Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

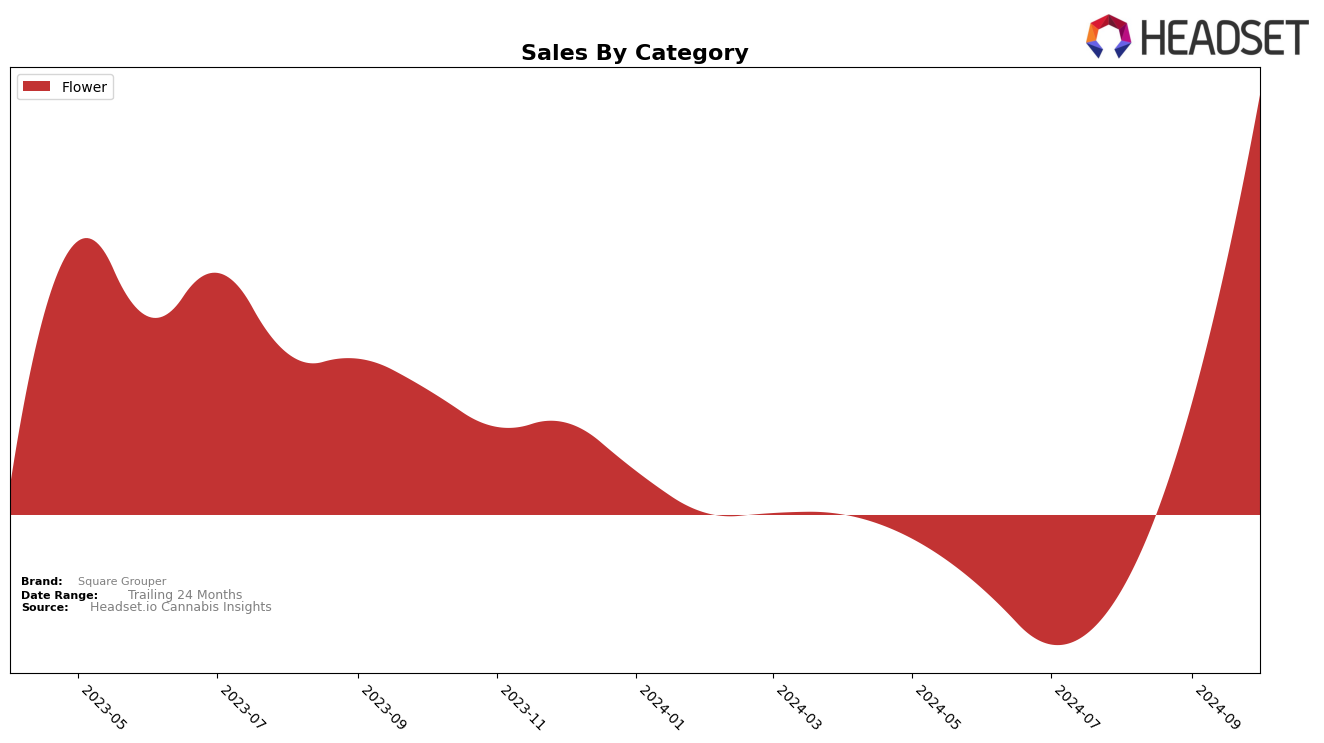

Square Grouper has shown notable performance improvements in the Flower category within the state of Missouri. In October 2024, the brand climbed to the 30th position, marking a significant leap from being unranked in the top 30 in previous months. This upward movement suggests a growing consumer interest and possibly successful marketing or distribution strategies that have been implemented recently. The brand's sales in Missouri have also seen a substantial increase from September to October, indicating a positive reception in the market. However, it remains to be seen if this trend will continue or if it was influenced by specific promotions or seasonal factors.

Despite the promising developments in Missouri, Square Grouper's absence from the top 30 rankings in other states or categories might indicate a need for strategic adjustments. The lack of presence in these rankings could suggest that the brand is either not focusing on those markets or facing stiff competition. To strengthen its position, Square Grouper might consider exploring opportunities for growth in other states or diversifying its product offerings. By analyzing consumer preferences and competitive landscapes, the brand could identify potential areas for expansion or enhancement, which could help in achieving a more balanced performance across different regions and categories.

Competitive Landscape

In the Missouri flower category, Square Grouper has shown a notable upward trajectory in recent months, moving from outside the top 20 to rank 46 in September 2024 and climbing to 30 by October 2024. This rise in rank is indicative of a significant boost in sales, particularly in October, where sales surged dramatically compared to previous months. In contrast, Willie's Reserve and Farmer G have maintained a more stable presence, with Willie's Reserve improving its rank from 43 to 31 over the same period, and Farmer G showing a slight decline in sales despite a consistent rank. Meanwhile, Notorious has also improved its position, reaching rank 29 in October, suggesting competitive pressure in the market. The rapid ascent of Square Grouper highlights its growing influence and potential to capture more market share in Missouri's competitive flower segment.

Notable Products

In October 2024, Square Grouper's top-performing product was Blue Cookies (3.5g) in the Flower category, maintaining its first-place ranking from September, with a notable sales figure of 3641 units. Super Glue (3.5g) also retained its second-place position, with sales increasing significantly to 2477 units. Sour Housley (3.5g) emerged as a new entrant in the rankings, securing the third spot with 2438 units sold. Alcapulco Gold (3.5g) followed closely in fourth place, while Sour Rain (3.5g) dropped from fourth to fifth, despite a sales increase to 2045 units. This month saw a stable performance from the top two products, while new entries and slight shifts characterized the rest of the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.