Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

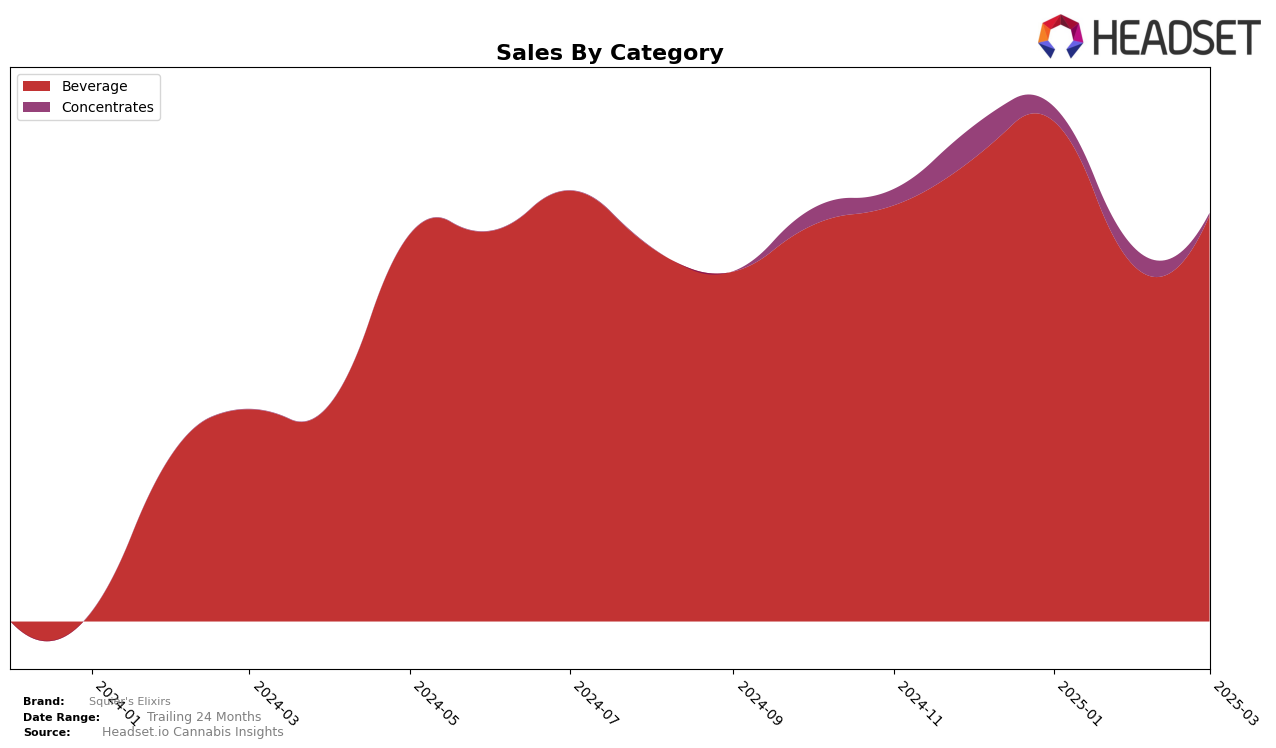

Squier's Elixirs has demonstrated a consistent performance in the beverage category within the state of Massachusetts. Over the span from December 2024 to March 2025, the brand maintained a solid position, starting at rank 6 and holding steady at rank 7 in the subsequent months. This stability in ranking is indicative of a strong market presence and customer loyalty, despite a notable dip in sales in February 2025. Such fluctuations in monthly sales figures are not uncommon in the beverage market, suggesting potential seasonal influences or competitive pressures during that period.

However, the absence of Squier's Elixirs from the top 30 rankings in other states or provinces might be a point of concern or an opportunity for expansion. This lack of presence outside Massachusetts could suggest a regional focus or limitations in distribution channels. The brand’s strategy might benefit from exploring new markets or enhancing its product offerings to appeal to a broader audience. Understanding the dynamics in other regions could provide valuable insights for Squier's Elixirs to leverage its strengths and address any potential gaps in its market strategy.

Competitive Landscape

In the competitive landscape of the beverage category in Massachusetts, Squier's Elixirs has maintained a stable position, consistently ranking 6th in December 2024 and January 2025, before slightly dropping to 7th in February and March 2025. This stability is significant given the fluctuating ranks of other brands. For instance, CANN Social Tonics has shown a strong presence, maintaining a top 3 position through January and February 2025, before dropping to 5th in March, indicating a potential shift in consumer preferences or competitive dynamics. Meanwhile, Pine + Star has consistently ranked just above Squier's Elixirs, holding the 6th position in February and March 2025. Despite a dip in sales in February, Squier's Elixirs' sales rebounded in March, suggesting resilience and a loyal customer base. This performance highlights the importance of strategic marketing and product differentiation for Squier's Elixirs to climb higher in the rankings amidst strong competition from brands like Keef Cola and Vibations, which have also shown notable sales trends.

Notable Products

In March 2025, the top-performing product from Squier's Elixirs was the Blueberry Lemon Hash Rosin Elixir, which moved up to the number one rank with sales of 429 units. The Mandarin Mango Hash Rosin Drink Elixir, despite a previous dip, secured the second position, showing a recovery from February's fourth place. The Pink Pineapple Hash Rosin Drink Elixir, which led in February, fell to third place, indicating a slight decline in its momentum. Sleepy Time Blackberry Lavender Hash Rosin Elixir climbed to fourth from its fifth position in February, suggesting growing consumer interest. Meanwhile, Raspberry Lime Hash Rosin Drink Elixir dropped to fifth, continuing a downward trend from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.