Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

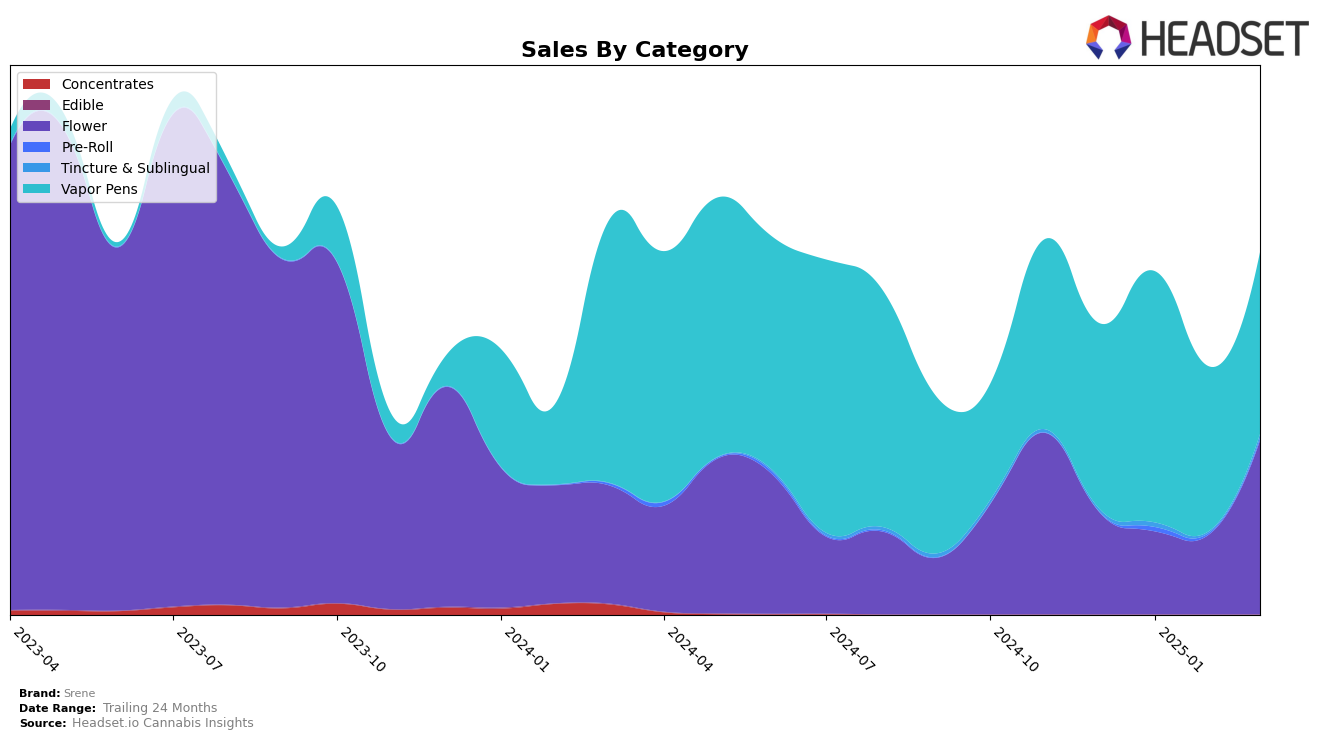

In the state of Nevada, Srene has shown mixed performance across different product categories. The Flower category exhibited a remarkable improvement in March 2025, climbing to the 25th position from being outside the top 30 in the preceding months. This upward trajectory in the Flower segment is noteworthy, especially considering the significant sales boost in March. On the other hand, their Vapor Pens category maintained a relatively stable presence, ranking consistently within the top 20. The slight fluctuations in rankings, from 19th in December 2024 to 15th in March 2025, indicate a steady demand for their vapor products in the Nevada market.

While Srene's performance in the Flower category in Nevada saw a positive turnaround, the Vapor Pens category experienced a more stable journey with a peak in January 2025, reaching the 13th position. This suggests that Srene's vapor products have a strong foothold in the Nevada market, maintaining their appeal despite minor rank changes. The absence of Srene in the top 30 for the Flower category in the earlier months can be perceived as a challenge they overcame, marking a significant achievement by March 2025. This overall performance highlights Srene's ability to adapt and improve its market position in Nevada, particularly in the Flower category, while maintaining a solid presence in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Srene has demonstrated a notable resilience and upward momentum in its ranking over the first quarter of 2025. Starting from a rank of 19 in December 2024, Srene improved to 13 in January 2025, although it experienced a slight dip to 16 in February before stabilizing at 15 in March. This fluctuation in rank is indicative of a dynamic market environment. Meanwhile, TRENDI, a strong competitor, showed a downward trend, slipping from rank 5 in December to 13 by March, suggesting potential market share opportunities for Srene. BOUNTI maintained a relatively stable presence, closely trailing Srene, while Dabwoods Premium Cannabis emerged in February with a rank of 29, quickly climbing to 16 by March, indicating a rapid growth trajectory. Royalesque faced challenges, dropping to rank 31 in February before recovering to 17 in March. These shifts highlight the competitive pressures and opportunities within the Nevada vapor pen market, positioning Srene as a brand with potential for further growth amidst fluctuating competitor dynamics.

Notable Products

In March 2025, the top-performing product from Srene was the Sin City Funk Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with notable sales of 1537 units. Following closely, Sin City Funk (3.5g) in the Flower category secured the second position, improving from fourth place in February. Strange Haze #8 (3.5g), also in the Flower category, made its debut in the rankings at third place. Daystripper (3.5g) dropped to fourth from its second-place standing in February, indicating a slight decline in its performance. The 747 Distillate Cartridge (1g) entered the ranks for the first time at fifth place, showing potential for growth in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.