Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

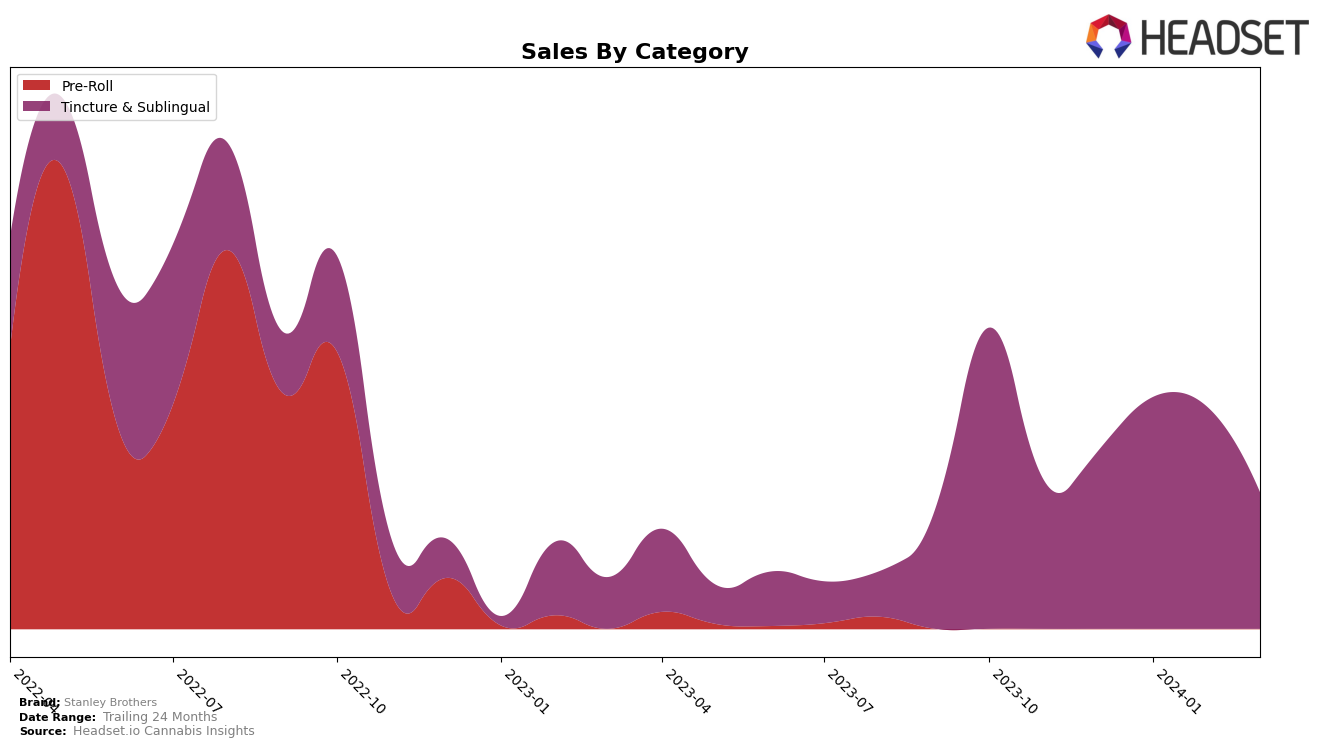

In the competitive landscape of Ohio, Stanley Brothers has shown a notable presence in the Tincture & Sublingual category. The brand experienced an upward trajectory at the beginning of the year, moving from the 11th rank in December 2023 to the 9th in both January and February 2024. This improvement reflects a growing consumer preference and trust in their products, particularly highlighted by a significant sales increase in January 2024. However, March 2024 saw a slight downturn, with the brand falling to the 13th position. This drop could indicate a fluctuation in consumer demand or increased competition within the state. Notably, the absence of Stanley Brothers from the top 30 brands in other states or categories might suggest a focused or limited market presence, which could be a strategic choice or an area for expansion.

The sales figures for Stanley Brothers in Ohio, particularly in the Tincture & Sublingual category, show an interesting pattern of growth followed by a slight decline. After an impressive sales jump in January 2024, there was a minor decrease in February, followed by a more substantial drop in March 2024. This could indicate several market dynamics at play, including possible saturation, pricing strategies, or the introduction of new competitors. The brand's ability to maintain a top-15 ranking amidst these challenges underscores its resilience and the loyalty of its customer base. However, the lack of visibility in top rankings across other states or provinces suggests that Stanley Brothers might be concentrating its efforts and resources in specific markets. This strategy could imply a deeper understanding and catering to the Ohio market's unique preferences or could highlight potential opportunities for geographic expansion and diversification in product offerings.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Ohio, Stanley Brothers has experienced fluctuations in its market position, indicating a dynamic competitive environment. Initially ranked 11th in December 2023, Stanley Brothers improved to 9th in January and February 2024 but saw a decline to 13th by March 2024. This shift in rank suggests a challenge in maintaining its market position against competitors such as Mary's Medicinals, which also experienced a slight rank fluctuation but remained relatively stable, and Lighthouse Sciences, which moved up in rank, indicating a stronger performance in the later months. Other brands like ONEderful and One Orijin have shown varying degrees of competition, with ONEderful consistently ranking lower than Stanley Brothers, whereas One Orijin has been closely competing, maintaining ranks just below or above Stanley Brothers in different months. The fluctuating ranks and sales of Stanley Brothers and its competitors highlight the importance of strategic marketing and product quality in maintaining and improving market position in the Ohio Tincture & Sublingual category.

Notable Products

In Mar-2024, Stanley Brothers' top-performing product was the CBD/THC/CBN 2:4:1 Night Tincture (110mg THC, 50mg CBD, 30ml) within the Tincture & Sublingual category, maintaining its number one rank consistently from Dec-2023 through Mar-2024, with a notable sales figure of 180 units in March. Following closely was the CBD/THC/CBG 2:1 Relief Tincture (98.28mg CBD, 50mg THC, 15ml), which also held its second position steadily over the same period. There was no change in the rankings of these products over the last four months, indicating stable consumer preferences within this brand's offerings. The sales figures for the second-ranked product, while not disclosed, clearly indicate a pattern of strong performance albeit lower than the leading product. These insights suggest a consistent market demand for Stanley Brothers' tincture products, specifically those combining CBD, THC, and other cannabinoids.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.