Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

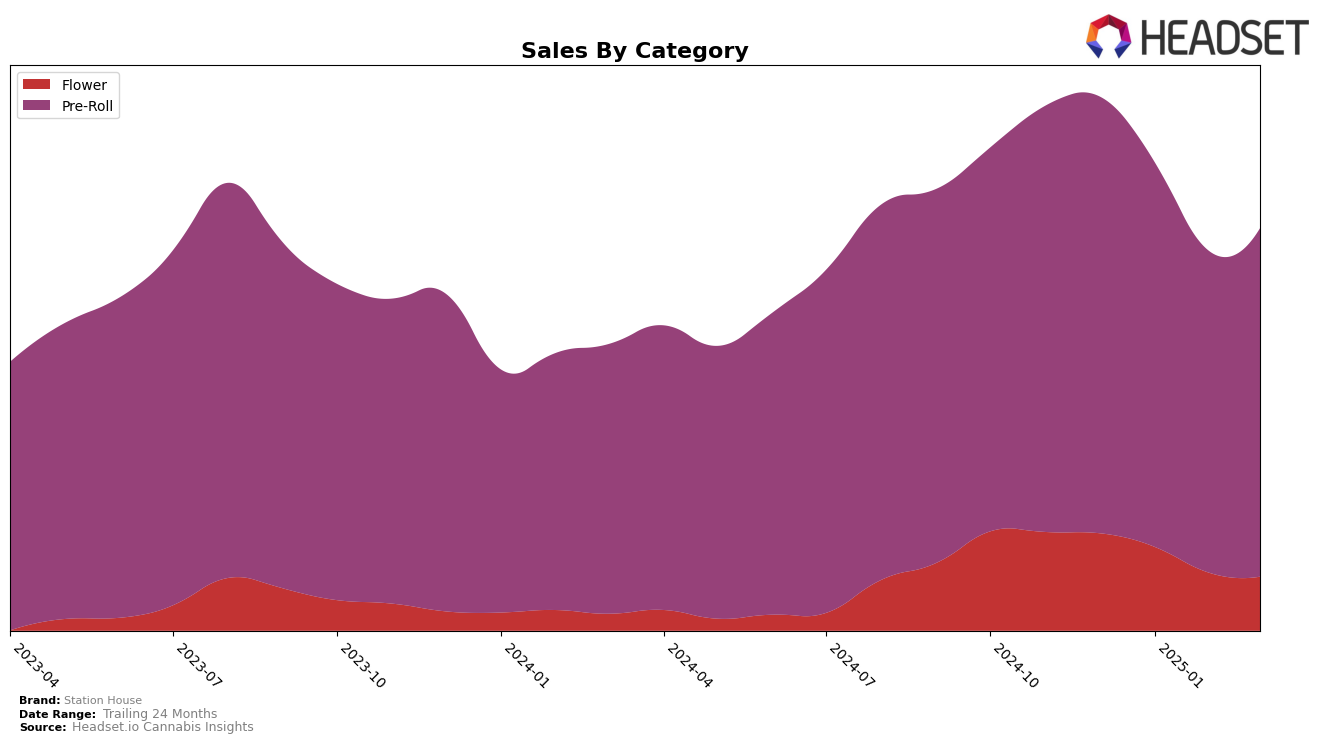

Station House has shown varied performance across different categories and regions in recent months. In Alberta, their Pre-Roll category has maintained a stable presence, albeit with a slight decline from a rank of 16 in December 2024 to 20 by March 2025. This suggests a competitive market dynamic where maintaining a top position requires consistent innovation and marketing efforts. In contrast, the performance in British Columbia for the Flower category has seen a downward trend, slipping out of the top 30 by February 2025. This drop indicates significant challenges in capturing consumer interest or possibly increased competition in that category.

On the brighter side, Station House's Pre-Roll category in British Columbia has shown remarkable stability, consistently holding onto a top 6 position from December 2024 through March 2025. This suggests a strong brand presence and consumer loyalty in this segment. Meanwhile, in Ontario, the Flower category has not managed to break into the top 50, indicating potential areas for growth or strategic adjustments. The Pre-Roll category in Ontario has demonstrated steadiness, maintaining a rank of 20 in March 2025, which could be seen as a solid foothold in a competitive market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Station House has maintained a consistent presence, holding the 6th rank from December 2024 through March 2025. Despite a slight dip in sales from January to February, Station House's sales figures rebounded in March, indicating resilience in a competitive market. Notably, Shred consistently outperformed Station House, maintaining a solid 4th rank throughout the same period, with sales figures significantly higher, suggesting a strong brand loyalty or market preference. Meanwhile, Thumbs Up Brand showed a notable upward trajectory, climbing from 11th in December to 5th by February and March, potentially posing a future threat to Station House's position. Additionally, Pistol and Paris and Dab Bods hovered around the 7th and 8th positions, indicating a stable yet competitive environment where Station House must strategize to maintain or improve its rank and sales performance.

Notable Products

In March 2025, the top-performing product from Station House was Blue Dream Pre-Roll (0.5g) in the Pre-Roll category, maintaining its first-place rank for four consecutive months with sales of 63,127 units. Northern Lights Pre-Roll (0.5g) also held steady in the second position, showing a slight increase in sales compared to February. OG Kush Pre-Roll (0.5g) remained in third place, continuing its upward trend since December 2024. Ghost Train Haze Pre-Roll (0.5g) improved its rank from fifth to fourth, indicating a positive shift in consumer preference. Meanwhile, Pink Kush Pre-Roll (0.5g) experienced a decline, dropping to fifth place from its peak in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.