Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

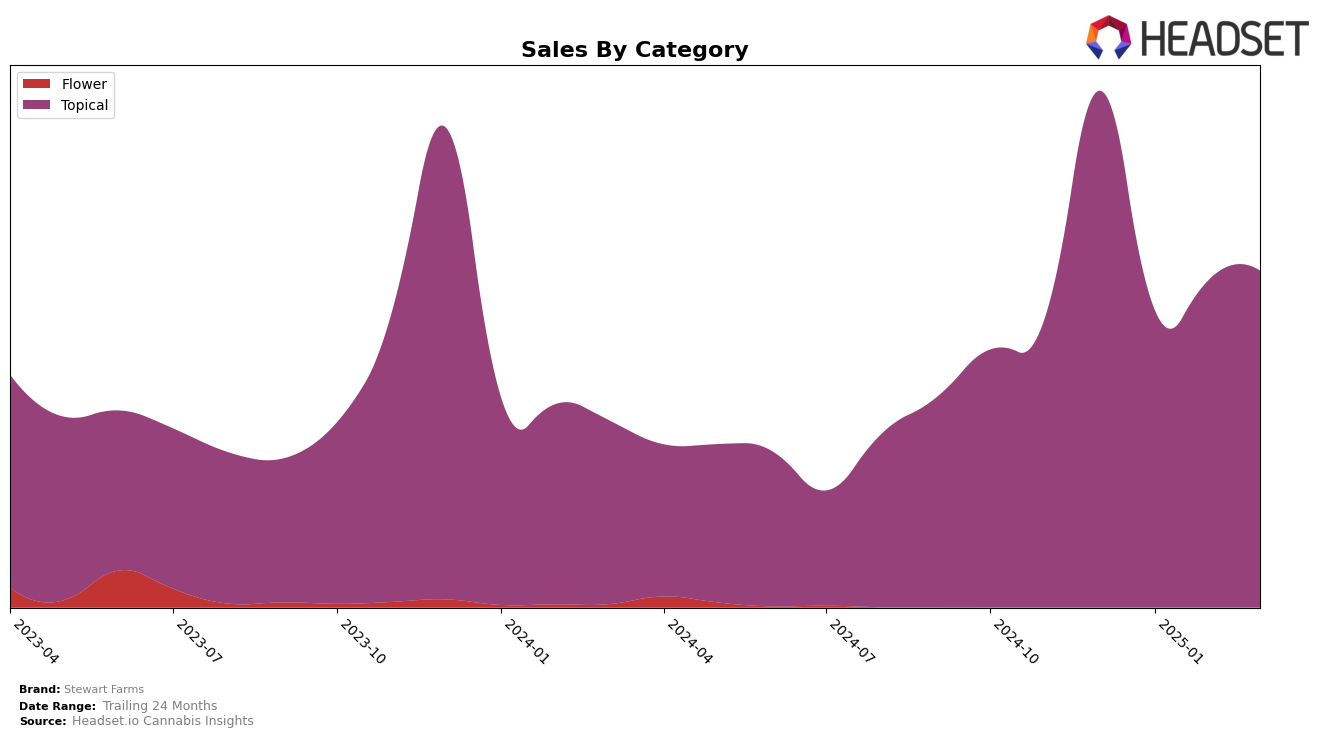

Stewart Farms has shown a consistent performance in the Topical category across several Canadian provinces. In Alberta, the brand maintained a steady second-place ranking from December 2024 through March 2025, reflecting a stable market presence despite fluctuations in monthly sales figures. Meanwhile, in British Columbia, Stewart Farms held the top position for three consecutive months before slipping to third place in March 2025. This drop suggests increased competition or market shifts that could be worth exploring further for potential strategic adjustments.

In Ontario, Stewart Farms experienced some variability, ranking second in December 2024, dropping to third in January, then climbing back to second in February, before settling again at third in March 2025. This movement indicates a dynamic competitive landscape in Ontario's Topical market, where Stewart Farms remains a strong contender. However, the brand did not appear in the top 30 for any other categories or states/provinces, which could be seen as a limitation or an opportunity for expansion depending on the brand's strategic goals and resources. Analyzing these trends can provide valuable insights into regional market dynamics and consumer preferences.

Competitive Landscape

In the Alberta topical cannabis market, Stewart Farms consistently holds the second rank from December 2024 to March 2025, demonstrating a stable position in the competitive landscape. Despite a dip in sales from December to January, Stewart Farms shows a positive rebound with increasing sales in February and March, indicating a strong recovery and growth trajectory. The brand is closely trailing behind Wildflower Canada, which maintains the top position, suggesting that while Stewart Farms is a leading contender, it still faces stiff competition from the market leader. Meanwhile, Stewart Farms outperforms Proofly and Solei, who consistently rank third and fourth, respectively, with lower sales figures. This competitive positioning highlights Stewart Farms' strong market presence and potential for further growth in the Alberta topical category.

Notable Products

In March 2025, Stewart Farms maintained a consistent performance with its top products. The CBD/THC 1:1 Blue Dream Bath Bomb remained the top-performing product, holding the first rank for four consecutive months with notable sales of 3,477 units. The CBD:THC 1:1 Multipack Bath Bomb 3-Pack and Rebound - CBD:THC 1:1 Arctic Heat Muscle Cream also retained their second and third positions respectively, showing stable demand. The Rebound - CBD Blueberry Sunset Salt Soak and CBD/THC 1:1 Bubba Kush Bath Bomb both held the fourth and fifth ranks, respectively, since February 2025. This indicates a consistent product lineup with no changes in rankings from February to March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.