Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

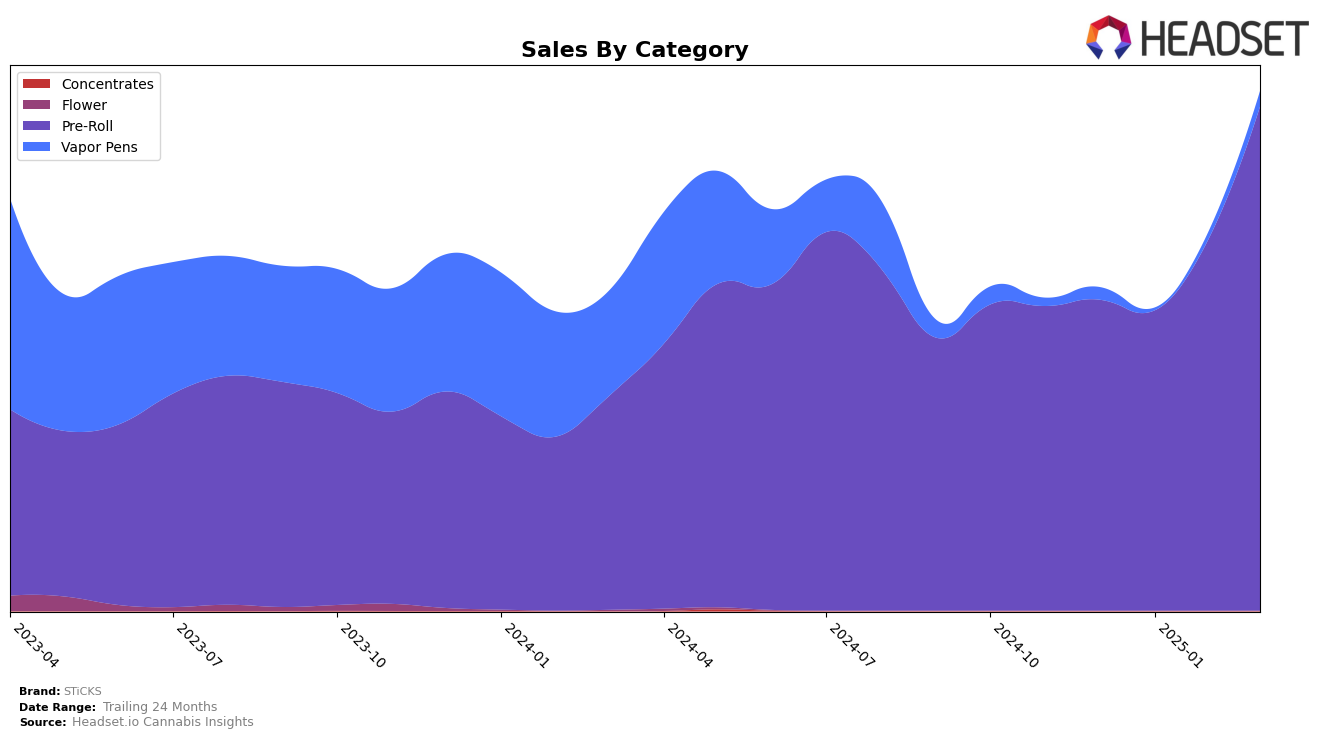

STiCKS has shown notable performance in the Oregon market, particularly in the Pre-Roll category. The brand maintained its position at rank 9 from December 2024 to January 2025, before climbing to rank 5 in both February and March 2025. This upward movement is indicative of a strong market presence and growing consumer preference for their Pre-Roll products. The sales figures support this trend, with a significant increase from $265,869 in January to $446,560 in March, highlighting an impressive growth trajectory. On the other hand, in the Vapor Pens category, STiCKS was not ranked in the top 30 for January and February, which suggests potential challenges or less focus in this segment, although they did reappear at rank 86 in March.

The absence of STiCKS from the top 30 rankings in the Vapor Pens category during January and February in Oregon could indicate a strategic emphasis on Pre-Rolls, where they have demonstrated consistent strength. However, their re-entry into the rankings in March at position 86 suggests a possible renewed focus or successful promotional efforts in this category. The contrasting performance across categories highlights the brand's varied success and potential areas for growth. Observing these dynamics can provide insights into their market strategies and consumer preferences, offering a glimpse into how STiCKS might adjust its offerings to enhance performance across different product lines.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, STiCKS has demonstrated a notable upward trajectory in recent months. From December 2024 to March 2025, STiCKS improved its rank from 9th to 5th, showcasing a significant rise in market presence. This upward movement is particularly impressive given the performance of competitors like Benson Arbor, which saw a decline from 6th to 7th place over the same period, and Kaprikorn, which maintained a steady rank just above STiCKS at 4th place. Meanwhile, Fire Dept. Cannabis consistently held the 3rd position, indicating strong competition at the top. STiCKS' sales growth, particularly the jump from February to March 2025, suggests a strengthening consumer preference and effective market strategies, positioning it favorably against competitors like Killa Beez, which remained stable at 6th place. This positive trend for STiCKS indicates potential for continued growth and increased market share in the Oregon Pre-Roll segment.

Notable Products

In March 2025, STiCKS saw Blue Magoo Infused Pre-Roll (1g) rise to the top position as the best-performing product, with sales reaching 9,647 units. Valley Purps Infused Pre-Roll (1g) maintained its strong performance, holding steady at the second rank with 9,509 units sold. MT. Hood Magic Infused Pre-Roll (1g) experienced a slight drop from first to third place, while OG Kush Infused Pre-Roll (1g) also fell one rank to fourth. Maui Wowie Distillate Infused Pre-Roll (1g) rounded out the top five, despite a decline in sales, indicating a shift in consumer preference. These changes in rankings from February to March suggest a dynamic market where product positioning can shift rapidly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.