Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

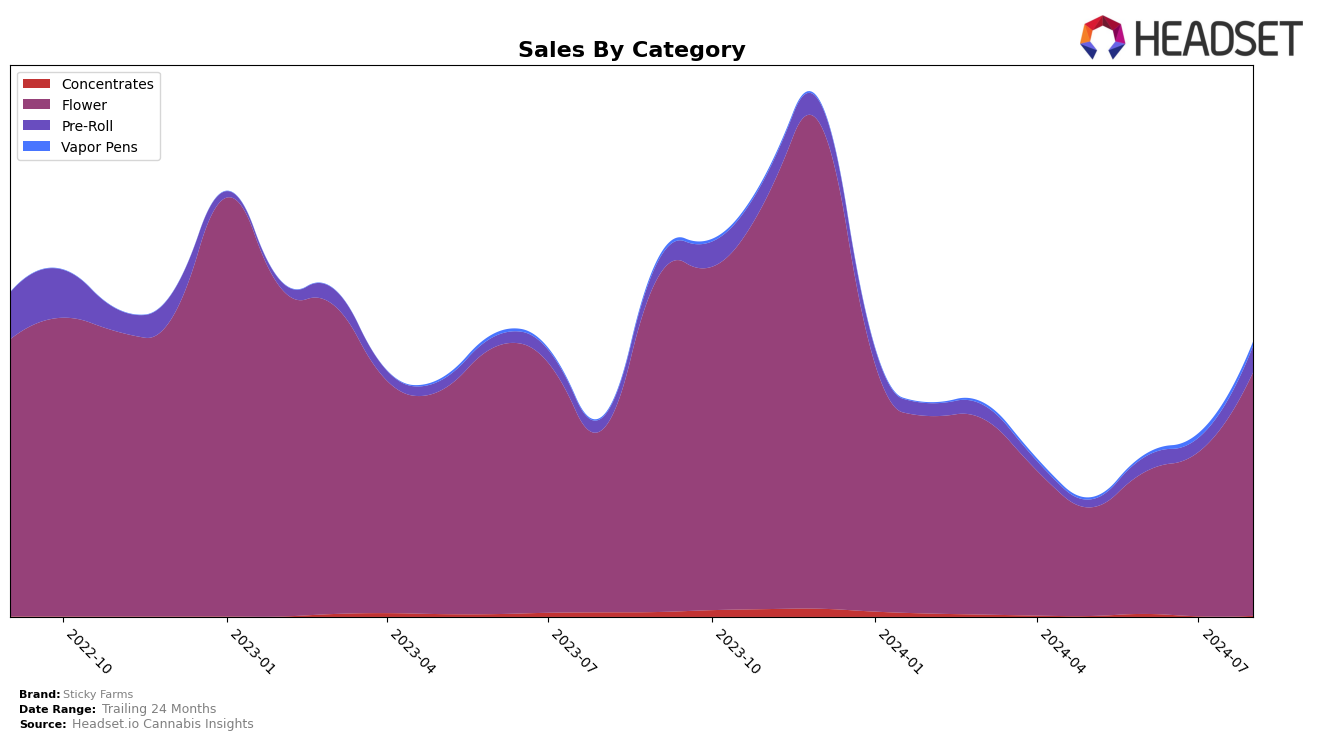

Sticky Farms has shown notable progress in the Oregon market, particularly within the Flower category. Over the summer months, the brand has climbed from a rank of 72 in May 2024 to break into the top 30 by August 2024. This upward trend is reflected in their sales figures, which saw a significant increase from $107,546 in May to $242,441 by August. Such a leap in both ranking and sales indicates a strong market presence and growing consumer preference in Oregon for Sticky Farms' Flower products.

In contrast, Sticky Farms' performance in the Pre-Roll category in Oregon has been less impressive. The brand did not rank in the top 30 in May 2024, and while they managed to enter the rankings at position 93 in June, their position fluctuated slightly, ending at rank 81 by August. This indicates that while there is some interest in their Pre-Roll products, it is not as strong or consistent as their Flower offerings. The sales figures for Pre-Rolls also reflect this, with a modest increase from $14,526 in June to $25,789 in August. This suggests that while there is potential for growth in this category, Sticky Farms needs to strategize effectively to gain a stronger foothold in the Pre-Roll market.

Competitive Landscape

In the competitive Oregon flower market, Sticky Farms has shown a notable upward trajectory in its rankings over the past few months. Starting from a rank of 72 in May 2024, Sticky Farms climbed to 30 by August 2024, indicating a significant improvement in market presence. This upward movement is particularly impressive when compared to competitors like Avitas, which fluctuated in rankings and did not maintain a consistent top 20 position, and SugarTop Buddery, which saw a decline from 18 in July to 34 in August. Additionally, Summary Farms and Bon Fire Farms also experienced volatility in their rankings, with Summary Farms dropping out of the top 20 in July. Sticky Farms' consistent rise in rank suggests a growing consumer preference and effective market strategies, positioning it favorably against its competitors in terms of sales momentum and brand strength.

Notable Products

In August 2024, the top-performing product from Sticky Farms was Purple Push Pop Shake (Bulk) in the Flower category, achieving the number one rank with sales of $6,711. Jack Herer (1g), also in the Flower category, secured the second spot. The Duct Tape Pre-Roll 10-Pack (5g) climbed to the third position, showing significant growth from fifth place in July. Garlic Juice Shake (Bulk) dropped slightly to fourth place, while Garlic Juice (Bulk) fell to fifth place after previously holding the top spot in May and June. Overall, the rankings indicate a dynamic shift in consumer preferences over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.