Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

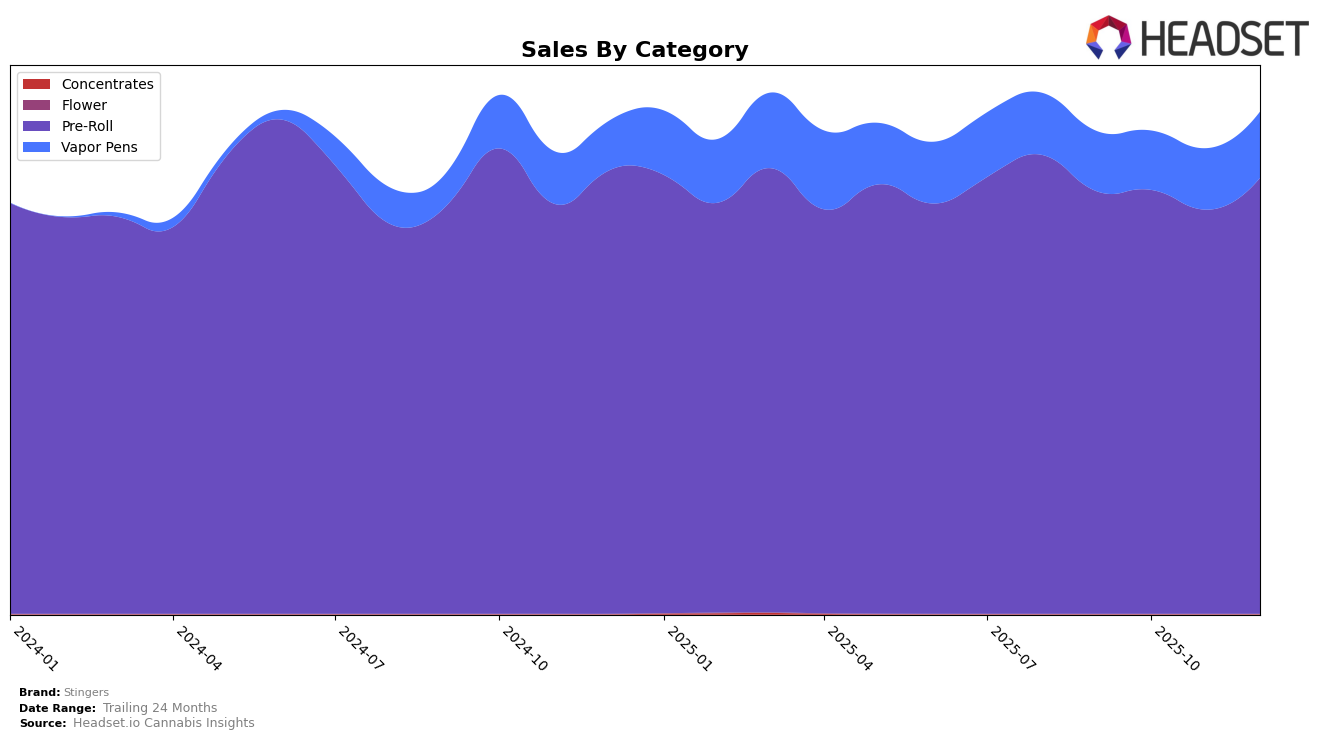

Stingers' performance in the Washington market shows a consistent presence in the Pre-Roll category, maintaining a top-five position over the last four months of 2025. This stability indicates a strong foothold in the Pre-Roll segment, suggesting customer loyalty and a solid product offering. In contrast, Stingers did not appear in the top 30 brands in the Pre-Roll category in Massachusetts during the same period, which could imply challenges in market penetration or competition from other brands. This absence highlights a potential area for strategic focus if Stingers aims to expand its influence in Massachusetts.

In the Vapor Pens category within Washington, Stingers' rankings fluctuated between 59th and 65th place from September to December 2025. While the brand is not among the top performers in this category, there is a positive trend in sales, with an increase observed from October to December. This upward movement in sales could signal growing consumer interest or effective marketing strategies targeting this segment. However, the brand's lower ranking compared to its Pre-Roll category performance suggests that there might be room for improvement or differentiation in its Vapor Pens offerings to climb higher in the rankings.

Competitive Landscape

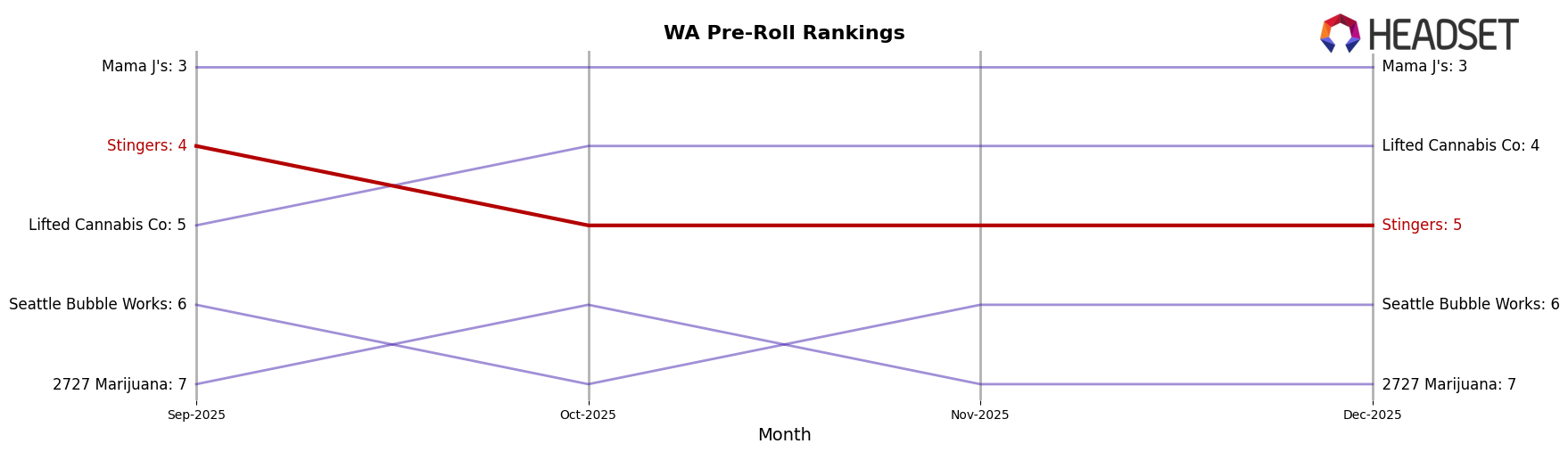

In the competitive landscape of the Pre-Roll category in Washington, Stingers experienced a slight decline in its ranking from September to October 2025, moving from 4th to 5th place, where it remained through December. This shift can be attributed to the performance of competitors like Lifted Cannabis Co, which consistently held the 4th position from October to December, and Mama J's, which maintained a strong 3rd place throughout the period. Despite the drop in rank, Stingers' sales showed resilience, with a notable recovery in December, reaching close to its October figures. Meanwhile, Seattle Bubble Works and 2727 Marijuana fluctuated around the 6th and 7th positions, indicating a stable yet competitive environment. This data suggests that while Stingers faces stiff competition, particularly from Lifted Cannabis Co, its sales performance remains robust, highlighting the importance of strategic marketing efforts to regain its previous ranking.

Notable Products

In December 2025, the 9lb Hammer Infused Pre-Roll 2-Pack (1g) maintained its top position as the leading product for Stingers, with sales reaching 2249 units. Following closely, the Super Stinger - Granddaddy Purple Infused Pre-Roll 2-Pack (1g) held steady in the second spot, showing consistent performance over the past three months. The Green Crack Liquid Diamonds Infused Pre-Roll 2-Pack (1g) secured the third rank, marking its first appearance in the top three since its entry in November. Northern Lights Infused Pre-Roll 2-Pack (1g) experienced a drop to the fourth position from its peak in October, while Wedding Cake Infused Pre-Roll 2-Pack (1g) re-entered the top five after being absent in November. Overall, the rankings reflect a strong preference for infused pre-rolls in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.