Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

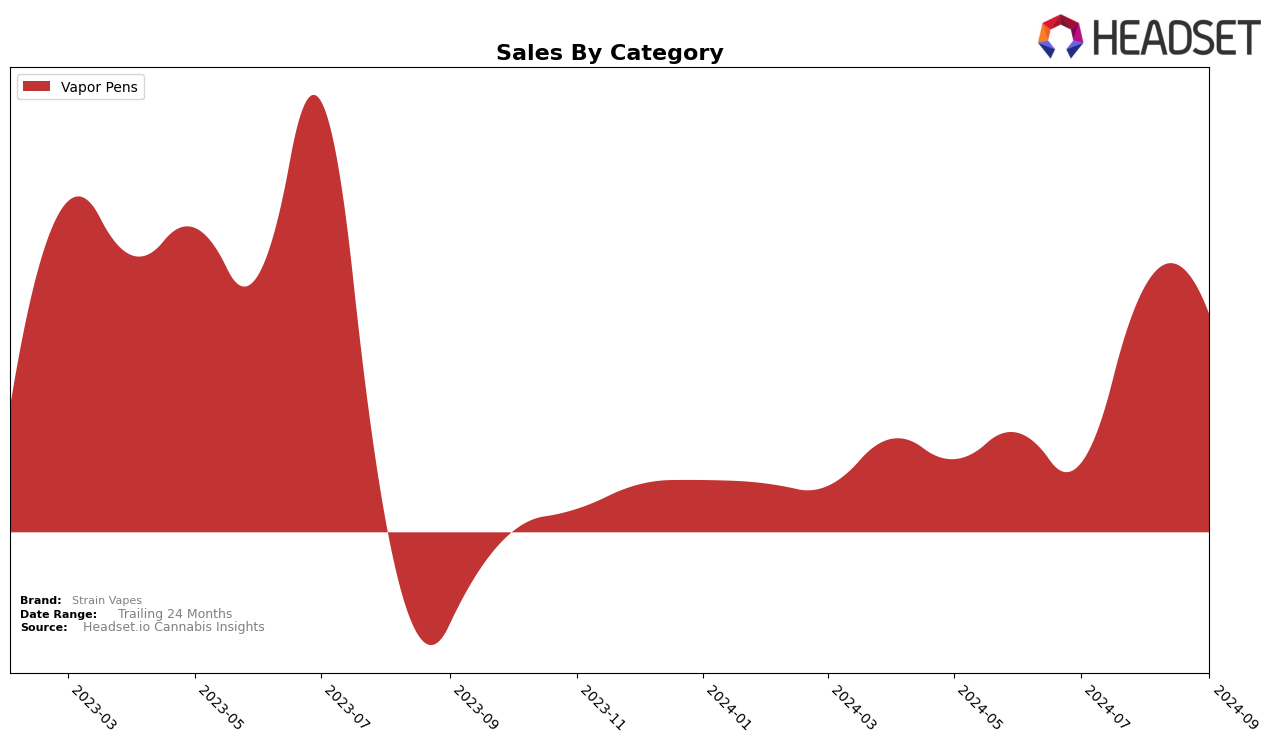

Strain Vapes has shown a dynamic performance across different states and categories in recent months. In Missouri, the brand has made significant strides in the Vapor Pens category. Despite not being in the top 30 in June and July, Strain Vapes broke into the rankings at the 30th position in August and continued to climb to 27th in September. This upward trend indicates a growing consumer interest in their products, potentially driven by strategic marketing efforts or product innovations. The substantial increase in sales from July to August suggests a strong market response, which could be a pivotal point for the brand's future positioning in Missouri.

While Missouri illustrates a positive trajectory for Strain Vapes, the absence of the brand in the top 30 rankings in other states or categories during these months could be a point of concern. This lack of presence might suggest challenges in market penetration or competition intensity in those areas. However, the brand's ability to improve its standing in Missouri may offer insights or strategies that could be leveraged to enhance its performance elsewhere. Observing how Strain Vapes navigates these challenges in the coming months will be crucial for understanding its broader market strategy and potential areas for growth.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Strain Vapes has demonstrated a notable upward trajectory in rankings from June to September 2024, moving from 44th to 27th position. This improvement is significant, especially when compared to competitors like Flora Farms, which experienced fluctuations and even dropped out of the top 20 in August. Despite starting with lower sales figures, Strain Vapes has shown a consistent increase in sales, particularly from July to August, aligning with its rise in rank. Meanwhile, Proper Cannabis and Plume Cannabis (MO) maintained relatively stable positions but did not exhibit the same level of upward momentum as Strain Vapes. This suggests that Strain Vapes is effectively capturing market share and could continue to climb the ranks if current trends persist.

Notable Products

In September 2024, the top-performing product for Strain Vapes was the Strawberry Cough Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with sales reaching 1653 units. This product showed a significant improvement from its second-place position in August. God's Gift Distillate Cartridge (1g), previously holding the top spot for three consecutive months, moved to second place with 1437 units sold. The Biscotti Distillate Cartridge (1g) made a notable entry into the rankings at third place, indicating strong market reception. Meanwhile, King Louis XIII and Girl Scout Cookies Distillate Cartridges maintained their fourth and fifth positions, respectively, showing consistent performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.