Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

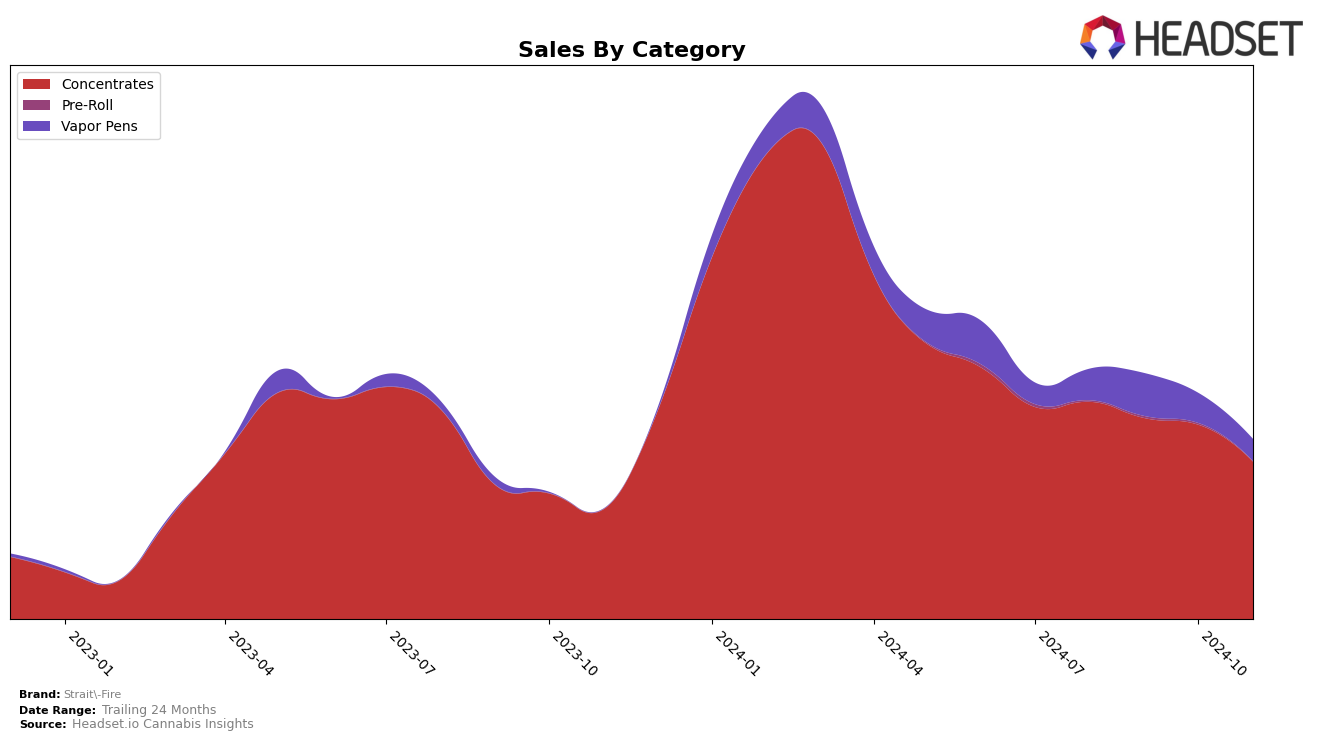

Strait-Fire's performance in the Concentrates category in Michigan has seen notable fluctuations over the past few months. In August 2024, the brand was ranked 26th, improving to 22nd in both September and October. However, by November, their ranking slipped to 30th, indicating a challenging market environment or increased competition. Despite the drop in ranking, it's important to note that Strait-Fire managed to remain within the top 30, maintaining a presence in a competitive category. This suggests resilience and potential for recovery, although the downward trend in sales from August to November, with November sales at $136,680, highlights areas that may require strategic adjustments.

The consistency in ranking during September and October indicates a period of stabilization for Strait-Fire, which might have been due to effective marketing strategies or a loyal customer base. However, the decline in November suggests that these strategies might need reevaluation or that external factors have impacted their market position. The absence of rankings in other states or categories implies that Strait-Fire's influence might be limited geographically or category-wise, which could be a strategic consideration for future growth. Understanding these dynamics can provide insights into the brand's current market position and potential areas for expansion or improvement.

Competitive Landscape

In the competitive landscape of the concentrates category in Michigan, Strait-Fire has experienced notable fluctuations in rank and sales over recent months. While it maintained a steady position at rank 22 in both September and October 2024, its rank dropped to 30 by November, indicating increased competition and potential challenges in maintaining market share. This decline in rank coincides with a decrease in sales, suggesting that Strait-Fire may need to reassess its strategies to regain its footing. In contrast, Five Star Extracts and Mischief have shown resilience, with Mischief improving its rank from 32 in September to 28 in November, while Five Star Extracts, despite a dip in October, managed to climb back up to rank 29 in November. Meanwhile, Monster Xtracts and LivWell have not been consistent contenders in the top 20, with LivWell missing from the rankings until November, when it entered at rank 33. These dynamics highlight the competitive pressures Strait-Fire faces and underscore the importance of strategic adjustments to enhance its market position.

Notable Products

In November 2024, the top-performing product from Strait-Fire was Trump's Candy Live Rosin (1g) in the Concentrates category, reclaiming its number one position with impressive sales of 1707 units. Los Muertos Bubble Hash (1g) climbed to the second spot, marking a significant rise from its fifth rank in October. Grape Gas Live Rosin (1g) made its debut in the rankings at third place, indicating strong initial sales. Yo Berry Live Rosin (1g) consistently held the fourth position from October to November. Papaya Punch Live Rosin (1g) entered the rankings at fifth place, rounding out the top five for November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.