Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

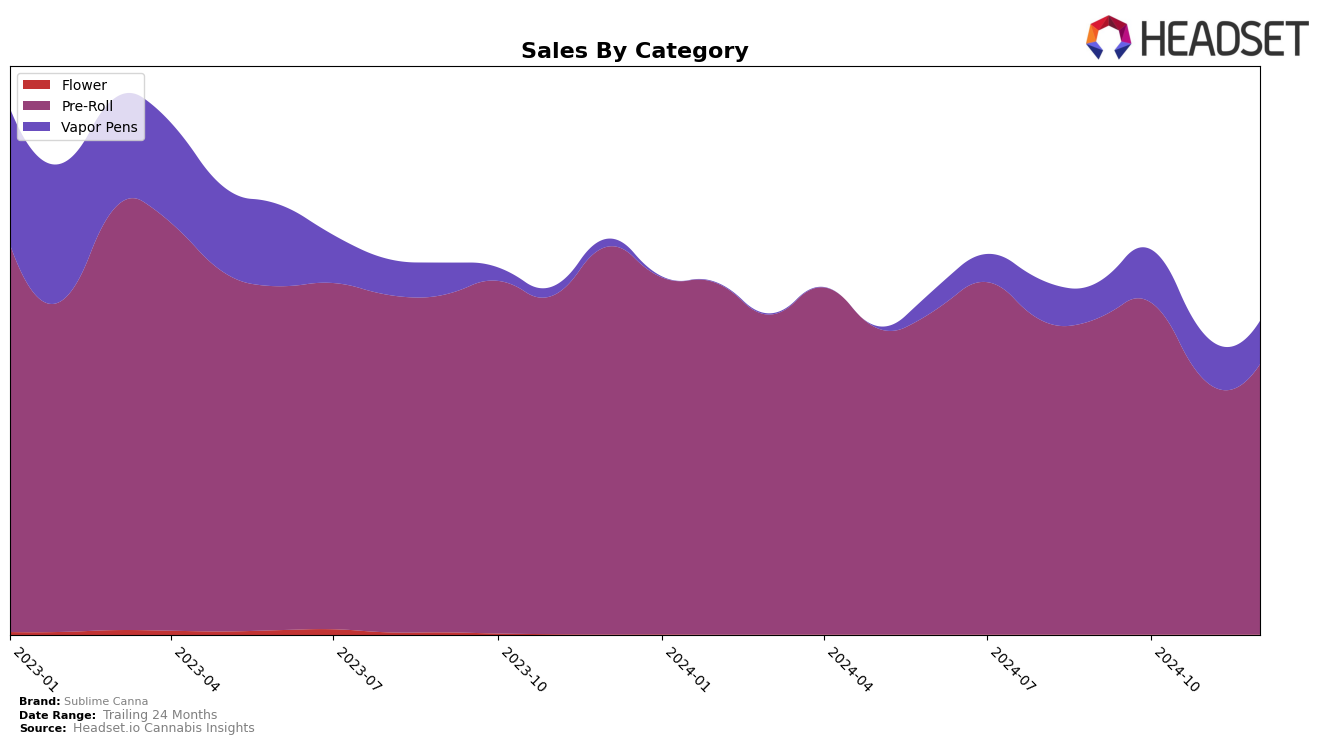

Sublime Canna has demonstrated varied performance across different states and product categories in recent months. In the California market, the brand has maintained a presence in the Pre-Roll category, albeit with some fluctuations. Starting at the 25th rank in September 2024, Sublime Canna experienced a slight dip to the 31st position in November before recovering to 28th in December. This movement indicates a resilient presence in the competitive Californian Pre-Roll market, although the brand's exclusion from the top 30 in November suggests challenges in maintaining consistent market traction.

It's noteworthy that Sublime Canna's performance in the Pre-Roll category reflects a dynamic competitive landscape. While the brand's sales showed a decrease from October to November, there was a rebound in December, suggesting potential seasonal influences or successful promotional strategies. The brand's ability to re-enter the top 30 by December highlights a positive trend, but the absence from the rankings in November serves as a reminder of the volatility in consumer preferences and market conditions. Observing these trends can provide insights into how Sublime Canna might strategize for sustained growth and stability in the future.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Sublime Canna has experienced fluctuating rankings over the last few months, moving from 25th in September 2024 to 28th by December 2024. This trend indicates a slight decline in their market position, although their sales figures show a recovery from a dip in November. Notably, EVIDENCE has consistently outperformed Sublime Canna, maintaining a top 25 rank throughout the period, which suggests stronger market traction. Meanwhile, Froot has shown an upward trend, surpassing Sublime Canna by December with a rank of 26th, indicating increasing consumer preference. On the other hand, UpNorth Humboldt has seen a similar trajectory to Sublime Canna, with a rank of 29th in December, suggesting competitive pressures in the mid-tier segment. These dynamics highlight the importance for Sublime Canna to innovate and differentiate to regain a stronger foothold in the California pre-roll market.

Notable Products

For December 2024, King Fuzzies - Honeydew Infused Pre-Roll (1.5g) emerged as the top-performing product for Sublime Canna, climbing from the second position in November to first place, with notable sales of 3050 units. Fuzzies Delights Shorties - Watermelon Z Infused Pre-Roll 5-Pack (2.5g) secured the second spot, showing a significant improvement from its fifth-place ranking in October. Fuzzies Delights - Honeydew Infused Pre-Roll 5-Pack (2.5g) ranked third, maintaining a strong presence in the top three since September. Blueberry Dream Infused Pre-Roll 5-Pack (2.5g) dropped to fourth place after consistently holding the third position in previous months. Fuzzies Shorties Fruities - Lemon Diesel Infused Pre-Roll 5-Pack (2.5g) rounded out the top five, re-entering the rankings after an absence in October and November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.